Why Contactless QR Code Payments Are a Lifesaver for Your Restaurant During the Holidays

December can push servers to their limits, with full dining rooms and constant requests. QR code payments reduce wait times, speed up table turnover, and keep guests happier. They can also boost tips and create opportunities for instant customer feedback. By cutting the back-and-forth with payment terminals, you ease pressure on your staff when they need it most. And because everything is done right at the table—via a customer’s smartphone—restaurants benefit from faster turnover, a more satisfying guest experience, and a real edge in holiday efficiency.

December’s Holiday Rush and Its Toll on Staff

The holiday season is both a delight and a whirlwind in the restaurant business. Between festive gatherings, office parties, and travelers seeking a cheerful dining spot, December is prime time for high-volume traffic. While the surge brings in significant revenue, it also often spells out more stress and physically demanding shifts for servers.

It’s not just about juggling orders—though that alone can be overwhelming when every seat is full. Servers also have to handle multiple tasks including table setup, checking in on diners, upselling items, relaying special requests to the kitchen, and, of course, dealing with payments. Balancing these tasks effectively is tough enough on a normal day. In December, the intensity doubles or triples. Hence, you might notice your dedicated servers racing around, short on time, and at higher risk of job fatigue.

During this end-of-year hustle, you obviously don’t want mistakes—like forgotten orders or mishandled bills—to taint your restaurant’s reputation. Word travels fast, and disgruntled holiday diners will sometimes share unfavorable experiences on platforms like Google Reviews. That’s why ensuring a smooth experience, from greeting to final check, is vital.

QR Code Payments: A Simple Concept, Powerful Effects

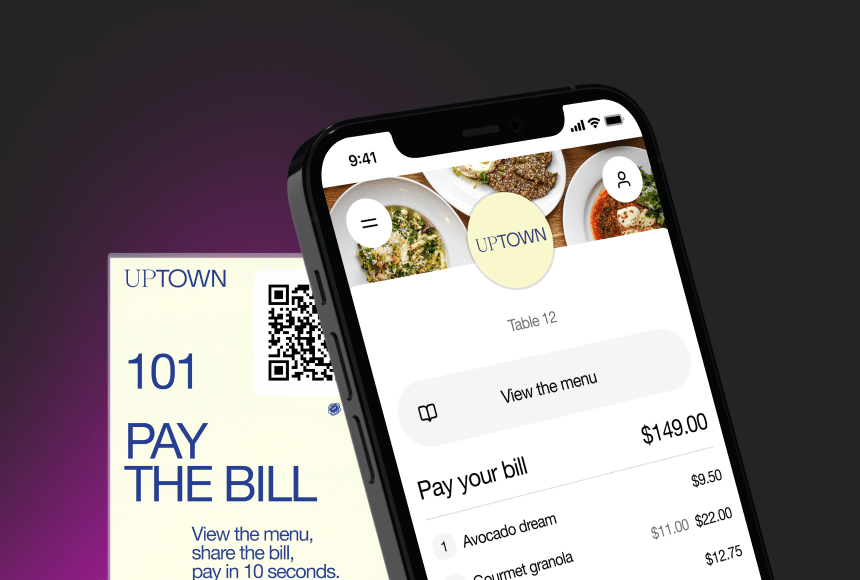

Imagine a customer finishing a cozy December meal at your restaurant. Instead of flagging down the server, waiting for a payment terminal, fiddling with a card, and then waiting for a printed receipt, the guest simply scans a QR code perched on the table. The bill pops up on their smartphone, they settle it in seconds, add a tip, even leave a quick Google Review, and that’s it.

This is the charm of QR code payments: a contactless solution that slices away wasted minutes. For customers, it’s speed and convenience. For servers, it’s a breath of relief—one less table that needs to be attended to in person to close the tab. QR code payments cut the wait, reduce the frequent back-and-forth with portable payment terminals, and streamline the overall checkout process.

For example, a solution like sunday allows diners to scan a QR code that directly displays their bill on their smartphone. Guests can split the bill or pay individually, which is a time-saver for big groups. Then, the tip is as easy as tapping one extra button. With holiday stress in overdrive, each minute you save is precious.

Beyond the Buzzwords: What “Contactless and Cashless” Means for You

In recent years, “contactless” and “cashless” have been buzzwords in the restaurant world, especially after health and safety concerns drastically changed the dining landscape. Yet as a restaurant owner, buzzwords alone won’t pay the bills or guarantee your staff a manageable workload. It’s crucial to know what these terms actually do for your bottom line and your team’s mental health.

- Faster Table Turnover: Quick payments reduce the time diners spend waiting, meaning you can seat more parties in an evening—without rushing anyone.

