Leading the Charge: Where Table Payments Are Headed Next

Why Table Payments Matter More Than Ever

Picture this: you’re running a bustling restaurant on a Saturday night. Your servers are zipping between tables, your kitchen is firing at full capacity, and guests are eagerly awaiting their meals. The last thing you want is a bottleneck at checkout. As diners signal for the check, half your staff is tied up handling card swipes, bringing paper bills, or fiddling with a payment terminal. It may seem trivial, but those few extra minutes can dent the overall guest experience, slow table turnover, and reduce potential revenue.

Fortunately, the payment process is evolving—fast. From scanning QR codes to tapping devices, new approaches are giving restaurants the power to reshape how customers settle their bills. And yes, tipping is still part of the equation, especially in the United States, where it’s an integral part of a server’s income. If you’ve been relying on outdated methods, it’s time to explore what the future holds. In French, we’d say “Le Futur du Paiement à Table : QR, Taps, et Pourboires,” but here in the U.S., we’ll stick to “The Future of Table Payments: QR, Taps, and Tips.”

The QR Code Revolution

QR codes—those small, square barcodes—used to appear mostly in tech-savvy or trendy locales. However, they’ve become a natural part of daily life. According to National Restaurant News, more than half of all restaurants in the U.S. tried some form of contactless solution or online ordering system in the past couple of years. QR codes are a big reason why. They’re easy to generate, simple to use, and can be scanned by any modern smartphone.

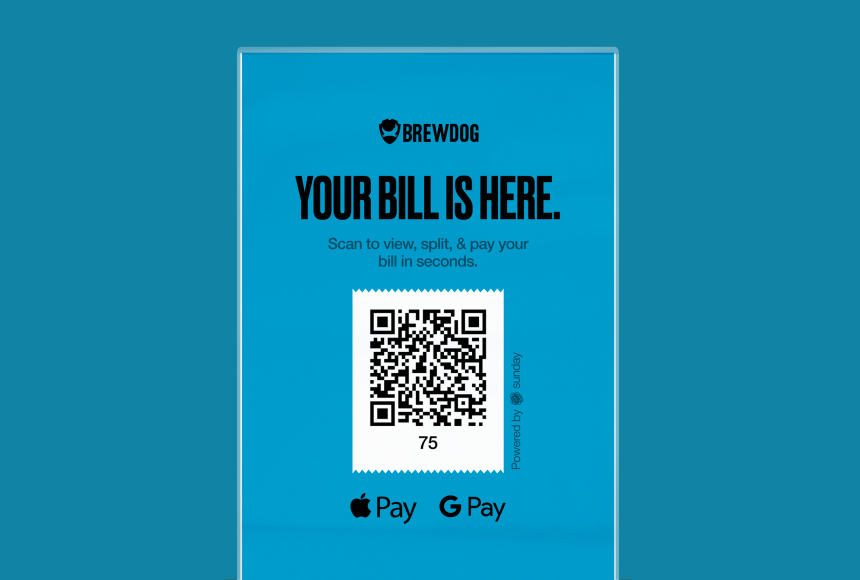

For table payments, a QR code is typically placed at each table or included on the bill. Guests scan the code with their phone’s camera, which instantly brings up the payment interface. No special apps needed—just an internet browser. They can settle the check in seconds, add a tip, and even leave a review on Google right afterward.

Some of the key advantages:

- Speed: No waiting for the server to bring the bill and return with a card reader.

- Autonomy: Guests control the payment process themselves. They can split the bill easily or choose their tip in private.

- Hygiene and safety: Contactless transactions reduce the number of touchpoints, a notable factor since 2020.

- Immediate feedback: If integrated, QR codes allow guests to leave a review right as they pay, capturing their fresh impressions.

Because of these benefits, a range of innovators emerged to bring QR payments to dining establishments. One such solution is sunday, where scanning a simple code can handle the entire process—from ordering to tipping to leaving feedback. It’s not magic; it’s just smart use of technology to make life easier for everyone involved.

Tap-to-Pay: A New Standard for Speed

If you’ve used your phone or smartwatch at a grocery store checkout recently, you already grasp the essence of tap-to-pay. Once reserved for high-end mobile phones, tapping to pay is now an everyday norm. Whether you’re dealing with gift shops, drive-thrus, or your local café, “tap-and-go” solutions have skyrocketed in popularity.

