Streamlining Your Restaurant’s Workflow With Smart Payment Solutions

Rethinking Efficiency in Your Dining Room

Operational bottlenecks can sneak up on the busiest dining rooms in the country. You might have complete confidence in your front-of-house staff’s skills. You might even pride yourself on a robust menu of crowd-pleasing dishes. Yet, if your payment process lags behind, you risk creating friction that affects guests, servers, and your bottom line alike.

Many restaurants focus on table turnover as a critical efficiency metric—and for good reason. Turning tables faster helps maximize revenue, allowing you to serve more guests in less time. However, there’s more to operational efficiency than cycling diners through their meals. If the final, crucial step—collecting payment—still relies on outdated equipment or disjointed workflow, you’re missing an opportunity to enhance the entire dining experience.

Let’s explore how embracing smart payment solutions—like those offered by companies such as sunday—can transform more than just table turnover. It’s about providing intuitive convenience for guests, reducing workload for staff, and eliminating pitfalls that have plagued the industry for decades.

What Are “Smart Payments” in the Restaurant Industry?

When we talk about “smart payments,” we’re referring to a modern, guest-focused approach that streamlines how customers settle their bills. Traditional methods involve a server handing over a printed check, then either taking a card to the POS terminal or returning with a paper receipt. This setup is time-consuming, and diners often wait for the server to return multiple times.

In a smart payment setting, guests can:

- Scan a QR code at their table using their smartphones.

- View the itemized check in real time and pay instantly from their device.

- Split the bill on-demand and leave tips, without waiting for a card reader to circulate.

- Provide on-the-spot feedback or seamlessly post online reviews.

All these steps happen in a matter of seconds—no more back-and-forth, and no additional administrative burden for your staff. In the US, where the typical dining culture revolves around tipping and swift guest turnover, these features can have an especially positive impact on both revenue and customer satisfaction.

The True Costs of Outdated Payment Flows

Holding onto familiar processes can seem comfortable, especially if your servers and regulars expect a certain flow. However, clinging to outdated payment methods can lead to hidden costs:

- Extended Table Times: Even a few minutes of delay during peak hours can add up—resulting in fewer total covers during a busy shift.

- Increased Labor Costs: Servers spend valuable time running receipts and waiting on credit card transactions, rather than flipping tables or assisting other guests.

- Higher Risk of Errors: Downtime with the payment terminal, manual calculations for tip splitting, or double-checking incorrect bills all contribute to inefficiencies.

- Limited Upselling Opportunities: When servers are stuck waiting on payment steps, they can’t focus on boosting revenue through dessert or beverage suggestions.

- Negative Guest Perception: In a world where speed and convenience are the norm, falling behind on technology can color a guest’s impression of the entire dining experience.

The net result can be a noticeable dent in your nightly revenue and a dampened guest experience. By troubleshooting your payment process, you free your staff to focus on what truly matters: outstanding hospitality and memorable cuisine.

Smart Payments Go Beyond Chasing Table Turnover

Everyone in hospitality understands the importance of table turnover. But a common misconception is that quicker closures inevitably mean rushed dining. The beauty of smart payment options is that they allow diners to control their own pace. If a guest wants to settle up quickly and leave, they can do so without interrupting a server. If they prefer to linger over coffee, they can take their time while the check remains available on their phone. This flexibility improves the guest experience and ensures your operations run smoothly.

Consider a typical scenario: You have guests who need separate checks. Instead of manually generating multiple printed bills, your staff can simply direct everyone to the same QR code. Each diner taps their orders, splits lines if needed, and pays in moments—little to no additional work for your team. By removing friction from payment, you end up pleasing both the speed-oriented diner and the more leisurely crowd.

Impact on Staff Efficiency and Morale

A well-run dining room isn’t just about guests—it’s about nurturing a productive and motivated team. Imagine the difference in a server’s day if they no longer have to manage the back-and-forth of card readers. The instant a table is done ordering or calls for the check, that step transitions to the guests’ smartphones. The server can pivot to essential tasks:

- Refilling beverages and maintaining stellar service.

- Engaging with diners, upselling items like dessert or wine pairings.

- Catching errors in the kitchen or orchestrating table assignments for new arrivals.

In many high-turnover restaurant environments, servers often feel stress when multiple tables want to pay simultaneously. Smart payments alleviate that tension, letting your team balance their focus on more complex needs—like checking for allergy accommodations or ensuring plates go out quickly. This relief in pressure can also reduce staff turnover—in an industry where employee retention is historically challenging.

