Why Contactless Payments Have Become a Game Changer for American Restaurants

Understanding the Contactless Payment Boom

Take a moment to picture a bustling dining room on a Friday night. Servers gracefully weave in and out of tables, customers share appetizers and laughter flows as easily as the wine. The last thing any guest wants is a hiccup when paying. That’s why a rapid shift in the way people pay is reshaping the restaurant experience in the United States. Contactless payment technology has emerged to ensure smoother, faster, and more satisfying transactions. More than just a convenience, it has become a key component in meeting guest expectations and staying competitive.

You might be thinking this trend is an overseas phenomenon, commonly associated with Europe or parts of Asia where people “tap to pay” everywhere from cafés to supermarkets. Yet contactless is catching on in America with remarkable speed. According to a report from eMarketer, the number of mobile proximity payment users in the US soared to around 100 million in 2021—and it’s expected to keep rising. The global pandemic accelerated the acceptance of contactless options, but technology and consumer preferences are driving it forward, even as times change.

For restaurant owners, understanding how and why this form of payment has exploded is critical. In an industry where small details can determine whether a guest returns or goes elsewhere, fulfilling new payment expectations is far more valuable than just adding another technological bell or whistle. It’s becoming a must-have, and the logical next question is: why does it matter so much right now, especially in the American market?

Guest Expectations Are Changing—Faster Than Ever

It’s no secret that in the US, people expect instantaneous results. Faster drive-thru lines, same-day deliveries, streaming content on demand—these modern conveniences have shaped the way guests perceive “normal” service. So when it comes to paying after a meal, quick and effortless is no exception. Contactless payments fit perfectly with this growing preference for speed and ease.

American diners often place a premium on efficiency. Consider the “to-go” culture in the States. Many guests order online, pick up en route, and expect the transaction to be fully streamlined. A brief pause to swipe or insert a card might not seem like a big deal, but it can feel lengthy to someone who’s used to tapping their phone or card and getting on the road in seconds.

Here are a few behaviors and expectations worth noting:

- Instant Check Closure: Guests want to spend more time savoring their meal and less time waiting for the final check.

- Minimal Wait: Americans appreciate speedy service, from how quickly the server arrives with beverages to how swiftly they can settle their bill.

- Digital Integration: People use their phones for everything—banking, shopping, entertainment, and now paying.

- Transparency and Control: Diners like to see the details of their purchase and tip options clearly, often on their own device, so they have full control and minimal friction.

Avoiding the Dreaded “Check Dance”

As an owner or operator, you’ve probably seen it thousands of times: the “check dance.” The server drops off the check, guests fumble for cards, another wait starts while the server processes the payment, and it takes multiple trips back and forth. Meanwhile, other tables are waiting to be turned over. Not only does this dampen the overall experience for diners, but it’s also an operational headache.

With contactless payment solutions, whether it’s through a QR code on the table or a portable payment terminal, you can eliminate that awkward dance. In fact, a well-structured system gives guests immediate access to the check on their mobile device, allowing them to split, tip, and finalize payment in seconds. This simple efficiency can open the floor to other advantages:

- Less pressure on servers during peak times.

- Higher table turnover—crucial for revenue.

- Lower margins of error since guests confirm their own bill.

Additionally, streamlining the process helps maintain a warm relationship between staff and customers. Instead of the server’s last moments at the table being about running cards, it’s about a genuine goodbye and seeing if they might return soon.

From Physical Cards to Mobile Apps: What’s Really Driving Adoption?

Contactless technology isn’t new. But the surge in acceptance for restaurants has multiplied for a few reasons:

- Mobile Wallets on the Rise: Apple Pay, Google Pay, and Samsung Pay are omnipresent on US smartphones. Many bank apps (like Chase, Bank of America, etc.) also support their own tap-to-pay functionalities.

- Wearables and Tech Gadgets: More people own smartwatches and other wearable tech, which naturally align with quick “tap and go.”

- Health and Safety Concerns: During and post-pandemic, many guests grew cautious about touching shared surfaces like PIN pads or pens.

- Marketing by Payment Networks: Major card networks push contactless card issuance, which encourages both merchants and consumers to adopt the technology.

