How Data-Driven Payments Can Deepen Your Guests’ Loyalty

Why Payment Data Matters in Today’s Restaurant Landscape

Imagine you’ve just perfected your latest signature dish. Perhaps it’s a delightfully savory braised short rib or a light and flavorful lemon tart—something so mouthwatering, your guests nearly break the door down for a second taste. But how do you pinpoint your loyal fans versus those just passing through for a quick bite? Payment data might be the missing ingredient.

Payment data encompasses all the transactions recorded by your point-of-sale (POS) system, online ordering platform, or QR code payment solution. It’s not just about final checks and credit card slips—it’s about discovering patterns hidden beneath every swipe, tap, and scan. These patterns can offer eye-opening insights into guest loyalty, from the frequency of repeat visits to average spending and even the tips left on each meal.

If “TPE” sounds unfamiliar in an American context, the term you’re looking for is simply “payment terminal” or “POS terminal.” Whether people pay at the register, at the table via QR code, or on a handheld device, each transaction holds data that can transform how you run your restaurant. Think of payment data as the stock you simmer all day: it’s loaded with flavor and nutrients for your decision-making. The moment you start harnessing its potential, you’ll find new ways to build and retain a loyal customer base—one that returns for your specials and spontaneously breaks out into glowing recommendations online.

Translating the Title

You might have noticed the title above is in English, “Payment Data Insights: What They Tell You About Guest Loyalty.” For French-speaking readers, here is the translated version: “Aperçus sur les données de paiement: ce qu’elles vous révèlent sur la fidélité des clients.” But let’s keep our focus on the American market, where digital payments and contactless solutions continue to expand. This entire article, therefore, is dedicated to what payment data can reveal about loyal guests in a US-based restaurant environment.

Defining Loyalty: More Than Just Repeat Visits

Guest loyalty in the restaurant industry isn’t just about the number of times someone walks through the door. It’s about how frequently they return, the size of their orders, and whether they leave a tip that’s proportional to their satisfaction—or even above the standard rate. Loyal guests also talk you up: they leave positive online reviews and spread the word to friends. In essence, loyalty is a tapestry woven from various threads of consistency, generosity, and advocacy.

According to the National Restaurant Association, a significant portion of revenue for the average restaurant comes from repeat customers—by some analyses, up to 70% of sales can come from loyal patrons. Loyalty isn’t just nice to have; it’s the steady fuel that keeps your business thriving no matter what twists the restaurant world throws your way.

Reading Payment Data Like a Menu: Key Metrics to Track

Just as you scrutinize ingredient costs to keep your menu profitable, analyzing payment data helps you maximize repeat business. The data flows in from multiple channels: in-person card transactions, mobile orders, delivery apps, QR code payments at the table—each revealing how, when, and why your guests choose you. Below is a quick look at the metrics that matter most:

- Average Ticket Size: Indicates how much a guest typically spends in one visit.

- Tip Percentage: Gauges overall satisfaction and generosity on the guest’s part.

- Frequency of Visits: Shows how often a guest returns, which can reveal core loyalty.

- Time Between Visits: Underscores if you’re a spontaneous choice or a planned outing.

- Payment Method: Tells you if guests prefer contactless, cash, or traditional card swipes—sometimes linked to convenience or generational preferences.

Connecting Payment Trends to Loyal Behavior

To better visualize how these metrics intersect, consider the table below:

| Payment Metric | Potential Loyalty Indicator |

|---|---|

| Average Ticket Size | Higher or steadily growing amounts often point to strong brand affinity. |

| Tip Percentage | Generous tipping can signal high satisfaction, potentially from loyal customers. |

| Frequency of Visits | Frequent returns are a prime indicator of loyalty. |

| Time Between Visits | The shorter the gap, the stronger the attachment to your restaurant. |

| Payment Method | A preference for quick, modern solutions (e.g., QR codes) can point to comfort and trust with your business. |

Unearthing Hidden Patterns Within Your Guest Data

If analyzing spreadsheets and transaction logs sounds intimidating, think of it as perfecting your secret sauce. Initially, it might appear complicated to juggle multiple ingredients, but with practice, it becomes second nature. Here’s how to start turning your raw payment data into actionable insights:

- Consolidate Your Systems: Merge data from online orders, in-store, and third-party delivery apps into one central location—often your POS terminal or a specialized analytics platform.