According to the National Restaurant Association, restaurants face some of the highest employee turnover rates in the US, often exceeding 70%. When staff feels supported by technology that eliminates a portion of the repetitive tasks, morale improves, thereby curbing turnover.

Enhancing Tips and Guest Satisfaction

Restaurant tipping norms can sometimes create awkward moments: does the guest have enough cash on hand? Are they remembering to tip appropriately? Does the server have to keep returning to see if guests are ready to sign? Smart payment solutions eliminate uncertainty by making the tip line part of a seamless digital checkout. Some key benefits include:

- Tip Suggestion: When a guest taps to pay, the interface can automatically suggest tip amounts customized to your restaurant’s style—whether that’s 15%, 18%, or 20%—clearly displayed.

- Faster Gratification for Servers: Digital payments finalize tips without requiring physical signatures, and servers see these tips deposited quicker in payroll systems aligned with your restaurant’s policies.

- Guest Convenience: Diners can easily adjust the tip amount on their phone before confirming payment—no scribbles on a receipt, no fumbling for small bills.

A streamlined tipping process not only bolsters staff earnings but fosters positive guest feelings about contributing to a well-deserved gratuity. This is the difference between a payment system feeling like a chore and it feeling like an integrated part of an excellent dining experience.

How Smart Payments Connect to Broader Operational Benefits

Smart payments might start at the table, but the advantages splash over into your entire restaurant operation. Here’s how:

- Accurate Sales Tracking: When payments sync with your existing POS system, sales data is reliably recorded without manual input, reducing errors and compliance risks.

- Reduced Cash Handling: Taking advantage of digital payments cuts down on the frequency of handling bills and coins, leading to safer working environments and simpler end-of-day reconciliations.

- Actionable Insights: Modern solutions allow owners to see patterns—specific times of day with higher spending per guest or top-selling menu items. This data informs staffing, inventory orders, and marketing efforts.

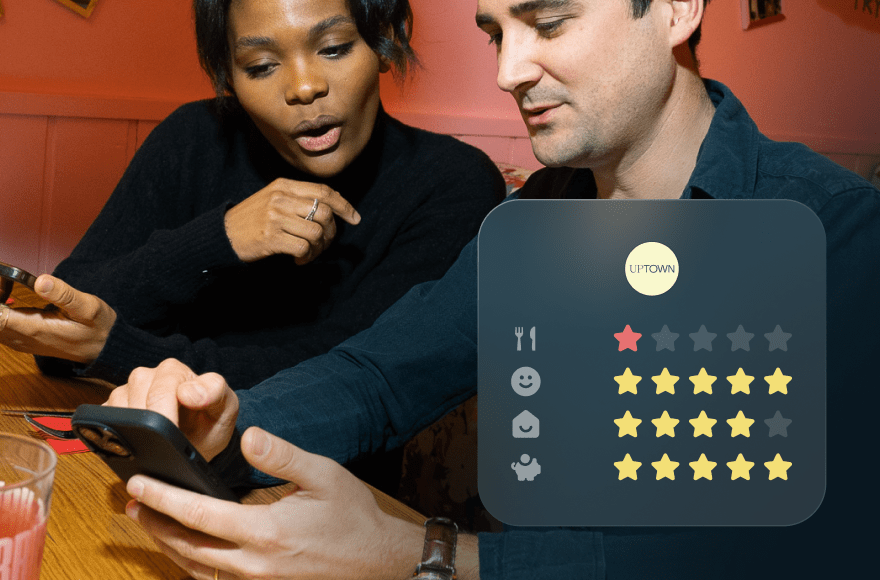

- Real-Time Feedback Loop: Some smart payment systems prompt diners to rate their experience or post an online review. This immediate feedback provides a goldmine of insights to help you improve.

A system that merges payment, tip collection, and feedback fosters a cycle of continuous improvement. Seeing exactly how quickly you turn tables or whether certain promotions spike tip amounts can refine your approach week by week.

Leaving Behind the POS Terminal Bottleneck

In many US-based restaurants, the physical POS terminal has become less of a solution and more of a traffic jam. It’s where servers congregate, waiting for it to free up. Sometimes, multiple staff members need to process a check at the same time, especially during rush hours.

By shifting the payment step to diners’ smartphones, you reduce congestion around the POS station. Plus, hardware maintenance costs go down, because fewer transactions pass through those machines, prolonging their lifespan. It also eliminates the fiasco of a broken or disconnected card reader bringing everything to a halt.

