How Payment Insights Can Transform Your Restaurant’s Efficiency

Restaurants can leverage the data generated at each payment transaction to refine and speed up their overall service experience. By collecting and analyzing sales peaks, menu preferences, table turnover times, and tipping trends, restaurant owners gain insight into how every shift flows. This data can help schedule staff more effectively, design a menu that meets customer expectations, and streamline operational processes. The end result: satisfied guests who spend less time waiting for service and more time enjoying their meals, all while boosting the restaurant’s profitability. Payment data can also inform smarter marketing efforts, helping you attract loyal guests and foster repeat business.

Understanding Modern Payment Data

Every swipe or tap at your restaurant’s point-of-sale terminal carries more information than just a dollar amount. Modern payment systems capture details about what was purchased, at what time, from which table, and sometimes which server handled that table. This interconnected data can paint a full picture of your restaurant’s daily operations.

Think of it like layers in a recipe: each ingredient lends its flavor and texture. Payment data adds critical “flavor” to your business insights. In the past, restaurant owners had to rely on shifting anecdotal evidence—servers’ recollections, scattered receipts, or vague impressions. Today, every transaction is an opportunity to quantify activity, identify trends, and make decisions backed by facts.

But how exactly does that data become actionable? By focusing on the core elements of service flow, you can transform raw numbers into practical insights. You may look at peak hours and discover that your most profitable times aren’t Sunday brunch but rather late-night on Fridays. Or note that credit card sales spike for certain menu specials, directing you toward future promotions. According to the National Restaurant Association (https://restaurant.org/), using precise data to inform your decision-making can be a game-changer in today’s competitive restaurant industry.

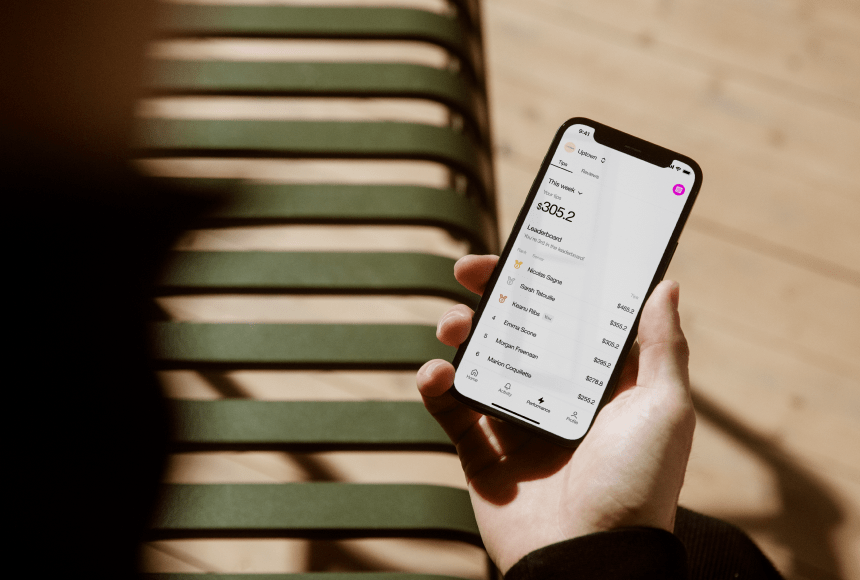

As you gather this information, look for easy-to-use dashboards or solutions that automatically compile it in real time. Some solutions—like sunday’s payment platform—allow diners not only to pay the check with a simple QR code but also to leave tips, share feedback, and even leave a review, offering a wealth of information for you to parse later. Instead of digging through piles of receipts, you can have comprehensive analytics at your fingertips.

Identifying Bottlenecks in Your Service Flow

A busy restaurant can sometimes be an orchestra of chaos, with servers weaving through tables, bartenders prepping cocktails, and cooks working on multiple orders. Meanwhile, managers keep an eye on the clock to ensure that diners don’t wait too long for their meal or for the check. But where do snags typically occur? Payment data can help you identify these bottlenecks through metrics such as:

- High Wait Times: If you see transactions piling up at certain intervals, it could indicate staff is struggling to meet demand.