Restaurants, in particular, benefit from this approach. Servers can bring a wireless POS device directly to the table, and guests simply tap their contactless card or phone. In less than two seconds, the confirmation beep signals that payment’s done. This minimal contact approach is ideal for fast-paced dining rooms and customers who want to be in and out quickly.

However, if you’re aiming for a more seamless approach—one that offers a direct path to capturing tips or requesting online reviews—tap alone may not fulfill all your needs. That’s why hybrid options that combine QR scanning with tap functionality are gaining ground. Guests can see their entire bill on-screen, tap if they wish, then add in a digital tip or even explore the dessert menu.

The Role of Tips in the American Dining Experience

Unlike some countries where tipping is discretionary or built into the menu prices, in the U.S., tipping is practically a cultural cornerstone. For many servers, the bulk of their income comes from tips. As a restaurant owner, making the tipping process smooth can significantly impact not only your team’s morale but also your revenue. Encouraging guests to tip is important, but not at the cost of comfort.

A digital payment process can prompt users politely. For instance, a screen can pop up with preset tip options (say 15%, 20%, and 25%), as well as a custom option. This strategy is highly effective. According to a study by Forbes, digital tip prompts can increase average tip amounts because guests are gently reminded of typical rates and can add them with a single click.

With a clear, visually appealing tipping interface, you can also see less friction at payment time. Old misunderstandings about math vanish, and the process is quick, guiding the guest from check to tip in a fluid motion. It’s a far cry from scribbling on a paper slip or fumbling for exact change.

Overcoming Common Hurdles

While the future of table payments is bright, every restaurant implementation has its challenges. Let’s consider a few frequent hurdles and how to address them.

- Technical Integrations: Moving away from paper or older systems often requires integrating a new platform into your existing POS software. Carefully check compatibility and ensure staff training is thorough to avoid confusion at peak hours.

- Guest Comfort: Not everyone is a digital native. Some diners might hesitate to scan or tap if they’re unsure. Clear signage and a quick explanation from your servers often solve this. By the second or third use, it becomes second nature.

- Mobile Data or Wi-Fi: QR-based solutions typically require an internet connection. Provide reliable Wi-Fi if cell service is weak. This minor investment can pay off big in convenience.

- Security Concerns: Cybersecurity remains top-of-mind when handling payments. Reputable solutions use encryption and tokenization to keep card details safe. Always make sure you choose a PCI-compliant provider.

Most of these issues can be mitigated through careful planning, training, and a focus on customer education. In the end, a well-executed digital payment solution elevates the entire dining experience—making it more efficient, secure, and satisfying for both guests and staff.

Comparing Payment Methods at a Glance

If you’re weighing whether to keep a traditional setup or upgrade to contactless QR or tap solutions, examining them side-by-side can offer some clarity. The table below outlines the main differences:

| Payment Method | Implementation Cost | Speed & Convenience | Tip Integration | Customer Experience |

|---|---|---|---|---|

| Traditional Payment Terminal | Usually moderate (device purchase or rental) | Requires card swipes or chip insert | Added manually or by device prompt | Familiar to most guests, but slower |

| Tap-to-Pay (Contactless Card or Mobile) | May require updated POS device, but cost is trending down | Very quick; single tap transaction | Can be integrated via on-screen prompts | Fast checkout, minimal friction |

| QR Code Payment | Low to moderate, QR codes are cheap to produce | Fast checkout once users adopt scanning | Easy tipping with customization options | Highly flexible, can link to reviews or loyalty programs |

Enhancing Guest Relationships Through Technology

As restaurants innovate, capturing customer data and feedback has become an important strategy to foster loyalty. When guests pay via QR codes or digital terminals, you have a chance to invite them to join a mailing list or leave a quick review. This can happen in the same flow as the tip prompt—no extra steps needed.

For example, in a single scan, a guest might settle their tab, tip the server, earn points in a loyalty program, and leave a five-star Google review. That feels almost magical compared to older processes. And while this type of seamless platform has generally been associated with large chains in the past, it’s increasingly accessible to smaller independent restaurants.

Another upside is collecting data on sales and tipping patterns. You might notice that certain menu items tend to correlate with higher average tips or that lunch crowds tip differently than dinner crowds. Having these insights at your fingertips helps you refine service, menu offerings, and staffing. When done ethically and transparently, technology becomes a friendly ally rather than a pushy sales tactic.

