Smoother Evenings with the Help of Digital Checks

Busy nights often overwhelm restaurant teams and frustrate customers eager to settle their bills quickly. Digital checks bring faster payment options, fewer errors, and simpler tipping. They also free up staff to focus more on hospitality. By reducing manual tasks and providing a streamlined method for guests to pay, digital checks lower pack-night stress and boost both customer satisfaction and staff efficiency for US-based restaurants.

The Realities of a Packed Night

Picture this: It’s Friday at 7:00 p.m. Customers are lining up at the door, your loyal regulars are chatting in the waiting area, and you can barely hear the kitchen staff calling out orders above the steady clatter of plates. Energy is high. Tables turnover rapidly, and servers hustle back and forth, balancing trays along narrow pathways. Everyone’s working in overdrive to keep pace. Sound familiar?

Under these conditions, one of the biggest choke points is getting checks to each table and processing payments. Customers dislike waiting too long. Servers struggle to juggle multiple tables at once. Meanwhile, the line for the credit card terminal lengthens behind the bar. By the end of the night, staff feel frazzled and guests may walk away with a less-than-stellar impression—even when the food was fantastic.

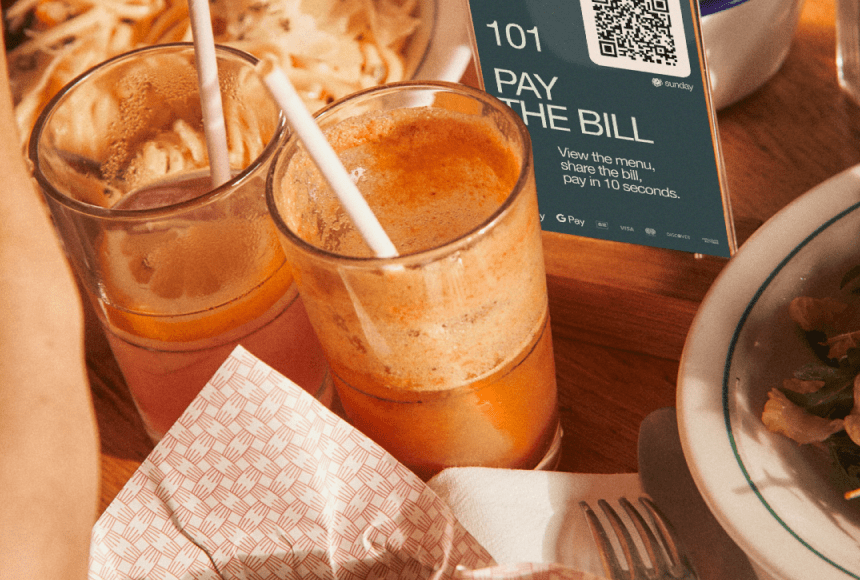

That’s where digital checks come in. Instead of passing by each table multiple times—dropping the check, picking it back up, running it to the terminal, bringing it back for a signature—guests can scan a QR code and pay instantly from their own device. That quick, streamlined process can do wonders to reduce tension and wait times, making your bustling Friday night a delight instead of a drain.

Where Traditional Receipts Fail

Restaurants often start noticing the bottleneck when the moment arrives to wrap up a guest’s meal. In a traditional setup, here’s what happens:

- The server prints the check at the register or a printer terminal in the kitchen.

- The server walks to the table and places the printed check for the customer to review.

- The guest places their card or cash in the check holder, then waits.

- The server picks it up when they have a free moment, runs it back to the credit card terminal, processes the payment, and returns to the table for signatures or change.

All this takes time. Multiply that process by your total number of tables: It can easily add up to 30, 45, or even more minutes in combined waiting for your customers. In many cases, this waiting game can be downright frustrating. With digital checks, you address these challenges directly:

- One-step payments: Scanning a QR code to view the bill and pay with a tap.

- Simplified tipping: Tip prompts are built in, encouraging gratuities without confusion.

- No lines at the register: Guests handle payments on their device, freeing the server from repeated round trips.

The result: a faster, more transparent, and far less stressful payment experience.

Why Speed Matters to the Modern Diner

Quick service is a hallmark of a positive restaurant experience in the United States. Many diners don’t just want a tasty meal; they want convenience. After all, in a digital age where nearly every transaction—ordering a ride, buying groceries, or booking a flight—can be done from a smartphone, waiting too long for a paper check seems outdated.