To capitalize on these drivers, restaurants need to send a clear message: “We accept contactless, we encourage it, and it’s easy for you to use.” The good news? It doesn’t have to be complicated. Solutions like a portable payment terminal or QR code technology can be integrated swiftly, and savvy owners can even find ways to brand or personalize the payment page, reinforcing their restaurant’s identity at the last step of the guest’s journey.

Boosting Tips and Encouraging Positive Reviews

One often-overlooked benefit of modern contactless payments is the boost in tipping. When the guest pays via a device that gently suggests gratuity amounts—such as 15%, 20%, or 25%—tips typically increase. Moreover, digital checkouts can smoothly insert an optional section for quick feedback or Google reviews. A subtle nudge like “Enjoyed your meal? Share your thoughts!” can prompt diners to leave a positive review right when they feel satisfied.

Digitizing the tipping process has other payoffs, too:

- Servers earn more consistent tips, which improves staff morale.

- Guests feel less pressure or confusion about calculating gratuity.

- Management gains better transparency and simplified accounting of tips.

While tipping practices vary across cultures, in America, it’s ingrained in the dining experience. Making it a seamless, friendly act on a guest’s phone or contactless screen leads to higher compliance with tipping norms—and it feels less awkward than scrawling a number on a worn receipt slip.

The Ins and Outs of Contactless Payment Technology

At its core, contactless payment works through Near Field Communication (NFC) chips embedded in cards or devices, or via QR codes that link directly to an online payment portal. Either way, the experience can be generally described in a few steps:

- The guest waves or taps their device/card near the payment terminal, or scans a printed QR code using a smartphone camera.

- The system securely confirms the transaction information.

- The guest sees a final total, chooses a tip, and completes payment.

- A digital receipt is generated immediately for both guest and restaurant.

What’s essential here is that no physical contact with the terminal is needed beyond a quick tap—or in the QR approach, no terminal interaction at all. In large-scale adoption scenarios, this reduces maintenance on hardware, speeds up lines, and offers a more efficient way to handle multiple payments. Restaurants can find a variety of user-friendly systems, including those that integrate with existing POS systems so staff can see checks closing in real time.

Why This Matters More in America

Global dining habits differ. Plentiful street kiosks in Asia have made contactless ultra-popular there, and in many parts of Europe, chip-and-PIN is the gold standard. So why is the US pivoting so aggressively toward contactless now?

One reason lies in the interplay of convenience and consumer culture. Americans have historically been comfortable with credit cards, but the outdated magnetic stripe method is rapidly giving way to chip technology and, increasingly, contactless. On top of that, US diners lead busy, on-the-go lifestyles. Whether it’s a business lunch that overran its time slot or a family dinner where the kids need to be whisked home, guests crave speed. Add the impetus from national card issuers that started rolling out contactless cards in bigger numbers around 2019 to 2020, and you have a perfect storm of reception.

Also, frequent travelers who have seen or used contactless overseas come back to the States and want the same ease. This cross-pollination of expectations is a real phenomenon, especially among younger diners who are highly mobile. As the technology becomes standard, any restaurant that refuses to offer contactless options risks seeming antiquated. It can send a subtle message: “We’re behind the times,” which may cost you the trust of new, tech-savvy guests.

Implementing a Contactless System: Where to Start

So you’re on board with the concept, but how do you actually put it into practice? As an experienced consultant in the industry, let me share a few steps that tend to work well for American restaurants:

- Evaluate Your Current POS Setup: Check if your existing POS system is compatible with contactless features or if you need an upgrade.

- Decide on Hardware or QR Approach: Portable payment terminals with NFC readers can be convenient. Alternatively, QR codes eliminate the need for additional devices at every table.

- Train Your Staff: From servers to managers, everyone should know how to guide guests through the process. Make sure your staff can answer questions about security, how to add tips, and so on.

- Announce It Clearly: Place signs or table tents that highlight, “Tap-to-Pay Available” or “Scan to Pay.” It encourages guests to use the service and signals that you’re modern and guest-focused.

- Test and Gather Feedback: Run a soft launch among friends, family, or trusted guests. Get their honest feedback. Tweak any confusing steps before rolling out fully.

- Keep an Eye on Reports: Once up and running, monitor how often people use contactless, average tips, and any feedback from staff or diners. This helps you optimize your setup if needed.

