Instant Mobile Billing: How Fast Payments Are Transforming Guest Experiences

Embracing the Shift to Digital Checks

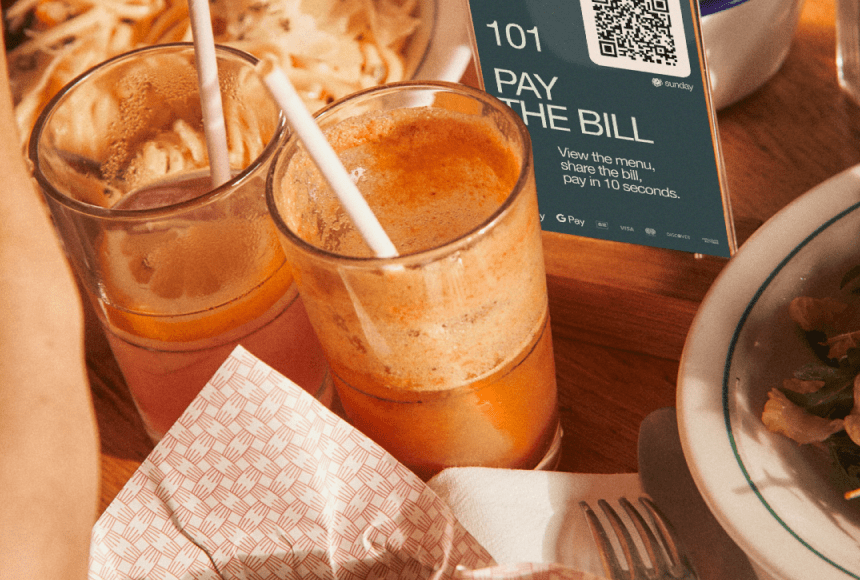

Picture this: your dinner rush is in full swing, and every table is alive with conversation, laughter, and the clink of silverware against plates. On a normal day, your servers would be weaving in and out, juggling orders, and nervously keeping an eye out for guests who need their credit card slips. But now, imagine a scenario where the check magically appears on diners’ phones the moment they’re ready to settle up, with just a quick scan of a QR code. No more frantically searching for the card machine. No more scribbling on paper receipts. Welcome to the world of digital checks.

Digital checks, also known as instant mobile bills, are revolutionizing how restaurants in the United States and beyond handle payments. As the National Restaurant Association highlights in its Restaurant Technology Trends, the industry has embraced the shift toward contactless transactions ever since diners began seeking faster, more hygienic ways to pay. Savvy restaurant owners who adopt these digital payment solutions find themselves rewarded with boosted revenue, higher guest satisfaction, and smoother table turns.

The move away from traditional payment processes is no passing fad. What was once considered a techy novelty is fast becoming the standard. From small mom-and-pop eateries to high-end dining establishments, opting for digital checks is proving beneficial not only for guests but also for the bottom line and your staff’s daily workflow. Throughout the rest of this article, we’ll dive into the many reasons guests adore these instant mobile bills and why you, as a restaurant owner, might want to offer them on your menu of services.

Why Diners Crave Instant Payment Options

There’s a reason diners look to instant, digital checks as more than just a flashy innovation. People appreciate convenience in all aspects of life—why should paying the bill at a restaurant be any different? Below are a few key elements driving the shift toward mobile payment methods:

- Speed and Efficiency: Diners can pull up their check and pay the second they decide they’re done with a meal. No waiting for the server to return with the bill.

- Transparency: Guests see all the order details laid out clearly on their phones, reducing accidental charges or confusion over items.

- Automation of Tips: Leaving a tip becomes as easy as tapping a button, which often leads to more generous tip percentages for servers.

- Independence: The check-out process is entirely in the diner’s hands. They don’t need to flag you or your staff for a credit card slip or a pen.

- Enhanced Hygiene: Fewer shared surfaces, fewer plastic cards exchanging hands. This factor, particularly relevant since 2020, still resonates strongly with many guests.

It’s no wonder people prefer to settle their bill on their phone. Think about the last time you ate out: if you were able to check out the moment you were ready, no lines, no delays, you would probably remember that as a standout positive experience. And it’s precisely these small, memorable experiences that build loyal customer relationships over time.

How This Shift Impacts Your Restaurant’s Operations

Moving to digital checks may sound like just another tech step, but the ripple effect on daily restaurant operations can be huge. For starters, an instant, mobile bill system can significantly reduce the time each table occupies. After all, every minute your guests wait on a traditional bill is a minute kept away from flipping the table and welcoming new customers. Faster turnover means more revenue and less friction in high-traffic periods like weekend brunch or peak dinner times.