According to QSR Magazine, the speed of a customer’s experience directly impacts satisfaction levels, whether it’s at a quick-service eatery or a full-service restaurant on a Saturday night. Streamlining the bill-paying process means diners leave with a sense of efficiency and gratitude, not frustration.

In short: People are ready and willing to pay swiftly. By offering a digital payment solution, you meet them where they already live—on their phones—and eliminate tedious table-side waits. This in turn speeds up table turnover, helping you serve more guests in the same time frame.

Crucial Benefits for Restaurateurs

Digital checks don’t just help customers feel good. They also pay off for owners and managers, especially on the busiest nights. Let’s explore a few of the specific benefits you can expect from implementing a digital check system in your restaurant:

- Reduced labor intensity: Less time running personal checks back and forth means servers can concentrate on taking orders, running food, and upselling menu items.

- Better tip capture: Clear tipping options prompt diners to leave a tip in seconds, resulting in fewer missed gratuities.

- Data collection: Because everything goes through a digital platform, you gain insights into sales trends, busy times, and more effective promotions.

- Streamlined financial reporting: End-of-night reconciliations are often simpler with integrated software that transmits guest payments directly to your POS.

- Happier customers: A frictionless payment process leaves guests with a positive last impression. That’s the feeling they’ll carry with them, whether they’re leaving a review online or telling friends about your place.

What Makes a Good Digital Check System

Not all digital payment solutions are created equal. When you’re evaluating systems, a few key features should stand out:

1. Easy Access for Customers

Any solution that requires lengthy sign-ups or app downloads will discourage use. Instead, look for a straightforward option: A QR code on the paper menu or on a small table stand that customers can scan immediately. They should see an itemized list of their order, along with clear payment buttons.

2. Secure Payment Processing

Security is non-negotiable. Choose a platform that meets PCI compliance standards and uses robust encryption to protect credit card and personal information. Always verify the company’s security protocols. Customers need confidence that their data is safe.

3. Versatile Integration

Ideally, the service works smoothly with your POS or other key systems. This ensures that, once a guest pays, the check automatically closes, your sales data updates accordingly, and your staff doesn’t have to manually reconcile anything at the end of a very busy night.

4. Tipping and Review Options

Tips matter for your team. A digital check system that makes tipping as simple as tapping “15%,” “20%,” or “Custom” drives revenue for your staff. And if the platform gives customers the option to leave a quick Google review, you tap into priceless word-of-mouth marketing. Satisfied guests can express their delight on the spot, giving you a new stream of positive exposure.

Seeing It in Action: Mia’s Cozy Corner

Let’s imagine a small neighborhood spot called Mia’s Cozy Corner. It’s a 12-table restaurant known for homemade pasta and a narrow yet charming dining room. Mia’s Cozy Corner is busiest on Thursday, Friday, and Saturday nights. The biggest challenge? After the entrees and desserts have been devoured, lines start forming at the credit card terminal near the front counter.

When Mia decided to implement digital checks, she didn’t want to overhaul her entire system overnight. She began a two-week trial on her busiest shifts. The results amazed her:

- Less waiting: People who used the QR code to pay, tip, and leave a quick review were out of their seats faster, freeing tables for waiting guests.

- Higher tips: Servers reported that tips overall improved because payment prompts on the digital check subtly reminded diners to show gratitude.

- Efficient service: The staff was less stressed. With fewer trips to the credit card terminal, they focused on tasks like checking on new diners and upselling that irresistible tiramisu.

- Boosted reputation: More guests left glowing online reviews. Having an option to post a review immediately—while the positive feeling was fresh—brought a noticeable uptick in Mia’s local search ranking for “Italian spots.”

Within a month, Mia realized she had no interest in going back. Her staff was happier, her customers were praising the easy payment experience, and she was even able to reduce the cost of paper receipt rolls, which are surprisingly expensive over time.

Minimizing Friction for Staff

While digital check solutions undeniably benefit customers, let’s talk more about the staff experience. After all, servers, bartenders, and support teams are the backbone of your business. Overworked employees can quickly burn out, resulting in higher turnover and additional training costs.