- Improved Customer Flow: No lines forming at a register or confusion over splitting the check. Diners handle payments right from their seats.

- Enhanced Sanitation: While concerns about touching shared card readers have eased somewhat, many customers still appreciate a hygienic process. Scanning with a personal smartphone checks the box.

- Convenient for Parties: December is prime time for large groups. Splitting the bill among multiple diners can be chaotic, but contactless options make it less stressful.

- Less Room for Error: With digital payments, each transaction is recorded automatically, avoiding manual input mistakes and ensuring more accurate accounting.

When contactless systems first became popular, owners worried about alienating older patrons who might find the technology confusing. However, statistics confirm that QR code usage has climbed significantly across all age groups. As reported by Forbes, many diners now prefer scanning codes for menus, reservations, and payments. The shift is no longer just about younger, tech-savvy customers. Everyone, from extended families celebrating early Christmas dinners to business associates raising a holiday toast, is adapting.

Relieving Overburdened Servers: A Tangible Impact

Servers are the heartbeat of your dining experience. They face countless demands throughout a shift, and in December, the stakes feel even higher. By integrating QR payment technology, you’re not just putting a neat gadget on tables—you’re actively making your servers’ lives easier.

Take a typical scenario: A group of eight finishes dessert, and you have just two minutes to get them their bill before they’re eager to leave for another holiday event. With a traditional approach, a server would have to gather multiple checks, re-check seat assignments for separate tabs, deliver the physical receipts, run back to the point-of-sale system, bring a card reader, and eventually print final receipts. Meanwhile, other tables are also calling.

Using QR code payments, that entire back-and-forth becomes unnecessary. The guests scan, choose how they want to split, tip, and pay. The server can then focus on receiving a new arrival or verifying that the kitchen is up-to-speed. The tangible impact is less chaos, fewer missed steps, and more genuine engagement with guests who might need extra attention.

Holiday Tipping Made Easier

December diners often feel generous, but they also might be prone to forget if the payment process is rushed or confusing. When the tip option is seamlessly integrated into an app or QR-based payment flow, it gently reminds customers to add a little extra for good service.

This approach leads to higher tip averages, especially when “preset tip suggestions” appear. For instance, a digital prompt might display 18%, 20%, or 25%. The latter might entice guests celebrating a special occasion or feeling festive. In turn, your servers end the night with a well-deserved reward for their dedication.

Placing the decision on the customer’s smartphone also removes awkwardness. Servers no longer linger around as customers scribble on a paper check. People are more likely to tip generously when it feels private, easy, and integrated into the process.

Encouraging Positive Reviews with a Single Tap

In the restaurant world, reviews on platforms like Google can be as pivotal as holiday decorations in setting the tone. A glowing review right after a happy meal can sway countless potential guests. But how do you get customers to actually follow through and post an online review?

One smart strategy is embedding a direct link or pop-up prompt that asks guests to rate their experience immediately after payment. With a QR-driven system, the guest’s phone is already in hand—so transitioning seamlessly into leaving feedback is natural. A solution like sunday might offer a prompt: “Loved your meal? Share your feedback!” That small nudge can translate into a steady influx of 5-star reviews.

Does it feel a bit forward to ask? Possibly. But in a digital-payment scenario, the prompt is subtle and can be declined with a simple tap. The ease of it, paired with the pleasant afterglow of a good meal, encourages more frequent and positive online reviews. Over time, those reviews turn into added visibility for your restaurant—especially around the holidays when prospective diners are scoping out new places to celebrate.

Practical Steps to Implement QR Payments

Switching to QR code payments may seem daunting if you’ve never offered it before. But the actual process is simpler than you might think. Here’s a short roadmap on how to successfully roll it out in time for the holiday rush.

- Assess Your Current Setup: Check what payment systems and point-of-sale procedures you already have in place. Identify what can be integrated with a QR-based platform. Many modern POS solutions can add a QR component with minimal trouble.

- Choose a User-Friendly Tool: Opt for a QR solution that’s intuitive for both staff and diners. If possible, request a demo or trial period from the provider to ensure it suits your restaurant’s specific needs. You’ll want an interface that’s easy to set up, and an option to include tipping and simple bill-splitting.

- Train Your Team: Go through hands-on training with your servers. Show them how to explain the QR code process to guests, how to handle common questions (“Where’s my receipt?”), and how to troubleshoot simple errors. Reassure your staff that QR payments are a tool to simplify their job, not a replacement for their personal touch.

- Set Up Clear Table Signage: Place a readable, easy-to-find QR code on each table. Some restaurants use small stands or coasters printed with instructions like “Scan to Pay.” Make it visually appealing, so guests won’t overlook it.