Consider how a digital bill solution plays out during a busy Saturday night:

- Quicker Table Turns: Guests aren’t stuck waving for the check or waiting for a staff member to run the card. They pay and go as soon as they’re ready.

- Balanced Workload: Servers spend less time processing payment after payment and more time engaging with guests, ensuring that each table’s dining experience is excellent.

- Reduced Paper Waste: Because checks and receipts exist digitally, you can significantly cut down on printer usage and paper costs.

- Fewer Steps for Staff: No more passing credit cards around multiple stations—funds go directly from the diner’s phone through a secure payment gateway.

By implementing an instant digital check system in your establishment, you simultaneously create a more efficient workflow for staff and a more pleasant experience for guests. The entire process is akin to having a well-planned menu, where each course seamlessly follows the last, without delays or unnecessary steps. In short, it’s a recipe for happier customers and smoother shift transitions for your team.

Fostering Better Communication and Engagement

Mobile, QR-code-driven payments don’t just make transactions simpler. They open up new channels of communication between diners, servers, and you—the restaurant owner. When the customer sees their digital check, they can also quickly leave a comment or review, perhaps even drop a photo of their meal on social media. A frictionless payment process can evolve into an active form of marketing for your brand.

Guests could be prompted to submit Google reviews directly from their phones right after paying—a perfect moment when the meal is still fresh on their mind. Since satisfaction is immediate, you’re harnessing the power of real-time sentiment. Additionally, with certain digital check platforms, pushing tailored offers or loyalty program perks becomes easier. Imagine converting a one-time diner into a regular because you reached them at exactly the right time with an offer to come back next week.

Besides marketing opportunities, digital checks also facilitate open communication about the dining experience itself. If there’s an issue—like an item that was accidentally billed twice—the diner can often flag it directly on their phone, clarifying any misunderstandings before negative feelings have a chance to linger. This direct, swift feedback loop is a massive advantage when it comes to providing top-notch hospitality.

The Psychology of “Paying with a Phone”

It’s worth noting that humans often welcome convenience wholeheartedly. In other words, if the process is streamlined, free of awkwardness, and clearly beneficial, people adapt quickly. A key psychological factor in digital checks is control. Guests feel empowered when they generate and review the bill themselves. Paying for a meal morphs from a sometimes uncomfortable waiting game into a painless, user-friendly step that they navigate on their terms.

Another advantage is the sense of privacy. Opening a check on a phone is discreet—no fumbling with a credit card or signing paper. The digital step has become familiar in other contexts—ordering groceries on apps, scanning mobile event tickets at venues, or paying for coffee with a smartphone wallet. The restaurant industry is simply catching up to these familiar consumer habits.

Humans also love consistency. With digital checks, once customers get used to the quick-scan-and-pay routine, they’ll be more inclined to revisit establishments that offer it, precisely because it aligns with the streamlined consumer experiences they’ve come to expect in modern life. On the flip side, a lack of such convenience could become a sticking point, particularly for younger generations who value swift, tech-enabled transactions.

Breaking Down Common Myths

Despite all the benefits, a few myths often float around about going fully digital for payments. If you or your staff have questions, here are some clarifications:

- Myth #1: It’s too complicated to set up. In reality, many digital payment platforms are designed for easy integration. They can typically be added to your existing POS or introduced as a straightforward QR code system with minimal hardware changes.

- Myth #2: Older guests won’t use it. While it’s true that certain demographics prefer traditional payment methods, you may be surprised by how quickly most people adapt when the interface is intuitive. Clear instructions and helpful staff make a big difference.

- Myth #3: It’s riskier than holding a physical card. In fact, digital payments can be even more secure if the provider uses encryption and tokenization standards, shielding both the business and the customer from fraudulent activity.

- Myth #4: It replaces the personal touch of hospitality. Going digital frees up your team to focus more on conversations and the overall guest experience, rather than running around with receipts. It boosts hospitality rather than diminishing it.

It’s normal to be cautious. Technology evolves at lightning speed, and it can feel intimidating to figure out which solution is right for you. However, as with any piece of kitchen equipment, the right digital check system can become a trusted tool that makes daily life simpler and more satisfying.

Choosing the Right Digital Check Solution

Restaurant owners want solutions that work seamlessly with everyday operations. Before readying your establishment for digital checks, here’s a quick checklist of considerations:

- Integration: Make sure your chosen platform connects with your existing point-of-sale system to avoid duplicating work or losing track of orders.