If you’re already agile with digital technology, implementing a flexible platform—like one that handles both card tapping and smartphone scanning—can cover a wide range of preferences. Don’t forget that your staff must remain well-informed, so they can calmly address questions like, “Do I still need to sign?” or “Is my phone secure?”

A Case Study: The Neighborhood Bistro That Went Contactless

Imagine Lisa, who owns a neighborhood bistro serving fresh pasta and local wines. Pre-contactless, her guests would often wait several minutes after finishing their tiramisu just to settle the bill. Her servers hustled, but peak periods were a dance of receipts, pens, and repeated trips to the POS.

After implementing a QR-based payment solution, Lisa placed discreet but noticeable QR codes on table tents. Now diners simply scan with their phones, view or split the check digitally, add a tip, and close out. Lisa integrated an optional feedback prompt after the payment. Within the first month:

- She noticed a 20% increase in tips.

- Table turnover improved by about 15% on busy nights.

- Her restaurant’s Google reviews went up, with numerous mentions praising how easy it was to pay.

Lisa also found that guests appreciate not having to speak above the noise to clarify a split bill or a custom tip amount. They handle it all on their device, and the server can quickly check the payment status from a simple display. Business is up, team morale is high, and the entire dining room has a more relaxed, modern vibe.

Security and Peace of Mind

Anytime a new technology is introduced, a common concern is security. While contactless payments might look new, they’re actually extremely secure. Contactless cards and digital wallets use encryption and tokenization, meaning sensitive details aren’t revealed during the transaction. In many systems, a unique one-time code is generated for each payment, making it very hard to duplicate or intercept data in a useful way.

Communicating these facts to your guests can build trust. They want to know that when they tap or scan, their information is well-protected. You can mention that some banks even offer “zero liability” policies for fraudulent charges encountered through official contactless transactions. If they need proof that this technology is legitimate, directing them to reputable sources, like FTC consumer resources, will help reassure them you’re taking security seriously.

Logistical Benefits for Restaurants

Beyond the guest-facing perks, there are logistical upsides of enabling contactless options:

| Benefit | Impact on Operations |

|---|---|

| Faster Transactions | Saves staff time and increases table turnover. |

| Less Wear and Tear | Fewer physical card swipes means reduced hardware maintenance. |

| Integrated Accounting | Digital records streamline end-of-day accounting and tip tracking. |

| Reduced Errors | Guests finalize their own splits and tips, decreasing disputes. |

For example, at the end of the night, managers must reconcile credit card receipts, cash payments, and tips. When the majority of checks are closed via a digital platform, the system automatically logs each tip and splits in real time. That means fewer slip-ups or missing receipts, letting you maintain meticulous accounts without a headache. Staff also appreciate finishing their shifts with minimal confusion over who paid for what.

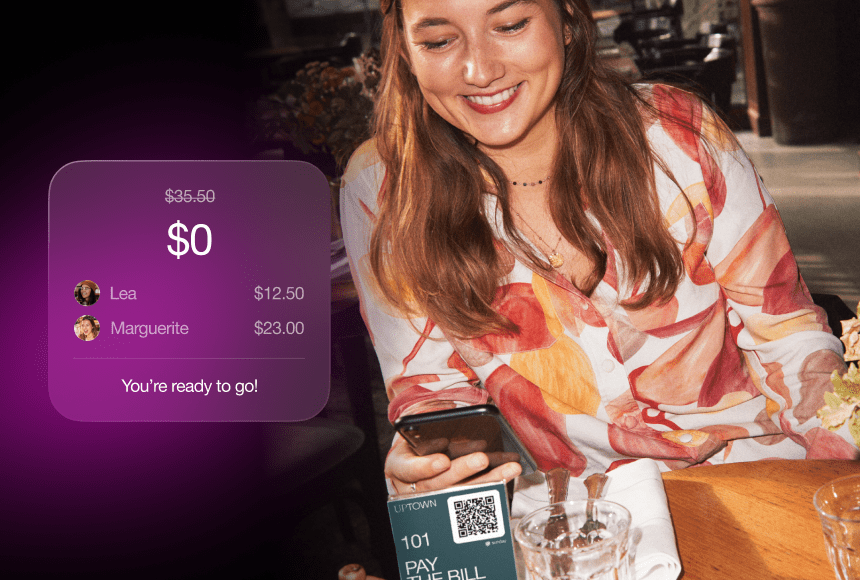

Creating a Better Guest Experience with sunday

When the moment arrives to choose a contactless payment solution, you’ll find many options. One that has made a notable impact in multiple markets is sunday. The platform was designed specifically for hospitality, providing a frictionless way for diners to settle their bill with just a quick scan. By offering a direct path to tipping and Google reviews, sunday aligns perfectly with the modern guest expectation for speed and convenience.