By clearing repetitive tasks like printing checks, collecting payments, and walking them back to the station, digital checks free up mental space for your staff to focus on what they do best: creating memorable guest experiences. Servers can spend more time:

- Guiding diners through the menu

- Suggesting wine or dessert pairings

- Ensuring each course arrives timely and at the right temperature

- Building rapport with regulars

These interactions foster customer loyalty. When the payment at the end of the meal isn’t a stressful countdown, you can close your night with a sense of satisfaction rather than scrambling nerves.

The Key Role of Table Turnover

A high table-turnover rate means more customers served and potentially higher revenue—especially during peak hours. Digital checks help reduce the critical lag time that often drags out the end of the dining experience, allowing restaurants to seat the next party that much sooner.

If you think about it, the moment customers decide they’re finished, every extra minute they wait to pay is lost potential revenue. That’s not to say you want to rush diners out the door. Rather, you’re respecting their time by providing a quick, user-friendly way to conclude the meal. In turn, a shorter wait list outside means less frustration for new arrivals.

By some industry estimates, shaving even five minutes off each table’s cycle time can add one or two more turns on a busy evening. That’s significant, especially if you run a spot with a limited number of tables. When your average per-person check is $25 or more, those extra turns go straight to the bottom line.

Empowering Guests with Transparency

One of the major selling points of digital checks is the feeling of control it gives diners. They get to see their total, item by item, in real time. They can verify that the appetizer arrived on the bill as expected, or that a special request was accounted for correctly. There’s no confusion or hidden fees. This openness goes a long way in building trust.

Whereas a paper bill may require scanning a small receipt printout for accuracy, a digital check can be crystal clear and easy to read, with taxes and tips automatically calculated. If a guest has a question, they ask the server to fix it before paying, saving everyone time and awkwardness afterward. This sense of transparency has become an important driver of repeat business in the increasingly competitive dining landscape.

Contactless Payments and Health-Wise Considerations

Another huge advantage in the last few years is the contactless nature of most digital check systems. The National Restaurant Association reported a rise in guest preference for touch-free solutions in the aftermath of heightened health awareness (source). Even now, many diners prefer scanning a QR code over exchanging receipts or passing cards around.

Contactless payment solutions reduce physical contact with menus, check holders, pens for signatures, or shared credit card terminals. By providing a frictionless, hygienic experience, you’re not only meeting modern health-related concerns, but also showing a commitment to safety and care. In turn, that bodes well for your customer loyalty and reputation.

Seamless Integration with Restaurant Layout

Worried about altering the vibe of your carefully designed dining room? Don’t be. You can incorporate QR codes in subtle ways that complement your brand’s look and feel. Some restaurants place small QR code coasters on each table. Others incorporate them into a tasteful stand or the back of a tabletop menu insert. The key is to make it easily noticeable, without breaking that warm, welcoming atmosphere you’ve built.

Staff can also inform diners about the QR code approach when they seat them or drop off the first round of drinks. A welcoming comment such as, “Feel free to pay from your phone anytime if you’re in a hurry,” sets the stage. That casual heads-up can remove any hesitation new users might have about scanning a code at the table.

Handling Special Requests and Splitting Checks

One frequent concern is check splitting. Some customers want separate bills. A digital check system that provides split options—by total cost, by item, or by manual selection—keeps groups happy and reduces staff’s mental math obligations. A few taps from each diner, and the entire table can pay their share without confusion or lost time chasing down the right amounts.

This is particularly handy during large gatherings or special events. The fewer the steps needed to split a check, the smoother your servers’ workflow. Large parties can sometimes generate chaos at the end of a meal, with everyone scrambling for calculators and credit cards. Let your digital solution do the work for them.

Subtle Ways to Highlight Digital Checks

Nudging customers toward digital checks doesn’t require massive signage or pushy sales tactics. A few small strategies can go a long way:

- Add a line to your menu: “Ready to pay or split the check? Scan the QR code on your table.”

- Train servers to mention it: “Whenever you’re ready, you can scan the code right there. It’ll show your entire tab. Quick and easy!”

- Offer a small incentive: Some restaurants run a short promotion, like a complimentary small dessert to first-time digital check users. This can help drive adoption without eating too deeply into your margins.