- Slow Table Turnover: Data showing checks stay open longer than usual means guests aren’t getting their bills or finishing transactions as fast as you’d like.

- Peak Hour Tangles: Identifying patterns around busy hours can highlight the need for extra servers or an additional host during certain shifts.

- Frequent Payment Errors: If payment details get incorrectly processed or closed out, your staff may need extra training or a more user-friendly payment solution.

Beyond these common factors, the patterns you uncover will depend on your specific restaurant concept—for instance, cocktail bars might note a surge in transactions just after happy hour, while casual bistros might see late brunch orders drag out the lunch shift. By correlating payment timestamps with the average payment duration, you can pinpoint the exact pinch points.

Large parties, for instance, could linger because of complicated split bills. Perhaps you’ve seen that big groups often request separate checks, which can slow down servers juggling multiple bills. If your analytics show that splitting checks results in more errors or a longer closeout time, it might be worth introducing a quick-scan payment method—like scanning your sunday QR code so each guest can settle their portion directly. Simplifying the payment step can help you shave minutes off the table’s departure time and free up seating for new arrivals.

Optimizing Staffing Schedules with Payment Trends

Once you’ve pinned down your busiest periods, the next step is to match your workforce to that demand. By analyzing payment data over weeks or months, patterns rise to the surface—like consistently high sales on Wednesday nights or a slump on Monday lunch. Relying on gut feeling alone to build a schedule can lead to either understaffing (frazzled service, stressed employees, and lost revenue) or overstaffing (higher labor costs and staff sitting idle).

Payment data serves as evidence of when you really need your top performers in place. Let’s say the numbers show that dinner service starts ramping up around 6 p.m. on Thursdays, hitting its peak at 7:30 p.m., and then tapering off by 9 p.m. This window can inform exactly when to bring additional staff on duty—like adding a second bartender at 6 or scheduling a seasoned server to start at 5:30 so they’re ready for early walk-ins.

For quick-service or fast-casual spots, you might notice that credit card receipts spike during lunchtime. That hour and a half could be the deciding factor in capturing maximum revenue. By scheduling enough employees around that surge, the line at the cash register moves faster, diners get served quickly, and you maintain a welcoming environment. In essence, you’re not just scheduling employees; you’re orchestrating a balanced workflow.

Additionally, keep an eye on overtime through these insights. If data reveals your staff frequently stays on the clock past their scheduled hours (especially on certain days), it might indicate that you need more staff overlap or a different shift arrangement. Locating that perfect balance ensures your team stays productive, not overextended, and that your labor margins don’t balloon unnecessarily.

Enhancing Menu Performance with Transaction Analysis

Restaurant menus are living documents. What soared in popularity last summer might be out of favor this fall, and pricing that worked before might not work after ingredient costs change. Payment data can validate—or disprove—your hunches about what’s truly happening on your menu. By studying what people purchase most, which items often get returned, or which have the highest profit margins, you can devise a menu that balances popularity with profitability.

Imagine you run a small neighborhood brunch spot. You notice from your data that avocado toast sells more than any other item, but it only nets you a modest profit. Meanwhile, an omelet with local produce sees fewer sales, but has a higher margin. By refining your dish descriptions or bundling items in a strategic way—like pairing the omelet with a mimosa special—you might boost that item’s visibility and start capturing more profit.

Another angle is timing. If you specialize in morning pastries, do certain treats become top sellers at coffee break hours (around 10 a.m.)? If so, consider placing a promotional poster near your entrance, or have your servers mention the pastry-of-the-day to every table ordering coffee. Consistency between data and marketing efforts can significantly lift sales.

Payment data also offers insights into your guests’ spending habits. If you see that patrons frequently add a dessert or upgrade to a premium side when it’s recommended, you can train your staff to highlight those profitable add-ons. Quick hits of data—like average check size per table—can prompt menu tweaks that elevate your average ticket price in a sustainable way. Or, if you’re using a CTLS (contactless) credit card reader or QR code payment solution like sunday, you can send a friendly prompt about a limited-edition dessert right as guests finish ordering their entrées.

