Time to Start Fresh: Upgrading Your Restaurant Payment Terminal This New Year

The beginning of a new year is the perfect opportunity to fine-tune your restaurant operations and offer your customers an improved dining experience. By switching to a more modern payment terminal, you can enhance efficiency, reduce payment friction, and meet evolving customer expectations. Newer systems bring automated tipping, QR code payments, and speedier checkouts—often increasing revenue and boosting staff morale. Above all, upgraded technology sets you apart in a competitive industry and gets your restaurant ready for future growth.

Why a Payment Terminal Refresh Should Be on Your 2024 Agenda

The turnover from one calendar year to the next signals a chance for renewal. Restaurant owners already know it’s the perfect time to review finances, update menus, and retrain staff. But there’s another critical item that often gets overlooked: payment technology. You could have the tastiest signature dish in town, but if your guests find it complicated to pay, they might suspect there’s more missing than just a modern receipt printer. Competition is tough, and consumers are quicker than ever to choose restaurants that offer streamlined operations.

You might be wondering why specifically the new year is so significant. The reasons are plentiful, but it often boils down to budget resets, industry trends, and consumer behavior. Starting off the fiscal year with efficient technology can set the right tone for the months to come. Plus, the best offers on new payment solutions and hardware frequently appear around the new year. Whether you’re running a cozy diner or a high-end bistro, this can be the season when you see a spike in guest interest—especially those looking for pleasant experiences that blend quick checkout with a warm atmosphere.

A Crisp Look at Payment Technology

Paying for a meal has changed dramatically over the past decade. From magnetic stripes to chips, then to contactless cards and digital wallets, we’ve witnessed a flurry of new technologies. According to recent research by the National Restaurant Association, technology adoption isn’t slowing down anytime soon. Most restaurant patrons carry at least one digital payment option (like Apple Pay or Google Pay), and their expectations for speed and accuracy are only getting higher.

While traditional swiped transactions once felt like a major convenience upgrade over cash, customers now expect to simply tap or scan—a shift fueled by the pandemic and evolving consumer habits. But it isn’t just about convenience for your diners. Modern payment terminals provide you with real-time sales data, automated tip handling, and safer transactions. In other words, the point of sale (POS) system is no longer just a “cash register.” It’s mission-critical technology.

The Biggest Benefits of Upgrading

If you’re running a restaurant, upgrading your payment terminal can feel like deciding whether or not to change a tried-and-true recipe. You might be asking: “Why fix something that isn’t obviously broken?” Here’s the deal: There are multiple payoffs to refreshing your payment system at the start of the year.

- Speedier Transactions: When guests are ready to pay, they’re typically eager to leave—especially during the busy lunch rush. Modernizing your terminal can slash transaction times and eliminate the dreaded bottleneck at the host stand.

- Better Tipping Options: An updated terminal can automatically suggest tip amounts or percentages. This helps your team earn more and reduces awkwardness (“Would you like to leave a tip?”) for your servers.

- Improved Customer Experience: Quick, frictionless payments mean happier diners. A more seamless payment journey can boost return visits and positive online reviews.

- Enhanced Security: Cybersecurity is on everyone’s mind. Advanced payment devices offer dynamic encryption that helps protect both you and your customers from fraud.

- Data Integration: Many modern payment setups connect directly to inventory and sales-tracking software. The result? One cohesive system that gives you insights into sales patterns, popular dishes, and even staffing needs.

- Going Contactless: Whether it’s scanning a QR code to pay at the table or tapping a mobile wallet, contactless payment is here to stay. Guests appreciate it, and you’ll see fewer bills and coins clogging the tip jar.

The real question isn’t if you should upgrade, but rather when and how. And given budgets, new year momentum, and the need to stay relevant, “now” often shapes up to be an excellent answer.

Key Features to Look For When Upgrading

Before you jump into the wide world of payment solutions, let’s look at some crucial, forward-thinking features that modern systems should offer. A slick new exterior is great, but the real magic is in the capability and compatibility under the hood.

