Untangling Restaurant Payments for a Stress‑Free Workflow

The Realities Behind Payment Complexities

Running a restaurant can be exhilarating, but let’s face it: managing money flow can feel like juggling a dozen sizzling pans at once. From processing payments to handling payouts, each step brings its own set of pain points. You might find yourself spending too many late nights matching receipts, worrying about compliance, or stressing about new technology trends. In a perfect world, restaurant owners would focus on creating memorable dining experiences instead of wrestling with cumbersome payment processes.

This challenge is especially clear when you consider that U.S. consumers increasingly expect quick, digital payment options. According to the Federal Reserve Payments Study, over 75% of Americans use some form of digital payments regularly. Meanwhile, the restaurant ecosystem is much more diverse, running everything from credit cards and contactless wallets to traditional cash transactions. If you’re not ready, that wave of digital demand can catch you off guard.

But let’s put out the fire before it spreads. By examining payments, payouts, and common pain points, you can streamline your processes and reclaim time for what really matters: delighting patrons with exceptional meals. Dive in and let’s discuss practical strategies to reduce the stress and complexity of restaurant payments.

Identifying the Main Pain Points

To simplify how you handle money, first pinpoint the areas causing the biggest headaches. That starts with looking at both your revenue and your expenditures.

- Transaction Processing Delays: Waiting several days for transactions to clear can impede your ability to stock fresh produce or pay your team on time.

- High Processing Fees: If you’re using outdated payment terminals or plans, you might be paying more than necessary. Being locked in expensive service agreements only compounds the frustration.

- The “Tip Tangle”: Tips are essential for your servers, but how you collect and distribute them needs clarity and transparency. Manual calculations can lead to confusion, payroll errors, or even staff dissatisfaction.

- Restrictive Cash Flow: Unpredictable revenue streams make it tricky to plan for expansions or unexpected expenses. Cash flow that’s stuck for days can force you to press “pause” on important decisions.

- Integration Woes: When your accounting software doesn’t connect seamlessly to your point of sale system, or when your bank deposits don’t match up with your daily sales totals, chaos can ensue in your books.

These aren’t just random annoyances; they’re core issues that can make or break a restaurant. A 2023 industry survey by the National Restaurant Association found that almost 60% of owners cite payment-related challenges as a primary area of operational stress. The good news is, improved technology and better processes can solve many of these issues. Before you master them, however, it helps to understand the mechanics behind payment and payout systems in more detail.

Cracking the Code of Payment Systems

Every restaurant has a unique style, so it’s no surprise you’re faced with tons of point of sale (POS) solutions, online processors, and even QR-code-based payment apps. But if the infrastructure behind your transactions is antiquated—or not suited to your establishment’s flow—you risk a mismatch that leads to errors or worse, unhappy guests. Here’s how restaurant payments typically flow:

- Order Placement: A customer orders, you prepare the delicious meal, and the bill is generated.

- Payment Initiation: The payment can happen tableside if you have QR codes or modern pay-at-the-table devices. If not, the server shuttles the card to a stationary terminal at the back bar or host stand.

- Authorization: The acquirer (your payment processor) communicates with the card networks and issuing bank to see if funds are available.

- Transaction Approval: If the finances check out, payment is approved and a digital record is created.

- Funds Transfer: After settling the batch, your processor deposits the funds into your bank account—often after deducting fees.

When you add staff tips, loyalty points, or promotional discounts on top, the complexity only grows. That’s why a user-friendly POS system that integrates these additional features can be a lifesaver. From a purely practical standpoint, you want the system that moves money quickly and transparently, so you see exactly how much is earned and where it’s going.

Bella’s Brunch Bistro: A Practical Example

Imagine Bella’s Brunch Bistro, a fictional café in Austin, Texas. Bella was using a stationary payment terminal that required servers to travel back and forth—and once the meal was complete, customers still had to wait in line at the counter. This created bottlenecks during busy mid-morning hours.