Moreover, with a less burdened POS station, your staff can quickly handle tasks such as voids or adjustments without a queue forming around that single device. This shift is not just about making it easier for the guest—it also refines your operational flow.

Security and Trust with Modern Technology

Restaurants and their customers rightfully care about data security—nobody wants to worry about fraudulent card usage or identity theft. Modern smart payment systems employ robust encryption methods to transmit data securely. By allowing guests to pay on their own devices, you reduce the chances of physical card skimming or mishandling of sensitive information.

Payment processors frequently undergo rigorous audits and must comply with safety standards such as PCI DSS (Payment Card Industry Data Security Standard). Meanwhile, smartphone-based payment solutions typically rely on secure app environments, multifactor authentication, and quick biometrics (like a fingerprint or face ID). These measures add layers of security, reassuring both you and your guests.

When your payment setup includes advanced security protocols, you create a sense of trust. Diners will know you’re using up-to-date technology that safeguards their personal and financial information.

Case Study: A Neighborhood Bistro’s Transformation

To illustrate the power of smart payment solutions, let’s look at a fictional but representative case: Bella’s Neighborhood Bistro. Located in a small city near Seattle, Bella’s spans just eight tables but has a loyal following of both locals and tourists. They initially relied on a single POS station, which often caused slowdowns when multiple guests asked for the check simultaneously.

After implementing a digital pay-by-QR solution, Bella’s saw immediate changes:

- 20% Faster Table Turnover: The check-drop-to-settlement process shrank from 15 minutes to under 5.

- Reduced Employee Turnover: Freed from the stress of constant payment runs, servers reported increased job satisfaction and stayed longer.

- Increased Tip Percentage: Tips jumped an average of 2%, likely due to built-in tip suggestions in the payment interface.

- More Online Reviews: With an easy link prompted right after payment, Bella’s got a surge of new Google reviews praising their efficient service.

This scenario highlights the real-world impact that rethinking payment workflow can have on a small or medium-sized operation. Smart payments let the front-of-house staff focus on hospitality while the technology quietly handles calculations, receipts, and even immediate feedback. What started as a desire to streamline table turnover transformed into a major upgrade in overall service.

Practical Implementation Tips

You might be excited about adopting a new payment technology, but as a savvy restaurant owner, you probably have questions about the implementation process. Here are a few points to keep in mind:

- Evaluate Vendor Reputation: Look for solutions that offer robust support, intuitive interfaces, and stable integrations with major POS platforms.

- Train Your Staff Thoroughly: A user-friendly interface still requires initial training. Make sure your team understands how to guide guests through scanning a QR code, splitting checks, and leaving tips.

- Communicate with Guests: Some diners might be trying QR payments for the first time. Provide clear, short instructions on table tents, stand-up cards, or even verbally so guests know how to proceed. Keep it simple and friendly.

- Test Internet Reliability: Smart payments rely on Wi-Fi or mobile data for seamless operations. Work with your Internet provider to ensure stable coverage across your entire dining area.

- Monitor and Fine-Tune: In the first few weeks, note any recurring hiccups. Perhaps older customers need a bit more explanation. Address feedback promptly and adjust your signage or training accordingly.

Commit to encouraging staff to embrace the new system. Enthusiasm and thorough guidance go a long way in ensuring that such a shift sticks—and that your guests immediately see the benefits.

Comparing Traditional Methods vs. Smart Payments

Below is a quick overview to illustrate how traditional payment flows stack up against a modern smart payment approach:

| Aspect | Traditional Payment | Smart Payment |

|---|---|---|

| Payment Time | Server brings check, waits for guest, processes card, returns receipt. Often 10+ minutes. | Guest scans QR code and pays on phone. Takes under 2 minutes. |

| Tip Process | Guest writes tip on receipt, server enters it manually. Risk of error. | Suggested tip amounts on-screen. Guest finalizes with a tap. |

| Receipt & Feedback | Printed copy. Feedback typically collected via comment cards. | Digital receipt and optional review prompt at checkout. |

| Staff Engagement | Focus on card handling and receipts. | Focus on upselling, customer service, table turnover. |

| Accuracy | Greater risk of manual entry errors. | Automated and itemized. Minimal staff involvement. |

As this table shows, shifting from traditional to smart payment systems can elevate multiple facets of your daily operations. Even small improvements in speed or guest engagement can have amplified benefits for restaurants with high volume or quick turnover models.