- Customizable Interface: You want the ability to include your restaurant branding and personalize tip suggestions to reflect your establishment’s ethos.

- Security Credentials: Look for providers that prioritize data encryption and compliance with industry standards. The last thing you want is a security gap.

- Ease of Use: Both staff and customers should be able to use the digital check system without a long learning curve. Simplify staff training by noting user-friendly interfaces.

- Support and Reliability: Opt for a provider that offers swift customer support, so any hiccup during a busy shift can be resolved quickly.

One solution on the market that checks these boxes is sunday. It provides a simple yet powerful QR code payment experience, allowing guests to open their bill on a smartphone, leave a tip, and even post a quick Google review. While some digital platforms require specialized credit card terminals, solutions like sunday pair well with the setup you already have, meaning you can introduce a new, modern touch to your restaurant without an overwhelming upfront investment. This kind of approach can be compared to adding a new dish to your menu: you keep your staff’s workflow intact while adding a fresh, inspiring flavor for guests.

Staff Training and Best Practices

Switching to digital checks isn’t just about flipping a switch. You’ll want to train your employees to make the most of this new feature so they can effectively communicate its benefits to diners. Consider these training tips:

- Hands-On Demonstrations: Let staff experience the digital check process from the guest’s perspective. Make sure they know how to scan the QR code, see the total, add a tip, and complete payment.

- Role-Play Scenarios: Practice the conversation a server might have with guests about using QR codes. This helps staff sound confident and supportive, rather than uncertain.

- Encourage Feedback: After a few days or weeks, gather staff input about the new process. They might have suggestions to make the rollout even smoother.

- Highlight the Upsell: Teach employees how digital checks can subtly showcase desserts, specialty drinks, or promotions right before diners pay, nudging them to try an extra treat.

With thoughtful rollout and training, your staff will embrace digital checks as a positive development rather than a burden. Keep in mind that the friendlier and clearer the experience, the more likely your team is to champion it to guests.

Real-World Example: A Neighborhood Bistro’s Success

Let’s bring this concept to life with a small hypothetical case study. Imagine a cozy neighborhood bistro in Chicago run by a dedicated chef-owner who wants to modernize her guest experience without losing the personal, local charm. She decides to integrate an instant bill solution so her diners can view and pay their checks on their phones.

The immediate outcomes:

- Her profit margins increase slightly because turnover speeds up by an average of 12 minutes per table.

- She notices that her servers are happier, as they no longer need to rush back and forth with receipts at closing time.

- Tips increase by an average of 15%, because guests often find it easier to select a tip amount right there on their device.

- She sees a spike in online visibility: 30% of diners leave a Google review or rating right after paying, many complimenting the efficiency of the new system.

All of this transpired without compromising the warmth of the bistro’s environment. Guests simply enjoy a frictionless end to their meal, which often inspires them to linger over desserts or coffee without the usual inconvenience of a card-based transaction. In a dynamic city dining scene, small touches that heighten convenience can make a lasting impression.

Stepping Beyond the Basics: Added Perks of Digital Checks

Beyond just convenience and speed, digital checks can bring unexpected benefits that propel your restaurant forward:

- Data Insights: Some systems offer analytics on purchase behavior, peak ordering times, and tipping habits. This information can guide menu decisions and staffing strategies.

- Reduced Human Error: Automating the check presentation decreases the risk of manual entry mistakes. No more accidental mix-ups of who got which entree.

- Upsell Opportunities: You can boost sales by highlighting special add-ons or promotions in-app just as the diner is about to pay.

- Eco-Friendly Angle: Going digital minimizes paper usage, a point you can highlight to environmentally conscious diners, thus polishing your brand image.

Integrating digital checks might even become part of a broader brand identity strategy. If your restaurant culture is approachable, modern, and service-oriented, an instant billing system underlines that you care about offering the latest conveniences without sacrificing personal warmth. As reported by Forbes, consumers routinely reward businesses that innovate and streamline their experiences. In other words, adopting digital checks is not just a move for efficiency—it’s also a brand statement that resonates with today’s expectations.

Meeting Diners Where They Are

You’ve likely noticed the near-universal presence of smartphones in your dining room. Our phones have become an extension of our lives: they carry our shopping lists, calendars, social networks, and payment apps. Leveraging this fact lets you integrate your restaurant into a tool diners already use daily. Rather than asking them to adapt to your processes, you simply meet them where they are comfortable—on their phone.