For those who incorporate it in their restaurants, you may notice that it simultaneously reduces staff stress while boosting overall diner satisfaction. The friendly, intuitive design is what makes it stand out. Every step in the process feels organic for the guest, encouraging positive feedback and a streamlined departure.

Venturing Beyond the Payment: Engaging Diners Post-Visit

Something truly remarkable about contactless technology is that it also opens a virtual door to follow-up communication. For instance, once a guest completes payment, you can offer a simple prompt: “Drop your email if you’d like to receive updates or special offers.” This is an organic way to expand your marketing reach without being pushy. The same technology that makes quick bill settlement possible can serve as a springboard for loyalty programs or direct feedback loops.

This direct link to guests isn’t limited to big chains. Even a small, family-owned diner can leverage digital receipts for subtle marketing, such as a coupon for “10% off your next visit, thanks for trying our new contactless payment solution!” If done tastefully, it adds value for both you and your diners, further enhancing the sense that your restaurant is connected and forward-looking while preserving the warmth that keeps regulars coming back.

Practical Tips for Promoting Contactless Usage

Once you have a system in place, the next challenge is encouraging table adoption. Here are a few tips:

- Staff Enthusiasm: Let servers lead with a smile, “Feel free to pay right from your phone at your convenience,” or “We have contactless if you’d like to settle quickly.”

- Clear Signage: A small sign on each table with a simple QR code or an icon for tapping can gently remind guests of the new option.

- Marketing Materials: Leverage your social media to inform followers: “We’ve gone contactless—no more waiting for the check!”

- Consistent Branding: If your restaurant uses a color theme or a special logo, let it appear on the digital payment screen. It helps guests recognize they’re in the right place and fosters trust.

Remember, convenience is the heart of it. The simpler and cleaner you present the option, the more enthusiastic guests will be to try it.

FAQ: Your Most Common Contactless Questions

Is contactless payment really secure?

Yes. Contactless cards and mobile wallets often use encrypted tokens for each transaction, making them more secure than traditional magstripe payments. Many banks also provide zero liability for fraudulent charges.

Will this new payment method confuse my older customers?

Not necessarily. Clear signage and friendly staff guidance usually clear up any confusion. Most diners quickly realize that scanning a code or tapping a phone is simpler than handling a manual signed receipt.

Do I need special hardware to accept contactless payments?

It depends on your approach. If you use payment terminals with NFC, you’ll need devices that support tapping. If you go the QR route, customers only need their phones. Check if your current POS solution integrates contactless features before investing in new hardware.

Do contactless payments affect my processing fees?

Often, fees aren’t drastically different than what you pay for standard credit card transactions, but it can vary by provider. It’s best to consult with your payment processor or chosen solution to clarify any details.

How can contactless options increase my reviews?

Many contactless systems let customers post a review immediately after paying, while their positive dining experience is fresh in mind. This quick prompt can double or triple your online review count.

What if the internet goes down?

Some solutions offer an offline mode where the transaction is stored and processed once the connection is back. However, having a stable Wi-Fi or 4G/5G connection is always recommended to avoid interruptions.

Meeting the Moment

Contactless payment technology isn’t just a passing fad or a European quirk—it’s a seismic shift in how American diners prefer to settle their tabs. In a culture that prizes simplicity, speed, and convenience, contactless meets those demands, all while benefiting tips, boosting operational efficiency, and fueling positive online reviews. As a restaurant owner, adopting this technology can help position your establishment as modern, guest-focused, and ready to exceed today’s expectations.

Above all, the decision to implement contactless isn’t about jumping on a trend—it’s about recognizing where the industry is headed and meeting your guests exactly where they want to be. By removing friction from the payment process, you give guests the freedom to enjoy the most important parts of their dining experience: the flavors, the ambiance, and the genuine hospitality that keeps them coming back again and again.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

“Check please” is a thing of the past.

With our integrated QR codes your customers pay in seconds, straight from their table.