Prepayment: A Smart Move for Efficiency or a Risky Bet?

The Rise of Prepayment in Restaurants

In the bustling world of restaurants, every minute counts. Diners expect quick seating, smooth service, and speedy checkouts. Many businesses are now looking to reduce friction at payment time—and some are going a step further by offering prepayment. With prepayment, customers pay in advance—often when placing an online order or before they even step foot in your dining area. This approach can be a breath of fresh air for some owners, but it’s not always the perfect solution for everyone.

Why consider it? According to recent research on shifting payment methods in the restaurant sector, more than 40% of consumers say they prefer a faster way to settle the bill—especially for lunch breaks or quick service. Prepayment checks that box, promising convenience for both you and your guests.

But are you really ready to shift that final payment moment ahead of time? In this article, we’ll explore the pros, the pitfalls, and the practical considerations you need to weigh before taking the leap.

Defining Prepayment: What It Actually Means

Let’s break it down. Prepayment means a customer is charged for their order upfront—either online or through a digital tool—before any food arrives at the table. It can apply to:

- Online Takeout Orders: The customer pays at checkout, just like buying clothes or electronics online.

- Dine-In Reservations: Guests reserve a table and pay a portion—or the entire cost—of the meal in advance.

- Special Events or Tasting Menus: Some higher-end restaurants require a deposit for lavish experiences to ensure no-shows don’t eat into profits.

By shifting the payment earlier in the dining journey, you reduce the friction of handling checks, swiping cards, or splitting bills at the end. But this convenience also brings up new questions about guest satisfaction, refunds, and menu flexibility.

The Key Advantages of Prepayment

Offering a prepayment option can benefit your restaurant in multiple ways, especially if you’re looking to streamline service and manage high demand. Let’s see how it might boost your business:

1. Faster Service

When your guests aren’t fumbling with wallets or waiting for credit card receipts, you free up tables more quickly. That boost in turnover can be a game-changer, especially during peak hours or lunch rushes. If you’re a quick-service spot, this speed can define your competitive edge. Even in a full-service setting, diners appreciate a seamless checkout—especially if they have midday appointments or evening plans to catch.

2. Reduced No-Shows and Last-Minute Cancellations

If your restaurant relies heavily on reservations, you know the pain of empty tables from no-shows. Asking diners to pay a deposit—or the full amount—up front can sharply cut down on last-minute cancellations. According to a study on reservation trends, restaurants that require deposits see about 20–30% fewer no-shows. That means your kitchen preps food for genuine guests, not for seats that stay vacant.

3. Smoother Cash Flow

Prepayment brings in revenue faster. You’re not waiting until the meal is over to receive funds; sometimes you get the money days in advance. This predictable, upfront cash flow can help with:

- Buying fresh produce without stressing about daily sales

- Paying staff on time

- Managing unexpected costs—like equipment repair—more comfortably

For many owners, that added financial stability is a welcome relief.

4. Improved Customer Data

When guests pre-pay through an online system or a digital tool like sunday, you often gather valuable insights—like email addresses, dietary preferences, or special requests. This data can fuel future marketing efforts. Offer a new seasonal dish? Let your list of prepay regulars know. Want to promote a loyalty program? These are your prime candidates, already comfortable with your digital channels.

The Limitations and Potential Drawbacks

Though prepayment can be a boon, it’s not without its downsides. Before diving in, consider these potential challenges.

1. Customer Pushback

While some diners love skipping the end-of-meal transaction, others might be skeptical of paying before they see the food. They may feel it removes part of the spontaneity—what if they want to add a dessert? Or what if the experience doesn’t meet their expectations? Addressing these worries requires clear communication, easy refund policies, and a user-friendly system that allows for last-minute changes or add-ons.

2. Refund and Cancellation Policies

Handling money in advance means you’ll need a robust system for partial or full refunds. If a guest cancels with reasonable notice or if an emergency arises, how do you handle that fairly? Determining your rules ahead of time—and sharing them openly—can prevent misunderstandings and negative reviews.

3. Technological Hurdles

Offering prepayment typically demands digital infrastructure. If your restaurant still relies on handwritten tickets and basic card readers, you’ll need an upgrade to manage online or app-based transactions. That shift might include training staff, integrating new software with your POS, and ensuring stable internet. These are not impossible hurdles, but they do take careful planning and investment.

4. Potential Loss of Personal Touch

Some restaurant owners worry that prepayment, especially online, might reduce the human aspect that sets their place apart from chain operations. But it doesn’t have to. If done right, prepayment simply automates the mundane steps—like handing over a credit card—so your team can focus on friendly hellos and thoughtful recommendations.

Finding the Right Approach for Your Restaurant

No two restaurants are the same—so your prepayment strategy should reflect your unique vibe, clientele, and operational style. Here are some pathways to consider:

- Partial Deposit for Reservations: Upscale dining spots or popular brunch joints can require a deposit to hold a table during peak times. This reduces no-shows while keeping a bit of flexibility for guests.

- Prepayment for Events: If you host large groups, private parties, or tasting menus, it’s common to request upfront payment or at least a percentage. This ensures your staff and kitchen are fully prepped with minimal financial risk.

- Full Prepayment for Takeout: Quick-service restaurants or busy takeout hubs might have customers pay online at order time. On arrival, they just grab their bag and go. This eliminates waiting and speeds up your line.