Leveraging Payment Data for Customer Experience

While operational efficiency is crucial, remember that customer experience is at the heart of your restaurant’s success. Data from payment transactions can help you create a more personalized and engaging dining experience. You could, for example, track when a loyal customer typically visits and their usual order. Armed with this information, your staff might greet the customer by name and offer their favorite drink before they even settle in.

Payment data can also reveal tipping patterns. High tip percentages often indicate a great experience; consistently lower tips may signify an underlying service or satisfaction issue. Suppose you see a dip in tips on Saturdays. Why is that? Are you short-staffed? Perhaps your servers could use some additional training on how to handle peak weekend rushes. Coupling payment data (like average tip percentages) with feedback from your guests and staff can direct you toward strategic changes—maybe an extra server for busy weekends, or clearer guidelines so diners know they can easily leave a tip via the same QR code they used to pay.

Additionally, collecting and analyzing payment data can form the backbone of a simple loyalty program. For instance, you might offer a free appetizer after a certain number of visits or a discount for regulars who hit specific spending thresholds. Not only does this encourage repeat business, but it also demonstrates that you value your customers’ loyalty. In time, the data you gather can confirm whether these promotions are worth continuing or need refinement.

Integrating sunday for Seamless Data Collection

Reliable data relies on having a dependable, easy-to-use payment solution. Imagine a Sunday brunch rush: you don’t want your staff struggling with clunky handheld devices or losing data because the system can’t keep up. With a fully integrated system like sunday, diners can pay effortlessly by scanning a QR code at the table. They can also leave a tip, provide feedback, and even write a quick Google review—all in a few taps.

What does this mean for you? Fewer discrepancies, consolidated analytics, and faster check-outs. Not only is it convenient for the guests, but it simplifies your back-of-house reporting. Since all payments flow through one platform, you can pull real-time sales figures, identify average ticket sizes, spot your top-selling dishes, monitor tip percentages, and see when clients are most likely to leave reviews.

Moreover, streamlined payments translate into less waiting time, reduced friction, and faster table turnover. For a busy restaurant that relies on high volume, every second counts. By improving payment speed, your guests can settle their checks without flagging down a server—meaning staff can focus on hospitality rather than paperwork. And from an operational standpoint, fewer manual processes reduce the risk of errors, saving you headaches and potential disputes.

Best of all, you don’t have to be a data scientist to interpret the numbers. In many cases, the payment platform dashboard will break down everything for you in easy-to-read charts. You can quickly find answers to questions like: Are my new lunch combos selling well? Are we seeing spike transactions on event nights? Armed with these insights, you can tweak your service flow and menu strategy on the fly, rather than waiting until month-end or quarterly reviews.

FAQ

- Q: Why should I analyze payment data instead of just focusing on sales totals?A: Sales totals only tell you part of the story. Payment data reveals patterns about when people dine, what they purchase, how they tip, and more. It helps you optimize staffing, manage your menu, and enhance overall service flow.

- Q: How can payment data help reduce wait times at my restaurant?A: By matching timestamps on transactions with average table turnover, you can see when and why delays occur. If you notice that checks stay open too long during peak hours, introducing a faster payment solution like sunday’s QR code system can speed up how quickly guests settle their bills.

- Q: Is it difficult for my staff to use a QR code payment system?A: Not at all. In fact, it often simplifies their work. Guests scan the code, pay digitally, and leave a tip without needing extra hardware or precious server time. Implementation usually involves straightforward setup and minimal training.

- Q: Will analyzing payment data add significant costs to my business?A: Many modern payment solutions include analytics as part of their service. By boosting operational efficiency, minimizing errors, and improving the guest experience, the investment in data-driven insights tends to pay for itself in the long run. Tools like sunday combine both payment processing and data collection, making it a cost-effective approach.

- Q: What if I’m not tech-savvy? Can I still benefit from payment data analysis?A: Absolutely. Many platforms offer intuitive dashboards and user-friendly reports that break down key metrics, from hourly sales to tip averages. If needed, you can train a staff member to interpret these reports and share the insights with you. According to the Cornell Center for Hospitality Research (https://sha.cornell.edu/centers-institutes/chr/), applying even basic data analysis can deliver clear gains in efficiency and revenue.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

Get the full, detailed picture.

sunday elevates your business with insightful data, instant feedback and precise analytics.