Transforming Your Restaurant’s Flow with Seamless At-Table Payment

The Race Against Time: Why Faster Service Matters

Picture this: your dining room is bustling on a busy Saturday night. Servers are weaving between tables, checking on guests, running food, and then—when it’s time to pay—fumbling with handheld card readers or waiting for guests to fish out the right credit card. Meanwhile, a line starts forming at the entrance, and every extra minute a table remains occupied means a missed opportunity to seat a new party. If you’ve ever had that frantic “I need another pair of hands” feeling, you know that time is a restaurant’s most precious currency.

Speedy service does more than ease your stress—it also directly impacts guest satisfaction, table turnover, and ultimately revenue. According to the National Restaurant Association’s 2023 State of the Restaurant Industry, diners rank timely service among their top considerations when choosing where to eat. But is there a concrete way to accelerate the payment step, which so often clogs up the flow of an otherwise smooth service? The answer is yes, and it’s called at-table payment.

Defining At-Table Payment: A Quick Overview

“At-table payment” is the process of allowing diners to pay right at their table, using either a mobile device or a digital point-of-sale system that doesn’t require them to line up or wait for a card reader to arrive. Instead of the traditional back-and-forth routine—where a server brings the check, waits for a card, processes it, and returns with a receipt—guests can handle the bill in seconds.

In practice, at-table payment often involves:

- QR Codes: A guest simply scans a code using their smartphone, reviews the check, and completes payment online.

- Mobile POS Terminals: Some restaurants hand a secure, handheld POS device to diners so they can insert or tap their card, without leaving the table.

- Contactless Payment Apps: In some cases, customers use an app to check out as soon as they’re ready, free from any waiting period.

These methods effectively transfer a part of the transaction control from staff to the customer, eliminating needless waiting and making the payment process as frictionless as possible.

How Technology Cuts Down Waiting Times

For many restaurant owners, the idea of deploying new technology might feel intimidating—especially if your staff is already juggling a dozen tasks at once. However, at-table payment is deceptively simple to implement, and the payoff in terms of faster service and happier customers can be significant. Here’s how:

- Reduced Server Trips: In traditional models, your server might have to drop the check, leave to process the payment, then return to the table for a signature. By letting diners pay themselves, you cut that sequence in half.

- One-Tap (or One-Scan) Convenience: Because the check is already itemized and displayed, guests usually need just a quick glance before they tap “Pay.” No more rummaging for cash, no more passing credit cards across the table.

- Instant Receipt Access: Digital receipts can be emailed or accessed through a customer’s phone. This avoids that awkward limbo where diners wait for a slip of paper, or you rush around looking for the receipt printer.

- Quicker Table Turnover: When payment is settled promptly, you’ll see less lag between parties. A few minutes shaved off each table can add up to an extra turn or two during peak hours.

The end result? Guests feel more in control, staff can redirect energy to hospitality rather than administration, and your business can handle higher volume without sacrificing service quality.

The Real Impact: Key Metrics and Data

While speed is a crucial factor, it’s worth looking at the numbers to see how at-table payment can affect your bottom line. A 2022 survey by Statista on mobile payment usage in the US suggests that the adoption of mobile-based transactions is climbing every year. More than 40% of respondents reported feeling more comfortable using their phone to handle everyday payments than they did just two years prior.

Additionally, quick adoption of this technology often translates to:

- 20–30% faster table turnover: Restaurants that implement mobile or digital payment options typically report a shorter table dwell time, which boosts total covers per shift.

- Reduced labor costs: When servers spend less time closing checks, they can serve more tables or focus on enhancing the dining experience.

- Fewer errors: Digital payment systems often reduce the risk of charging the wrong check or misplacing a card, improving overall guest satisfaction.

These metrics aren’t just theoretical. They highlight a shifting landscape where diners expect—and increasingly demand—modern, fast, and convenient payment processes.

Enhancing the Guest Experience Beyond the Payment

Speed isn’t the only advantage that at-table payment solutions can bring to your dining room. By freeing staff from manual payment tasks, you open up a host of possibilities:

- More Time for Hospitality: When servers no longer have to shuffle between tables to manage checks, they can spend more energy enhancing the overall dining experience. Whether it’s recommending wine pairings or offering dessert suggestions, this improved face time helps boost guest satisfaction.

- Improved Accuracy: Hand-keying orders or tips into a register can invite mistakes. Automated calculations for tips, taxes, and discounts minimize human error.

- Encouraged Tipping: Many digital payment platforms prompt guests with suggested tip amounts, creating a subtle encouragement to tip at or above standard percentages. This can be a morale booster for staff and a revenue enhancement for your restaurant.

- Post-Payment Engagement: Solutions like sunday can prompt customers to leave Google Reviews immediately after payment. That nudge can translate into higher review participation, which in turn boosts your online presence.

And, of course, happier guests tend to return. Offering a seamless, tech-savvy experience can set you apart in a crowded marketplace, giving you a fresh angle to stand out among local competitors. In essence, at-table payment is more than a gadget or a gimmick—it’s a strategic investment in your restaurant’s future.

Finding the Right Fit: Key Considerations for Implementation

Just like adding a new dish to your menu, rolling out an at-table payment solution needs to be done thoughtfully. Here are some steps to guide you:

- Evaluate Your Current Workflow: Before anything else, map out the payment flow in your restaurant. Identify the choke points—where do lines form, where do guests have to wait? This baseline will help you measure improvements after implementation.

- Choose the Appropriate Hardware or Software: If you already have a POS system, look for an add-on module that enables at-table payment. If you’re starting from scratch, explore comprehensive solutions that include QR codes or mobile functionalities. Make sure you opt for a secure, PCI-compliant system to protect your customers’ data.