Even more crucially, this pivot to digital checks demonstrates respect for guests’ time. Diners want an escape from stress when they share a meal outside. They want to settle their bill swiftly and seamlessly. By eliminating that awkward waiting period at the end, you send the message: “We value your experience from the moment you walk in until the moment you leave.” This approach fosters loyalty, word-of-mouth recommendations, and repeat business.

A Fresh Take on Payment

Digital checks are becoming a must-have for modern restaurants aiming to stay relevant and satisfy tech-savvy diners. If your patrons can open their check, view each dish, add a tip with a quick tap, and even leave a stellar review without waiting, you’ve recast the payment experience into something that drives positive emotions rather than a finale that can sometimes feel tedious.

From a restaurateur’s perspective, the value of streamlined operations and a happy, well-tipped staff is hard to ignore. Instant mobile billing frees up resources, shortens table times, and gives you more ways to connect with your community. It’s fast, it’s convenient, and it adds a dash of modern flair without sacrificing your signature hospitality vibe.

As you plan for your restaurant’s future, consider how digital checks can help you embody the welcoming environment you’ve always wanted to create. Embracing this approach signals to your guests that you respect their time, and it ensures that your team can focus on what they do best: serving up great food and memorable experiences.

FAQ: Your Questions Answered

1. Is adding a digital check option expensive?

While costs vary depending on the platform, many digital check solutions—including providers like sunday—are designed to work with your existing systems. You don’t typically need to purchase additional or specialized hardware; a QR code can be scanned by any smartphone. Budgeting for setup and transaction fees is standard, but the potential boost in table turnover, tips, and customer satisfaction often outweighs the expense.

2. How do I handle guests who still want to pay in cash?

Maintaining flexibility is key. Even if you add digital checks, it’s wise to still accept traditional payment methods for those who prefer them. Make sure your server staff is comfortable handling both approaches in parallel. Encourage—but never force—digital payments, so that guests can choose whichever method suits them best.

3. Will digital checks be safe for my customers’ data?

You should always verify that the solution you choose meets standard encryption and PCI compliance criteria. Quality digital payment providers implement security protocols to protect sensitive customer data. In many ways, a secure mobile payment system can be safer than traditional physical cards because it minimizes the chance of skimming or accidental theft.

4. Do I need to update my entire POS system to implement digital checks?

Not necessarily. Some digital check platforms can integrate seamlessly with popular POS solutions, so you don’t need to replace everything. The key is finding a platform that works in sync with the tools you already use, keeping your workflow intact while adding convenience for your guests.

5. What if my staff isn’t tech-savvy?

With proper training and hands-on demonstrations, most staff members adapt quickly. Choose a platform that’s intuitive and user-friendly for both your servers and your patrons. Also, it helps to have ongoing support or tutorials from the provider. Staff appreciation of the streamlined process usually grows once they see how much time they save during each shift.

6. Can digital checks really increase tip amounts?

Yes! Many restaurants report higher tips with digital check solutions. The ability to customize tip percentages on-screen makes leaving gratuity straightforward—and sometimes encourages diners to choose a slightly higher tip than they might have on paper. Additionally, it’s quick and doesn’t feel rushed, so guests can comfortably leave a tip they believe is fair.

7. Can I promote my restaurant’s loyalty programs through mobile billing?

Certainly. Some digital check platforms allow you to embed special links or offers that appear right before the customer finalizes payment. It’s an opportune moment to invite guests to join a rewards program, redeem a coupon, or sign up for future events. Since diners are already engaged in the payment process on their phone, they may be more inclined to take that extra step.

8. How do I announce the switch to digital checks to my customers?

Clear communication is essential. You can print a friendly note on your menus or table tents inviting guests to try scanning the QR code. Have your staff mention it at the beginning of the meal, so guests are aware of the option well before it’s time to settle up. Emphasize simplicity and speed to ease any concerns.

9. Will digital checks help with rush-hour congestion?

Absolutely. During peak times, waiting for traditional checks can slow table turnover and cause bottlenecks. Instant mobile billing trims that waiting period, enabling you to seat new guests faster. It’s a practical way to handle busy shifts without compromising guest satisfaction.

10. Where can I learn more about payment trends in the restaurant industry?

Credible resources, such as the Restaurant Dive technology reports, the National Restaurant Association, and industry-focused publications like Forbes Business, regularly publish insights on emerging payment methods and POS solutions. They often share articles that break down trends and highlight best practices, which can help guide your decision-making.

“Check please” is a thing of the past.

With our integrated QR codes your customers pay in seconds, straight from their table.