Overcoming Owner Concerns

Restaurant owners may hesitate to adopt new technology. Common worries include high setup costs, training complexity, or the fear of alienating less tech-savvy customers. But consider the offsetting factors: minimal hardware investment, fewer staff training hours (compared to rotating multiple card readers), and an overall simplification of tasks.

For those concerned about older patrons or those who dislike using smartphones, keep offering the traditional payment method as a backup. This hybrid approach ensures no one feels excluded. Meanwhile, most patrons—especially Gen Z and Millennials—will likely embrace the convenience of scanning a QR code to pay faster. By communicating the benefits and maintaining a flexible policy, you will see broader acceptance over time.

When it comes to setup costs, many providers charge a subscription fee or a small transactional percentage, but the net effect can still be positive when factoring in labor savings, faster turnover, and higher guest satisfaction.

Why the Time Is Right for QR Code and Contactless Payments

Contactless and QR code payments surged in the past few years for a range of reasons, from public health concerns to cultural shifts in how Americans handle money. According to data from Statista, the user base for mobile contactless payment systems has grown dramatically year after year, reflecting Americans’ increasing smartphone reliance. For restaurateurs, ignoring this trend means missing out on meeting guests where they are most comfortable—on their personal devices.

At a time where online ordering, curbside pickup, and delivery have changed diners’ expectations, offering an in-restaurant digital payment option fits seamlessly into that new normal. Even older demographics have grown more comfortable with scanning and tapping. The convenience factor is too big to deny.

Embrace the shift, and you’ll see your brand reputation rise in tandem with your daily revenues. Diners want frictionless experiences, from reservations to dessert, and your payment process should reflect your commitment to quality service.

Looking Beyond the Transaction

A vital consideration for any forward-thinking restaurant owner: the transaction doesn’t end once money changes hands. Smart payment solutions let you track or re-target satisfied customers. You can offer them loyalty perks, coupons, or follow-up surveys. By weaving payment into the larger tapestry of digital customer engagement, you build stronger relationships with regulars and entice first-time guests to return more frequently.

Some practical examples include:

- Digital Loyalty Programs: Prompt diners to sign up for a reward system after they pay.

- Personalized Offers: Use purchase data to offer targeted promotions—like a free appetizer on a future visit.

- Immediate Review Requests: Encourage guests to share positive experiences online, amplifying your restaurant’s visibility in local search results.

By keeping the conversation going beyond “Bill is paid, thanks for coming,” you extend your reach and add continuous value to your clientele’s experience. That cyclical approach to guest interaction is how you build a loyal following in a highly competitive market.

Frequently Asked Questions

How do smart payments handle split bills?

Most QR-based solutions let diners select which items to pay for right on their phone. The system automatically calculates portions of tax and tip. This eliminates the clumsy back-and-forth of splitting checks at a POS terminal.

Does this technology add a big expense to my bottom line?

While there may be subscription or transaction fees, restaurants often see a net positive return. Labor savings, faster turnover, enhanced tips, and improved guest satisfaction help offset the costs.

Will my older guests be comfortable using QR codes?

While some might prefer more traditional methods, QR code payments are increasingly accepted across all age groups. You can keep a backup option (like the standard POS terminal) available, but with clear instructions and a friendly approach, most guests find it straightforward.

Are digital payments more secure than handling physical cards?

Yes. Digital payments often employ encryption and adhere to PCI DSS standards. They reduce the chance of compromising sensitive credit card data and streamline the entire transaction, making it both safer and faster.

Can I still collect feedback even if I use smart payments?

Absolutely. Many smart payment systems prompt guests for immediate feedback or provide a direct link to post reviews on platforms like Google. This immediate feedback loop lets you gather insights and respond promptly.

Staying a Step Ahead

In an industry known for razor-thin margins, every operational detail counts. Smart payment solutions offer a path to not just streamline table turnover, but to reimagine how both staff and guests experience the final moments of a meal. You give your diners a smoother exit and your servers more breathing room to focus on service. Over time, these incremental improvements add up to greater efficiency, higher staff morale, and improved profitability.

With the right approach, implementing smart payments becomes less about newfangled tech and more about human-centered service—exactly the kind of warm, attentive experience that keeps customers returning. By staying alert to shifting consumer habits and embracing a solution that eliminates operational bottlenecks, you can turn the mundane act of paying the check into a moment that delightfully matches the rest of your hospitality.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

Get the full, detailed picture.

sunday elevates your business with insightful data, instant feedback and precise analytics.