- Train Your Staff Thoroughly: The best technology won’t work if your team doesn’t understand it. Host quick, hands-on training sessions. Show staff how to explain the payment process to guests in a friendly, non-technical way.

- Set Clear Guest Expectations: Encourage your servers to introduce the payment option at the beginning of the meal. A simple phrase like, “By the way, you can pay anytime by scanning this QR code,” goes a long way in smoothing the experience.

- Monitor and Collect Feedback: For the first few weeks, keep an ear out for guest feedback. Are they finding it easy to use? Any glitches or frustrations? Use that insight to fine-tune your system and your staff training.

Done right, implementation can be as smooth as a well-stirred sauce—integrating seamlessly into the day-to-day flow of your restaurant, rather than feeling like an abrupt shift for your diners.

A Little Dose of Human Touch

One concern some restaurant owners have is whether at-table payment removes the personal touch. After all, part of the dining experience is the friendly server who checks in to see if you loved your meal as much as they promised you would. The good news is: technology doesn’t replace hospitality—it enhances it.

By cutting down mechanical tasks like running cards back and forth, your servers can interact more with guests on a personal level. They can recommend daily specials, chat about cooking methods, or share fun anecdotes about the local food scene. And yes, they can do all this while a guest is scanning a QR code to pay. Think of it as the best of both worlds: the warmth of human interaction plus the efficiency of digital transactions.

Where sunday Fits In

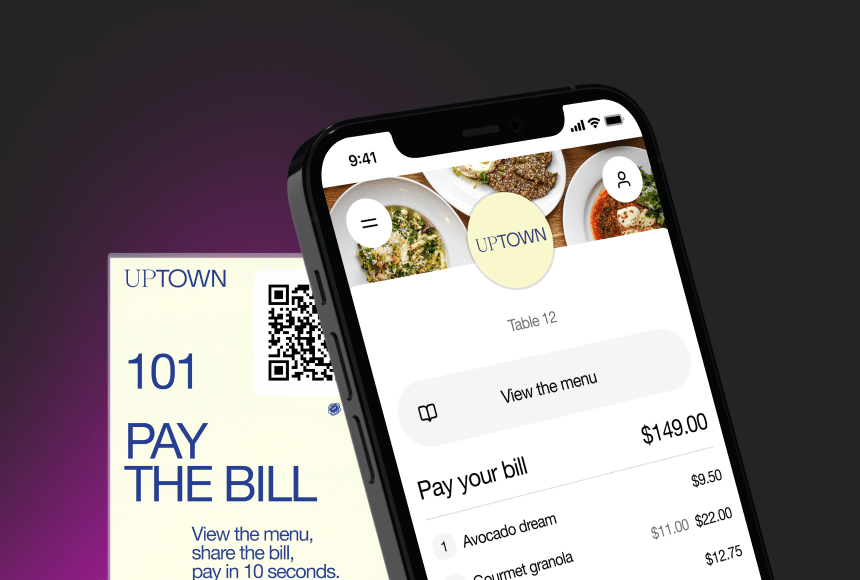

At this point, you might be wondering whether a specific solution can integrate effortlessly into your operations. That’s where sunday comes in. With sunday, your customers can:

- Scan a QR code at their table to see their itemized check in real-time

- Pay instantly using a preferred method—no waiting, no hassle

- Leave a tip through suggested tip tiers or custom amounts

- Receive a digital receipt and a prompt to leave a Google Review

The platform is designed to be user-friendly, with a straightforward interface that doesn’t require a tech manual to understand. For restaurant owners, that means minimal disruption to your existing workflow and maximum efficiency gains. It’s simply a matter of scanning, paying, and going—like adding a pinch of salt to your dish at just the right time.

Practical Tips for Making a Smooth Transition

If you decide to make the leap toward at-table payment, here are a few final pointers from someone who’s spent time on the floor:

- Test it Off-Peak First: Try a pilot run on a less busy night or in a small section of your restaurant. Work out any kinks before rolling it out across the board.

- Market the Convenience: Let guests know about the new feature in your social media posts or on table tents. Sometimes, diners won’t use it simply because they’re unaware it’s an option.

- Stay Open to Feedback: If guests say the text is too small on their phones, tweak it. If servers feel uncertain, give them more training. Adapt, improve, and watch your service flow speed up with each adjustment.

Ultimately, introducing at-table payment is less about adding a shiny piece of tech and more about committing to a frictionless guest journey. It’s one more step toward making sure your guests leave with a smile—and maybe an online review proclaiming they “never had such an easy time settling the bill.”

Charting a Faster Future

In the modern restaurant landscape, every minute counts. As customer expectations evolve—especially around speed and convenience—embracing at-table payment can give you a crucial edge. You free up staff to focus on providing exceptional hospitality, you minimize waiting times that frustrate diners, and you streamline your own operations so you can welcome more guests each shift.

From the bustling kitchen to the final farewell, each phase of a diner’s visit is a chance to leave a memorable impression. By simplifying your payment process, you’re not just shaving seconds off a transaction—you’re reimagining the overall dining experience. Whether you have a cozy bistro that thrives on personal interaction or a high-volume establishment aiming for quick turnover, the payoff is clear: more satisfied customers, happier staff, and an efficiency boost that elevates your entire operation.

So, if you find yourself craving a more seamless workflow, consider the potential of at-table payment. It’s like refining a classic recipe—you only need a few smart adjustments to see (and taste) a world of difference in your final product.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

“Check please” is a thing of the past.

With our integrated QR codes your customers pay in seconds, straight from their table.