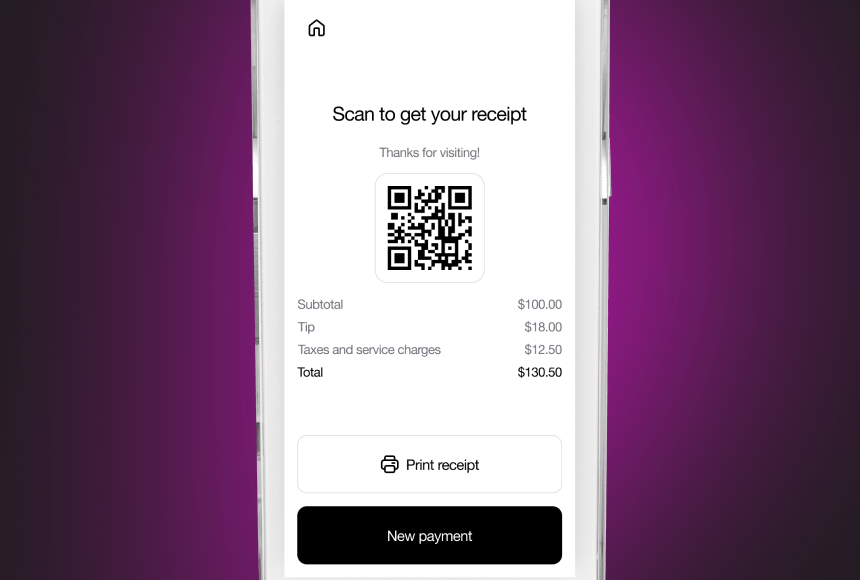

- QR Code Payments: Many systems now allow a quick scan directly at your table, reducing the back-and-forth while also sparing you from printing additional receipts.

- EMV and Contactless Acceptance: By now, chip and contactless acceptance should be non-negotiable. This ensures you’re aligned with the payment methods guests already prefer.

- Cloud-Based Analytics: Cloud integration can give you real-time data about everything from table turnover rates to daily revenue, allowing you to make faster, smarter decisions.

- User-Friendly Interface: A terminal or POS solution is only as good as your staff’s ability to quickly learn and use it—especially when the pressure is on during the dinner rush.

- Integration with Your POS Platform: Ideally, your new hardware should unify with your existing inventory, loyalty programs, or delivery integrations, rather than creating more tech sprawl.

- Customer Feedback Tools: Some modern solutions offer ways to prompt patrons for quick feedback or direct them to your online review platforms, magnifying each satisfied customer’s voice.

A Real-World Example: Jake’s Tex-Mex Makeover

Sometimes, it helps to see a real-world scenario. Jake runs a lively Tex-Mex restaurant in Austin, Texas, known for its mouthwatering fajitas and tangy margaritas. Yet despite brisk business, Jake noticed an odd pattern of negative feedback. People loved his guacamole but complained about slow payment processing—especially on busy weekends.

So last January, Jake decided to invest in an upgraded payment solution. He introduced QR code pay-at-table options alongside mobile wallets. The result? His servers stopped lining up at a single payment station, and customers could handle the bill in under a minute. Tips jumped by 15%, table turnover increased, and Jake noticed a spike in five-star reviews mentioning “super easy payment.” In short, the investment paid for itself well before the year was up.

Jake’s experience highlights a common truth: often, it’s the final stage of the dining experience—payment—that forms guests’ lasting impression. Just like how a perfect dessert can crown a memorable meal, a hassle-free final interaction can inspire diners to come back.

Why Early-Year Budgets and Planning Matter

Most restaurants operate on a year-by-year budget, planning menu changes, expansions, or renovations at the start of each cycle. Upgrading to a modern payment terminal early sets the tone for the rest of the fiscal year. It’s like prepping all your ingredients in advance and having them neatly organized in your mise en place station: everything flows more smoothly.

Also, this time of year often sees slightly more downtime compared to peak holiday seasons—especially in certain dining segments. That can give you and your staff a window to train, pilot new features, and iron out any hiccups. If you implement changes just before, say, a Valentine’s Day rush, you’ll have a chance to work out any kinks and capture the full benefit of speedier transactions and higher tips.

Moreover, many payment providers roll out fresh promotions as the new year kicks off. You might find discounted transaction fees, special leasing offers, or favorable long-term contracts. Keep an eye on vendors that bundle hardware, software, and analytics into one streamlined package. Think of it like a prix fixe menu: you get more value by combining items rather than ordering them à la carte.

Stats and Figures that Tell the Story

To underscore the benefits, let’s look at a few important data points from the restaurant industry. These figures help paint a clearer picture of why upgrading your payment terminal can be a game changer:

| Metric | Insight |

|---|---|

| Restaurant Industry Sales | Expected to hit over $900 billion, according to the National Restaurant Association. |

| Contactless Adoption | Nearly 80% of consumers used contactless payments in 2022, per a Forbes analysis. |

| Positive Reviews Boost | Restaurants that streamline payments often see a 10-15% increase in online ratings, based on surveys by various industry groups. |

| Tipping Trends | Suggested-tip features can raise average tip percentages by 3-5 percentage points. |

Each number stands for something tangible: improved brand image, happier employees, and a more stable bottom line. As they say, numbers don’t lie.