Fed up with negative reviews about the slow checkout process, Bella adopted an integrated solution that included the ability for customers to scan a QR code at their table. Rather than waiting for a printed check and conversation with the server, customers completed the transaction in seconds. The difference was immediate:

- Check-out times dropped by over 50%

- Customers left more tips due to the simplicity (Bella noted an 18% increase in tips, on average)

- Staff freed up time to chat with returning guests and upsell coffee specials

It was a simple switch, but it dramatically altered Bella’s daily workflow. By shifting to a more modern setup, Bella also reduced manual errors and never had to chase tip reconciliation at the end of the day. Her experience highlights the reality: daily payment hiccups add up and eventually weigh down the entire customer experience. Eliminating the friction can bring immediate results.

Strategies to Make Payouts Less Painful

On the other side of the coin, payouts are just as critical as payments. Timely bank deposits are the life force that keeps your kitchen stocked, your staff paid, and your lights on. But it’s easy to lose track of fees, lumps in your deposit schedule, and overhead when you’re living day to day. Consider these strategies to smooth out the process:

Negotiate Better Rates

Don’t assume that high transaction fees are a necessary evil. Many processors are open to negotiation, and if you have a consistent track record and growing sales volume, you stand a good chance of securing better rates. Shop around if you must—competitive quotes often help you get a better deal from your existing provider.

Stay on Top of Settlement Schedules

Whether your payments settle daily or weekly, keep a tight watch on the timing. Talk to your payment processor about the settlement cycle if you notice that deposits lag too long. Optimizing that schedule can be a game-changer for your daily operations, turning a trickle of funds into a predictable, steady stream of income.

Automate Accounting

One of the biggest culprits in payout nightmares is manual reconciliation. Exporting CSV files, matching them to bank statements, and trying to figure out which fees were taken out at which stage can feel like detective work. Automated integrations between your POS system and your bookkeeping tool significantly reduce errors. They also save you time and lower your stress levels, so you can focus on more creative tasks—like planning next week’s special brunch menu.

How Technology Can Fill the Gaps

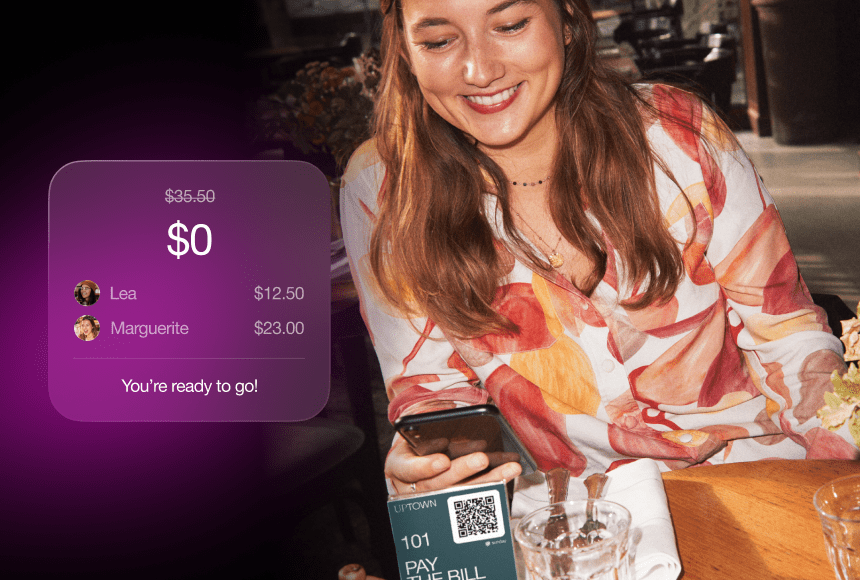

Technology is no silver bullet, but coupled with a well-trained staff and a savvy mindset, it can transform your payment workflow. For instance, sunday offers a streamlined way to handle fast, secure payments via QR codes. Customers simply scan, pay, tip, and even leave a quick review on Google if they wish.

It’s not just about flashy gadgets—it’s about removing every possible barrier between the guest’s desire to pay and receiving payment in your bank. Below is a short breakdown of the difference between traditional setups and an optimized payment approach:

| Traditional Setup | Optimized, Modern Setup |

|---|---|

| Server collects cards, walks to terminal, prints receipts (manual steps) | QR code allows guests to settle bills and tips on their phone |

| Multiple fees stack up (processor, hardware rental, subscriber fee) | All-in-one platform with transparent fees |

| Lengthy end-of-day reconciliations | Automated settlement and simplified reporting |

This difference is a big one. By reducing friction in the payment loop, you provide a better guest experience while also simplifying your own internal processes. It’s a win-win scenario.