- Promote the Option: Let your diners know the feature is available. Servers can mention it when dropping off the check—“Feel free to use our QR code to pay whenever you’re ready!”—and you can advertise it on your website or social media channels.

- Monitor and Optimize: Gather feedback from the staff and diners. Is the code scanning quickly? Are customers confused on any step? Use that information to refine your instructions or signage. A small tweak—like labeling the code “Pay Here”—can make a big difference.

A Holiday Scenario: Big Family, Quick Turnaround

Picture a large family visiting your restaurant after a day of holiday shopping. Lovers of tradition, they order an abundance of dishes: appetizers, main courses, drinks, desserts—some splitting items, others insisting on personal favorites. At the end of this cheerful meal, they are ready to pay swiftly and head off to see holiday lights downtown.

If you rely on old-fashioned payment methods, your server could be stuck sorting and re-sorting checks for a party of ten or more, potentially leading to confusion or missing items. With a QR code on the table, each family member can scan, view their share, tap to pay, and tip. The entire chore of dividing the bill on multiple credit cards moves off your server’s shoulders.

That scenario might repeat itself dozens of times over the holidays: group dinners, late gift-buying sprees, boisterous gatherings of friends. This is peak season for complicated checks. But QR payments transform that complexity into a quick, frictionless step. Meanwhile, your staff remains calm and free to focus on ensuring great service across all tables.

Boosting Your Bottom Line with QR Technology

The obvious financial benefit is that QR payments speed up table turnover. More seats become available sooner, and you can better accommodate walk-ins or last-minute holiday bookings. But let’s break down some other revenue and cost-saving angles:

- Higher Tip Averages: As noted earlier, digital tipping often increases average tip percentages.

- Reduced Need for Extra Terminals: Each table acts as its own “payment station.” Fewer physical payment terminals are required, saving on purchase or rental costs.

- Fewer Chargeback Risks: When payments go through a secure, digitally tracked system, there’s less confusion about unauthorized transactions or missed checks.

- Brand Reputation: Positive reviews, streamlined service, and modern conveniences amplify your brand’s appeal. Guests are more willing to spend on premium items if they trust your operation is well-managed.

- Upselling Opportunities: Some QR payment solutions offer integrated marketing, letting you highlight specials or add “Would you like to try our dessert special?” prompts alongside the checkout. Strategic promotions can boost overall tickets.

Especially in December, when every seat can translate into additional revenue, these benefits compound. A 10% improvement in tip averages or a 15% faster turnover might be the edge that brings extra holiday cheer to your balance sheet.

Handling Security and Fraud Concerns

One question restaurant owners often raise about any tech-based payment method is security. With QR codes, you can rest assured that secure encryption and typical online payment protocols are in place, provided you choose a reputable solution.

Moreover, a QR-based system eliminates some vulnerability points. Guests’ credit cards never leave their hands, and no one has to manually transcribe card numbers. That means a reduced risk of skimming or card theft. From your perspective, each transaction is locked, tracked, and verified instantly. In many cases, you’ll see clear records in your management system, helping you identify any discrepancies quickly.

If you want an added layer of trust, consider posting a simple sign near the QR code: “Powered by secure payment technology” or referencing the encryption standard used. This level of transparency helps put guests at ease, especially those who may be scanning a QR code for the first time in your establishment.

Empowering Your Servers to Shine

You might wonder: If the payment interaction is removed, will servers lose an opportunity to connect with guests? In reality, the shift can do the opposite. With less time spent fumbling around with payment terminals, your servers can invest more energy in meaningful tableside moments—recommending a holiday-themed cocktail, describing your chef’s special that pairs well with a seasonal dessert, or simply engaging in friendly banter that builds rapport.

Yes, payment is an essential step in the dining experience. But it doesn’t need to be a time drain or an awkward moment. By reducing friction during checkout, your servers can focus on what they do best: offering hospitality, warmth, and prompt attention. The guests feel valued. The servers feel liberated from the mechanical tasks that can bog them down.

In an industry where staff turnover is high, having a system that makes servers’ lives easier can help with employee retention. When your team feels their workload is balanced, they’re more likely to stick around, provide consistent service, and help your business flourish long after the holiday madness has subsided.

Maximizing the Full Potential of QR Payments

It’s easy to think of QR payments as a one-note solution—scan and pay. However, the real potential extends beyond this. You can add layers of convenience or even delight for your guests. For instance:

- Integration with Loyalty Programs: If you have a loyalty app or rewards tracking system, linking it to the same QR code can streamline the process. Guests can earn points or redeem offers without needing a separate card or app.