Aim for a balanced model that doesn’t alienate those who prefer paying at the end of the meal. You can always offer prepayment as an option rather than a blanket policy.

How to Communicate Prepayment to Your Diners

Introducing a new payment process can raise questions. The smoother you explain it, the more comfortable guests feel. Consider these steps for a friendly rollout:

- Website FAQs: Devote a section to explaining how prepayment works, why you’re offering it, and how refunds or changes are handled.

- Clear Messaging in Emails: If your guests reserve through email confirmations, highlight the prepayment detail—what it covers, deadlines to cancel, and how to add items on the day of.

- Social Media Teasers: Show short videos or posts emphasizing how prepayment speeds up the overall experience. Focus on the convenience factor.

- Front-of-House Staff Training: Make sure your team can calmly and concisely address any on-the-spot concerns. Having them communicate the benefits with warmth goes a long way.

When diners understand that prepayment is designed to save them time and guarantee availability, most will see it as a perk, not a burden.

Technical Considerations and Integration

Implementing prepayment can involve bridging multiple software solutions: your reservation platform, your POS system, and potentially a third-party ordering app. Look for:

- Real-Time Sync: Orders and payments should flow directly into your main system, reducing manual data entry and the risk of mistakes.

- Omnichannel Integration: If a customer pre-pays online, they shouldn’t have to jump through hoops if they want to add an item at the table. Staff should see everything in one place.

- Secure Payment Protocols: Ensure you’re PCI compliant and only partner with reputable gateways. Guests must trust that their card info is safe.

A user-friendly solution like sunday can unify these steps—letting customers settle costs in a few taps while keeping your staff in the loop.

Keeping Room for Flexibility

Even if your system runs perfectly, keep in mind that restaurants thrive on spontaneity. A new diner might order a dessert you didn’t pre-charge for. Or maybe your regular decides to surprise a guest with an upgraded bottle of wine.

Ensure your system allows add-ons, changes, or partial refunds if something goes awry. Your aim is to create a frictionless experience, not a rigid, automated machine. Let diners feel that they can still adapt their experience while enjoying the speed and convenience of prepayment.

Weighing the Pros and Cons for Your Own Space

Ultimately, the decision to offer prepayment depends on your specific context:

- High Demand? If you frequently turn away reservations, prepayment ensures serious customers commit for prime time slots.

- Casual or Upscale? A casual eatery might gain from the immediate revenue, while a fine-dining establishment may prefer partial deposits to maintain the personal touch.

- Customer Demographics: Tech-savvy crowds adapt quickly to digital payment. Traditional diners might be hesitant. Consider running a pilot program or offering prepayment as an option first.

Think of prepayment as a strategic layer—one that can boost your efficiency if done well. But it’s never a one-size-fits-all solution.

Conclusion: A Tool, Not a Silver Bullet

Prepayment can streamline operations, enhance your cash flow, and cater to time-pressed guests who crave a swift experience. On the other hand, it requires upfront tech, careful communication, and a readiness to handle refunds or changes. The payoff can be immense: less chaos at checkout, fewer no-shows, and happier customers who appreciate a modern approach.

As you consider whether to roll out prepayment, ask yourself: Does it align with your brand? Will it genuinely improve the guest experience? And are you prepared for the challenges—like refunds or skepticism from those who like to pay at the end? If the answers point you toward a “yes,” consider starting small, monitoring feedback, and refining your approach.

Because, at its core, a restaurant is all about delivering an enjoyable experience. If prepayment helps you deliver that—faster, simpler, and with less hassle—then it might just be the next step in delighting your customers and growing your business in a competitive market.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

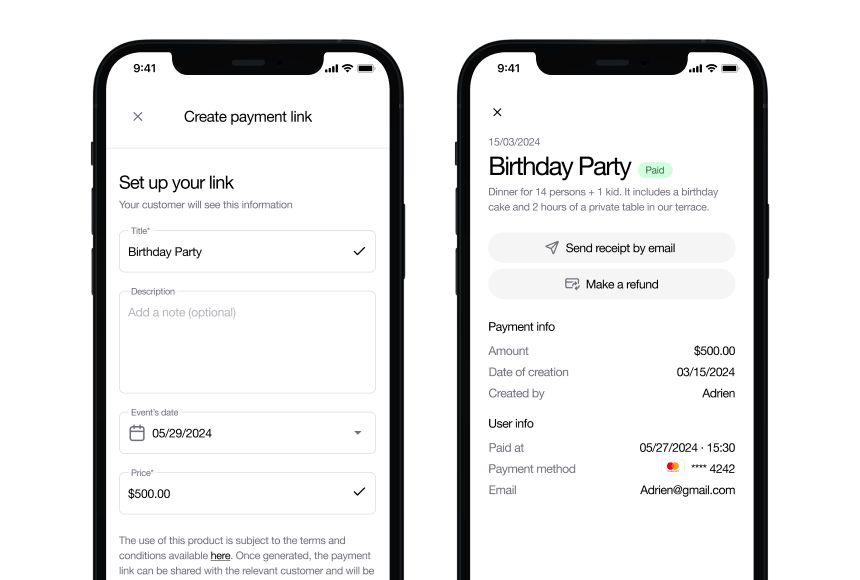

Get paid in advance in a couple of clicks.

Make groups prepay with a simple payment link and cut down on admin work.