- Identify Repeat Transactions: Look for patterns in card numbers or digital wallet IDs to see how often the same guest pays you a visit.

- Segment by Spending Behavior: Group transactions by average ticket size to distinguish high-spend guests from more budget-conscious diners.

- Analyze Tips: Compare tip percentages with the time of day, day of the week, or ticket size. High tips can highlight premium experiences or especially loyal patrons.

FAQ: Payment Data and Privacy

One common concern is how to analyze guest payment data without violating confidentiality or privacy norms. The key is to focus on aggregated and anonymized metrics. You don’t need to know every detail about an individual diner’s name or phone number; you simply need broad insights to power your marketing and guest experience strategies. Just be sure to follow all relevant payment card industry standards (PCI DSS) and local regulations.

How Payment Data Reveals Loyalty in Surprising Ways

Let’s consider a scenario: a sought-after brunch spot sees two distinct patterns for the same credit card number over three weeks:

- Two Sunday brunch visits with an average check of $45, each with a 25% tip.

- An impromptu Wednesday lunch for a quick salad and iced coffee, totaling $18 with a 20% tip.

At first glance, these are just another set of numbers. But once connected, they suggest a guest who not only values your weekend brunch vibes but also trusts your weekday lunch menu enough to drop by spontaneously. This repeat behavior across different times and spending levels is a prime marker of loyalty.

Payment data can also highlight if a guest is part of multiple channels, such as takeout or delivery orders. If they’ve visited you in person on Friday and also ordered delivery on Tuesday, that’s a strong signal they’re happy with your brand regardless of the setting, reinforcing their loyalty trajectory.

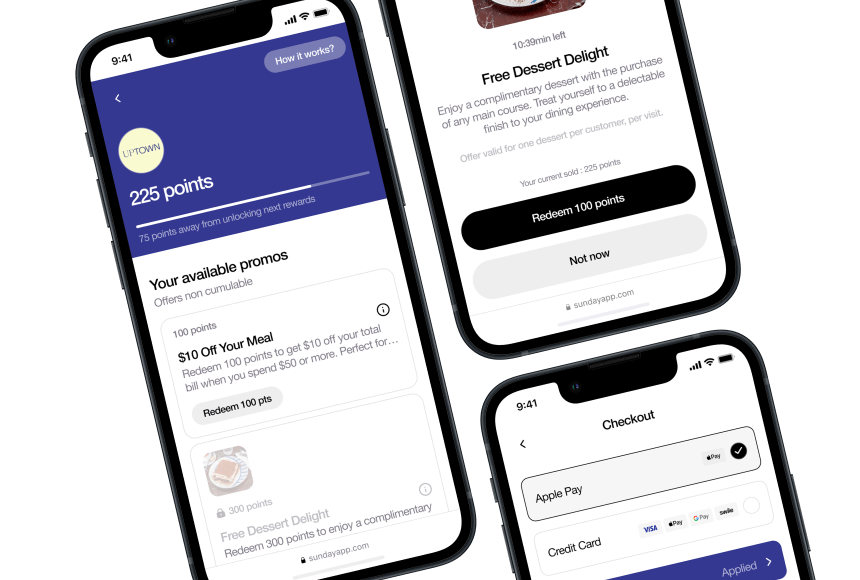

Tips, Compliments, and Google Reviews: Tying It All Together

Many modern payment solutions, like sunday, offer options for diners to leave tips, settle their bill, and even post a Google review—all from the convenience of their phone. This digital approach provides instant feedback on the dining experience. A particularly glowing review combined with a higher-than-average tip might denote a customer who has just become a brand advocate. Understanding these combined data points can help you foster even stronger loyalty. After all, a satisfied diner who leaves a tip isn’t just rewarding good service—they’re often acknowledging the overall experience, from ambience and menu quality to ease of payment.