- Interactive Digital Menu: Some restaurants pair the payment flow with a digital menu, letting customers browse daily specials or nutritional details. This can spark interest in additional dishes or drinks throughout the meal.

- Cross-Selling Gift Cards: December sees a huge spike in gift card purchases. With a well-designed QR payment interface, you could add a simple link or button, “Gift a friend,” so that diners can purchase a digital gift card on the spot.

- Collecting Customer Feedback: Beyond Google Reviews, you can incorporate feedback forms or quick surveys to learn what your clientele loves—or what might need improvement.

The key is to avoid overwhelming the user. A short, intuitive flow is ideal. Always test the entire experience from your customer’s viewpoint. If too many pop-ups appear, or if the interface feels cluttered, it might deter them from engaging fully. Keep it clean, logical, and relevant.

Remember the Human Element

Technology is never a substitute for genuine hospitality. In December, many customers visit restaurants seeking the festive atmosphere and the feeling of celebration. QR code payments shouldn’t turn your place into a cold, impersonal transaction hub. Think of it like a helpful sous-chef: it does part of the job, but the main dish still comes from the chef’s creativity and personal touch.

Encourage your staff to maintain their usual warmth—explaining menu items with passion, checking in on customers promptly, and responding to any issues with genuine empathy. When a payment solution is used to remove friction from your team’s workload, it frees up more time for those personal flourishes that win hearts and keep people coming back.

Real Stories from Eateries That Embraced QR Payments

Still hesitant? Let’s highlight a typical success story. A casual dining spot in Chicago, for instance, reported a 20% decrease in average table payment time when they introduced QR codes. Servers found themselves with more availability to greet new arrivals, answer questions, and handle special requests for holiday-inspired dishes. Meanwhile, the place enjoyed a noticeable bump in holiday revenue because tables turned over faster during busy dinner services.

Another upscale bistro in Los Angeles found that tips spiked by about 15% in December after switching to digital payments with preset tipping percentages. Customers appreciated not having to wait for a physical check, especially on nights with tight schedules.

While each restaurant is unique, the consistent theme is that QR payments streamline the final part of the dining experience and reduce the operational headaches.

Metrics Worth Tracking

How do you measure the success of implementing QR code payments in December? Consider these key performance indicators (KPIs):

- Average Payment Time: The period from when guests request the bill to when the payment is confirmed. Shorter durations signal success.

- Table Turnover Rate: If this climbs during peak hours without sacrificing guest satisfaction, you’re on the right track.

- Tip Percentage: Track tip amounts before and after introducing QR, noticing if there’s a consistent uplift.

- Average Check Value: Keep an eye on whether guests order more or add items once they discover how effortless the payment process is.

- Online Reviews: Monitor not only the number of reviews but also the sentiment. Are they consistently noting speedy service or convenient payment?

Gather these insights, and if any area falls short of expectations, tweak your approach. Maybe there’s confusion about how to split bills. Perhaps you need more prominent signage or clearer instructions. Refine until you find the sweet spot.

Commit to a Future-Proof Method

Contactless payments in restaurants have progressed from a trend to a norm, more so in the wake of consumer demand for convenience. The holiday season might be your proving ground, but the benefits will last all year. Even after the festive bustle fades, the improved efficiency, user-friendly payment system, and positive reputation remain in place.

Adopting a QR code solution is not just a whim or a temporary fix for the December rush. It’s part of the evolution in dining experiences. Much like how online reservations were once a novelty but are now widely expected, mobile payments aligned with digital menus will become standard in the restaurant world. Getting ahead of that curve is a savvy business move, ensuring you’re ready for the next wave of customer expectations.

FAQ

Below are answers to some typical questions restaurant owners ask about using QR payments, especially during the holiday season:

How do I handle diners who prefer traditional payment methods?

You can offer both. Keep a payment terminal at hand for guests who truly want to pay by handing their credit card to the server. Let them decide. Over time, many will switch to the QR option when they see its ease and speed.

Is it difficult for older guests or less tech-savvy customers to use?

Usually, QR scanning is straightforward, especially post-pandemic when a large segment of the population learned to scan codes for menus. Provide a small line of instructions on your table signage. Your staff can also reassure them that it’s safe and help if needed.

Does offering QR payments mean I lose control over the checkout process?

Quite the opposite. You’ll have immediate digital records of each transaction, and you can track tip percentages and real-time table closures. It reduces chaos for both you and your team.

Will customers still tip if they don’t see a physical bill?

Yes. In many cases, customers tip more in digital formats because the process is integrated seamlessly into the payment steps, and they can pick one of several convenient suggested percentages with a single tap.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

“Check please” is a thing of the past.

With our integrated QR codes your customers pay in seconds, straight from their table.