Navigating Tips and Staff Satisfaction

In a busy restaurant, tips are the lifeblood for many employees. Without a well-structured system, you risk confusion or even staff mistrust. Here’s how you can set up a healthy tipping environment:

- Transparency: Make sure employees understand how tips are tracked, pooled, and distributed. When possible, use POS integrations that automatically assign tips to the correct staff members.

- Prompt Payouts: Holding on to tips for too long, or not paying them out according to local labor regulations, can harm morale. Confirm your POS or payment solution helps you deliver tips quickly—preferably in the next paycheck or nightly closeout.

- Fair Splits: If your restaurant uses a tip pool system, set up rules that reward the people who directly serve your patrons without neglecting behind-the-scenes employees. Consider a tip share that includes kitchen staff, especially if they contribute significantly to each diner’s experience.

A well-run tip system goes beyond compliance—it fosters a sense of teamwork. Staff sees that management respects their contributions, and they’re more motivated to provide top-notch service. It’s amazing how far a transparent approach can go in creating a positive workplace.

The Role of Customer Engagement in Payment Processes

A smooth payment experience can do wonders for customer loyalty. Think about it: after a satisfying meal, no one wants to wrestle with complicated payment steps. For many diners, the payment process is the last memory of your establishment. Make it a pleasant one. Here are a few methods to incorporate:

- QR Code at the Table: As we saw with Bella’s Brunch Bistro, scanning a code to pay is quick, intuitive, and reduces friction.

- Easy Review Prompts: Jump-start your online reputation by prompting satisfied guests (at the right moment) to leave a review on Google. By embedding this step in the payment flow, you capture genuine feedback. This also helps new customers discover your place.

- Rewards and Loyalty Programs: Show your appreciation by offering digital loyalty punches or points during checkout. Tracking loyalty automatically encourages repeat customers without requiring extra forms or punch cards.

- Cross-Promotion: If you run multiple restaurant locations or sister brands, you can share promotions during payment. It’s the perfect time to give a gentle nudge about your upcoming events or across-town venues.

Practical Tips for a More Efficient Workflow

At this point, you might have ideas racing through your mind. Before you start contacting vendors or upending your current system, step back and prepare a measured approach. Here are a few pointers:

- Audit Your Existing Setup: Make a list of all the software, hardware, and services that connect to your payment processing. Break down the monthly costs, contract lengths, and any integration frustrations. This baseline information will guide you toward meaningful upgrades.

- Train Your Team: Technology only solves problems if your staff knows how to use it. Offer short, focused training to ensure everyone—from hosts to servers to managers—has the skills to troubleshoot basic issues and effectively assist customers at the table.

- Evaluate Security Measures: The restaurant industry is increasingly a target for fraud. Make sure new solutions are Payment Card Industry (PCI) compliant, and train your team to recognize suspicious behaviors.

- Look for Adaptability: Your restaurant might evolve to include delivery, new pickup services, or expansions to multiple locations. Choose systems that scale with your success, so you don’t find yourself in the same situation a year from now.

- Test Before Committing: Many POS providers and payment apps allow trial periods or monthly contracts. Use these to your advantage so you’re not locked into a contract with hidden fees or subpar support.

A Fresh Look Ahead

Overhauling the way you handle payments and payouts might seem like a daunting task, but it’s worth every bit of effort. When you remove friction from the last step of a diner’s experience, you leave them with a sweet final impression—rather than a rushed afterthought. This is exactly why solutions like sunday have gained so much traction: quick, simple settlement methods enhance the overall dining experience while saving you time and hassle behind the scenes.

Take the time to evaluate your existing pain points, look for technology that addresses your biggest workflow issues, and keep your team fully in the loop. By focusing on clarity, consistency, and warmth, you’ll create an environment where customers are eager to settle the check—and even more eager to come back. Refining how you handle money is not just about padding the bottom line; it’s about helping your business and its people thrive. Because, in the restaurant world, the best recipes are the ones that bring everyone together—both in the kitchen and at the table.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

The fastest way to pay in restaurants

- Scan the QR code

- View the menu

- Split the bill

- Add a tip

- Pay in 10 seconds

- Leave a review