Implementing Loyalty Programs Based on Payment Data

Once you’ve identified what loyal behavior looks like for your restaurant, it’s time to capitalize on it. Maybe the data confirms your best customers visit twice per month with an average ticket above $40, or frequently leave tips in the 20–25% range. These insights help you create tailored loyalty programs that encourage similar behavior. Here are a few strategies:

- Exclusive Perks: Offer members-only happy hour pricing or early access to new menu items.

- Milestone Rewards: Earn a free appetizer or dessert after hitting a certain spending threshold.

- Tiered Levels: As guests spend more or visit more often, they climb tiers—each with increasing perks, fostering a sense of achievement and exclusivity.

- Instant Feedback Loop: Encourage your guests to link their review or comments to additional offers—turn a positive experience into a repeat visit the next weekend.

Collecting the Right Payment Data: Practical Tips

Getting started with payment data analysis can feel as challenging as setting up a brand-new kitchen. Yet, once you have the right tools and methodology, you’ll wonder how you ever made decisions without them. Here’s how to collect reliable, relevant data:

- Upgrade Your POS System: Ensure your payment terminal or integrated POS software can track the specifics you need, such as transaction amounts, time stamps, and payment methods. Modern POS solutions often include dashboards to visualize these metrics automatically.

- Leverage QR Codes and Mobile Payments: Systems like sunday can make the payment process seamless, letting you gather data hassle-free. The less friction for your guests, the cleaner your data becomes.

- Integrate Online Ordering: If you offer online pickup or delivery, those transactions should feed into the same analytics platform. Cross-reference them with in-house visits for a full picture of your guests’ loyalty.

- Train Your Staff: Show your servers and managers how to properly record transactions and handle any manual processes. Ensuring data accuracy starts on your front lines.

- Watch for Redundancies: Confirm that each transaction is captured only once. Duplicate entries cloud your perception of loyalty, complicating your ability to spot returning guests versus single-visit outliers.

Case Study: The Cozy Corner Diner and Their Loyal Brunch Crowd

For a concrete example, let’s look at The Cozy Corner Diner, a small restaurant in a suburban neighborhood. With capacity for just 30 guests and a classic American menu, their challenge was retaining weekend brunch enthusiasts who visited sporadically and rarely offered feedback.

After installing a QR code payment solution and upgrading to a more robust POS system, they began to spot patterns:

- Guests who visited on Sundays with an average ticket of $35 or more returned at least once every four weeks.

- Patrons who left tips in the 22–25% range were more likely to dine again within two weeks, often turning into regulars.

- Big tippers also tended to rate the diner 4 stars or higher on Google Reviews when prompted post-payment.

Within three months of focusing on these high-value repeat guests, The Cozy Corner introduced a brunch punch card (for physical engagement) combined with a digital loyalty tracker integrated into their online ordering system. By the end of that quarter, they saw a 15% jump in revenue from repeat Sunday patrons, and almost half of the new loyal customers started ordering takeout during the week.

For The Cozy Corner, something as simple as “Sunday brunch spending $35 with a 22–25% tip” turned out to be a powerful loyalty predictor. They used payment data not just for tabulating revenue but as a guide for targeted promotions and menu adjustments. This data-first approach not only stabilized their bottom line but also nurtured a close-knit community that kept the Diner buzzing all week long.

Creating a Seamless Guest Experience with Technology

Loyalty thrives on consistency. If your guest’s payment experience is quick and intuitive—with no awkward fumbling for devices or multiple swipes—they’re more likely to rate you favorably and return. Solutions like sunday enable guests to settle up with a simple scan of a QR code, leave a tip, and even leave a review without waiting for the server to process their card. This convenience fosters a positive impression that resonates long after they step out the door.