Making the Most of Fresh Trends

We live in a time when technology evolves faster than you can dice a tomato. Embracing new tools is about more than efficiency—it’s about positioning your restaurant as a forward-thinking player in your community. You might even find that younger diners, often labeled as tech-savvy and convenience-driven, will pick your restaurant precisely because you offer innovations like QR code payments and one-touch tipping.

And it’s not just about the younger crowd. Many older patrons, having spent months learning how to order groceries online or use video chat, now feel more comfortable with apps and contactless transactions. By offering more accessible payment solutions, you respect the varying comfort levels of all your guests.

Partnering with Payment Solution Providers

Choosing a partner for new payment technology isn’t necessarily about picking the fanciest gadget. You’ll want a solution that can adapt to changing times and keep you a step ahead. That might mean a device that can push out software updates, plug into your reservation system, or quickly integrate with a new online ordering partner.

When you’re assessing potential providers, ask questions like:

- Does their solution minimize friction at the end of the meal?

- Will it help me prompt online reviews or feedback to my website?

- What kind of support can they provide if any hardware fails?

- Is the analytics dashboard robust enough for my needs?

For instance, a product like sunday addresses multiple needs: scanning a QR code to pay, tapping to add a tip, and smoothly giving customers the chance to share a quick Google review. In an industry where keeping the guest experience top-notch is paramount, that combination of features can simplify life for both operators and diners.

Training Your Team, Winning Over Guests

Even the best technology won’t shine if your staff isn’t comfortable using it. When introducing a new payment terminal, set aside time for thorough training. Let your servers practice scanning cards, processing refunds, and suggesting tip options for guests. Empower them with the knowledge to troubleshoot minor issues quickly—this builds confidence and reduces the wait times that frustrate customers.

Your diners also need some gentle guidance. If you’re going contactless, make sure signage or table tents explain how to use it. A quick mention as you serve the check—“Feel free to scan that QR code whenever you’re ready, then add a tip of your choice”—will prevent confusion and help guests feel like they’re in the driver’s seat. In an era where personal touches can set you apart, courtesy and clear instructions go a long way.

Preventing Security Issues

As with any technology, security is paramount. Restaurants process hundreds (sometimes thousands) of transactions in a single week. That’s plenty of occasions for potential breaches. When you’re shopping for a new payment terminal, look for end-to-end encryption, PCI (Payment Card Industry) compliance, and ongoing software updates. A single data compromise can erode trust in a heartbeat—far faster than a burnt appetizer would.

Modern devices often use dynamic encryption or tokenization to secure each transaction. While these are big words, they offer a simple benefit: your customers’ card data stays locked behind multiple layers of protection. By upgrading to a more secure terminal, you’re effectively telling your guests, “We value your safety and your trust,” which resonates on more than just the practical level.

The Right Moment for Change

Drumming up the courage—and budget—to upgrade your payment terminal can feel like bracing for a new, complicated recipe. However, many restaurant owners discover that the adaptation period is briefer and easier than they feared. Even better, they see benefits quickly. From higher tips to faster table turnover and fewer mistakes, the time invested in rolling out a new system pays you back in droves.

Kicking off the year with a fresh solution means you’ll reap rewards the entire year. Instead of holding off until summer or waiting for a “slow season” to make the switch, capitalize on the new-year energy when your staff is mentally ready for improvements and your guests are in a receptive mood.

The best part is that an upgraded payment terminal does more than just process transactions—it also helps your servers engage more meaningfully with diners by freeing them from manual tasks. Think of it as an invisible sous-chef, quietly doing the heavy lifting so your front-of-house team can focus on the personal touches that make your restaurant unique.

FAQ

Q: Is upgrading my payment terminal really worth the cost?

A: In most cases, yes. While the upfront cost may vary, faster checkouts, potential fee savings, and higher tips can help offset the investment. The competitive advantage of offering contactless or QR code payments can also boost guest loyalty.

Q: How long does it take to train my staff on new payment devices?

A: It depends on the complexity of the terminal, but in many cases a few hours of hands-on practice does the trick. Modern solutions often have intuitive interfaces modeled after smartphones, which your staff may learn very quickly.

Q: Do I have to replace my entire POS system?

A: Not necessarily. Many newer payment terminals can integrate smoothly with your existing POS setup. Be sure to ask potential vendors about compatibility and support before committing.

Q: How can I encourage customers to use the new payment method?

A: Simple communication and good signage. You can train your servers to mention it when they deliver the check or point to a short how-to sign at the table. Many guests are already used to using mobile payment apps and will appreciate the option.

Q: What if my internet goes down?

A: Many systems have offline modes or can tether to a backup network. It’s a good idea to keep a backup plan (like a portable hotspot) in place, but most modern payment solutions are quite reliable.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

The payment terminal to make your operation simpler.

Connected to your POS, we offer the only payment terminal specifically designed for restaurants.