- Place friendly reminders: Tabletop tents or coasters with playful messages, like “Scan. Pay. Enjoy!” or “Settle up anytime—no waiting!” can lessen any hesitancy.

Why sunday is Part of the Conversation

Among the digital payment platforms, sunday stands out as a streamlined solution tailored for restaurants. It allows guests to scan a QR code, view their bill, pay with a credit or debit card, leave a tip, and even drop a Google review—all from their smartphone. With a user-friendly approach, sunday reduces the typical wait for checks while letting your staff reclaim precious time on busy nights.

Restaurants using sunday emphasize reduced friction at the end of service, quicker table turnover, and happier staff who feel less pressured. The brand’s warm and dynamic image aligns with an industry that thrives on personal connection and memorable experiences. If you’re looking to add a digital check solution, a product like sunday can slot seamlessly into your existing workflow without complicated overhauls.

In short, adopting a tool like sunday is more than just a tech upgrade. It’s about recognizing the real, human moments at play in every dining experience. When you cut out the hassle of pass-the-check, sign-here, wait-for-the-receipt, you create an environment where service is less about chasing down payments and more about ensuring every guest leaves smiling.

Finding Balance Between Efficiency and Hospitality

Restaurant owners sometimes fear that technology will erode hospitality. But, used wisely, digital checks can enhance the sense of service. By automating the transactional part—payment—you free up emotional bandwidth for genuine human connection. That additional time can be spent chatting with a table of first-time guests or going the extra mile to suggest a favorite house cocktail.

Hospitality remains at the core. A digital payment solution simply supports your team by removing friction points that can cause stress. With less running around, staff can focus more on welcoming customers, personalizing recommendations, and delivering an overall excellent meal from appetizers to goodbyes.

Staying Competitive in a Changing Landscape

Technology is racing forward in every industry, and restaurants are no exception. Digital menus, reservation apps, smartphone loyalty programs—these solutions are transforming how people dine out. A slow or clunky checkout process stands out more noticeably than before, as guests become accustomed to faster, more integrated experiences.

By adopting digital checks, you ensure you’re not only keeping pace but also positioning yourself as a trailblazer in your local dining scene. It’s a conversation point, too. Diners might say, “I love that they let you pay at the table using just your phone!” Such personal endorsements can bring new customers through your doors.

Nurturing Loyalty Beyond the Last Bite

The moment of payment is sometimes your final chance to shape a diner’s experience. Make it smooth, and they’ll walk away satisfied. But certain digital check options, including sunday, can go a step further by providing an easy way to repeat a visit or stay in touch. For instance, if the tools allow a follow-up on a guest’s phone, you might email or text them with an exclusive invite to next week’s tasting menu or a seasonal promotion. This fosters a sense of relationship, not just a transaction.

These small touches create a loop of engagement that’s more personal than a standard marketing email blast. When guests feel valued and engaged, they’re more likely to return and spread the word to their friends. Building a loyal following doesn’t always require big gestures—it’s often about consistent, thoughtful interactions at every point, including the very end of the meal.

FAQ

Below are some frequently asked questions to help restaurant owners explore the practicalities of going digital with check payments.

1. Are digital check systems difficult for older guests or those who aren’t tech-savvy?

No. Most systems rely on a simple QR code scan and a secure payment page. Even guests who aren’t frequent smartphone users can often manage it with minimal help. A polite server introduction can smooth over any concerns: “Just open your camera and point it at the code until a link pops up.”

2. Does going digital replace my need to offer paper checks at all?

Not necessarily. You can still keep traditional paper checks on hand for those who prefer them. Many restaurants find that over time, however, digital adoption grows naturally as more guests appreciate the convenience.

3. Is a fast payment option really enough to boost my bottom line?

Yes, especially if you operate a busy venue where table turnover is critical. By reducing wait time for each table, you can serve more guests in the same window. Plus, simpler tip prompts often lead to better gratuities for your servers.

4. Can digital checks integrate with my existing POS software?

In many cases, yes. You should look for a solution that provides integration capabilities or an open API, so sales data and transactions sync in real time without extra manual entry. Check with your POS provider or the digital check service to confirm compatibility.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

“Check please” is a thing of the past.

With our integrated QR codes your customers pay in seconds, straight from their table.