Also, digital checkouts help you gather more complete data. Instead of scribbled receipts or missing purchase records, you get a well-structured digital paper trail for every transaction—especially useful if you allow partial payments, split checks, or multiple tipping options. All these details help you refine your loyalty strategies down the road.

Keeping an Eye on Industry Trends

Restaurant technology evolves quickly. Contactless payments soared in popularity—especially in recent years as more guests preferred minimal personal contact during their dining experience. According to a Deloitte study, 40% of millennials are more likely to choose restaurants offering contactless solutions. Monitoring shifts in the payment landscape can sharpen your competitive edge and keep you on par with emerging guest expectations.

Popular trends include digital wallets, NFC-enabled smartphones, and platforms that blend loyalty with payment (like scanning a single QR code to open the check, tip, review, and even convert those points toward future discounts). The more you stay on top of these trends, the more seamlessly you can fold them into your loyalty-building efforts.

Moving Forward: Action Steps

By now, you know that crunching payment data isn’t some big-data fantasy beyond the scope of your restaurant. It’s an essential evolution—one that can tell you exactly which diners come back, how often, and why. Once you get a handle on these insights, tailoring your service becomes easier:

- Craft limited-time offers based on your best-selling menu items.

- Extend personalized promotions to guests who haven’t visited in a while.

- Promote user-friendly payment solutions to keep friction at a minimum.

- Reward guests who demonstrate the highest loyalty with exclusive perks and experiences.

In short, it’s all about turning the payment process—a necessary function—into a beneficial touchpoint that drives loyalty. Like adding just the right spice to a dish, purposeful use of data can take your restaurant from good to unforgettable.

FAQ: Your Top Questions Answered

What if my restaurant is small and primarily cash-based?

Even if you handle mostly cash, adopting a rudimentary POS system for card or mobile payments can help you start gathering basic data. You don’t need to go full-tech overnight—begin with a phased approach, record what you can, and grow from there. Small restaurants often experience faster gains from loyalty strategies because they can focus on personal connections.

Is analyzing payment data complicated or time-consuming?

Modern POS systems and payment solutions automate many elements of data collection. You can generate regular reports that highlight average check size, tip percentages, and frequency of visits. Once you’ve set up these tools, maintaining the flow of information is usually seamless. The key is to set aside time—weekly or monthly—to review the numbers.

Can I really spot loyal customers just by looking at transaction patterns?

Yes. While payment data alone isn’t the entire story, recurring patterns—like multiple visits within a month and tipping above a certain threshold—can point strongly toward dedicated fans. Combine payment data with anecdotal notes from your staff, and you’ll have a well-rounded picture of guest loyalty.

How do digital orders factor into loyalty?

Delivery and pickup orders are another aspect of guest engagement. If a diner counts on you for at-home meals, that’s a different expression of loyalty but still crucial. Connecting these transactions to in-person visits builds a multi-channel viewpoint, helping you accommodate guests wherever they enjoy your food.

What about privacy concerns when analyzing payment data?

Focus on aggregated metrics or anonymized IDs rather than collecting personal data like names and addresses. Ensure that any data you store follows PCI DSS (Payment Card Industry Data Security Standard) rules and local consumer protection laws. Data analysis is about trends, not snooping.

Where do I start if I want to improve my guests’ loyalty using payment data?

Begin by auditing your current POS system and payment methods. Identify which data you already collect, and explore solutions that can fill the gaps. Consider adopting a QR code payment tool—like sunday—to streamline billing and feedback collection. Then, set up simple weekly or monthly reviews of your transaction reports to spot emerging trends.

Armed with the right insights, you’ll be well on your way to nurturing a dedicated community of loyal diners who come hungry—and leave happy—time after time.