Case Study: A Cozy Bistro Adopts QR Payments

Let’s imagine a family-owned bistro in a vibrant city center. Before a modern solution, staff would spend valuable time running to and from a payment terminal at the bar. Busy nights meant lines of customers were building just to settle up. This was frustrating for both servers and diners, especially those in a rush.

After introducing QR payment at each table, the bistro noticed:

- Tables turning over an average of 10 minutes faster during peak hours.

- A 15% increase in daily tip averages, as the QR interface nudged guests to tip in a more convenient way.

- Immediate jump in Google reviews, with about 30% of diners leaving feedback after paying.

- Less credit card confusion or handling mistakes by staff, cutting down on stress and errors.

The biggest surprise was how quickly customers embraced it—especially regulars who were relieved they didn’t have to wait for the check. For the bistro owner, it felt like adding a secret ingredient to a well-tested recipe, one that instantly improved the “flavor” of the overall dining atmosphere.

How to Implement QR and Tap Solutions in Your Restaurant

It’s one thing to read about these innovations. It’s another to bring them into your establishment. Implementation doesn’t have to be intimidating. Here’s a concise roadmap:

- Evaluate Your Current Systems: Is your POS software up to date? Can it integrate with a QR or tap-to-pay provider without major renovations? Check with your POS vendor if you’re unsure.

- Choose a Trusted Provider: Look for a partner that offers reliable, PCI-compliant technology. Ask about their integration process, fees, and whether they support easy tipping and feedback options.

- Train Your Team: Make sure your servers, hosts, and managers know how to explain and troubleshoot the new payment process. Prepare a short, positive script they can use at the table.

- Announce It to Your Guests: Post signage; let them know scanning the QR code or tapping is available. A little instruction can go a long way for first-time users.

- Monitor and Optimize: Track how quickly people adapt. Notice if tips increase or if table turnover times improve. Adjust as needed, whether it’s clarifying instructions or adding discreet reminders for feedback.

This step-by-step approach keeps the process manageable. And if your chosen platform is user-friendly—like sunday—rolling it out is surprisingly straightforward.

Beyond Payment: Building a Solid Digital Strategy

Today’s diners are a savvy bunch. They’re as interested in convenience as they are in taste. Integrating a modern payment system is only the first step. Once you’ve streamlined the process, it makes sense to think about the bigger digital picture:

- Online Ordering and Delivery: With the growing popularity of takeout, your digital presence can capture off-site diners. If the same system can track loyalty points or store payment details, that’s a bonus.

- Feedback Loops: Encourage diners to share their experiences. Not every review will be glowing, but constructive feedback helps you fine-tune your offering.

- Loyalty Programs: Reward repeating guests with digital points or perks. Combining loyalty with a friendly payment process can keep your restaurant top of mind.

- Menu Optimization: Digital payments can yield data about which dishes sell best, which combos are popular, and how pricing affects guest decisions. Use those insights to refine your menu in real-time rather than guessing.

By weaving all these elements together, your restaurant becomes more than just a place to eat. It evolves into a modern, capable enterprise where technology efficiently supports every corner of the dining experience.

Seizing the Future of Payments

Table payments aren’t just a neat gesture to impress tech-savvy customers; they’re an essential part of scaling your operations. The era of waiting for one overworked server to juggle physical checks and run credit cards is fading. Instead, you’re invited to adopt solutions that reduce friction, foster better customer relationships, and ultimately boost your bottom line.

Whether it’s scanning a QR code for a lightning-fast checkout or tapping a card to finalize the bill, these technologies open the door to:

- Higher daily tip averages—not just from increased speed, but from well-placed digital prompts.

- More efficient operations, as staff can focus on hospitality rather than purely transactional tasks.

- Enhanced guest satisfaction, where split checks, quick pay, and immediate feedback come naturally.

- Better insights into customer behavior, which helps refine your menu, marketing, and overall approach.

Of course, your path should reflect your specific needs. Some restaurants might dive headfirst into full QR adoption; others prefer a blend of tap and QR technologies. But one thing is clear: sticking exclusively to outdated payment methods limits your potential.

Embracing the future doesn’t mean discarding what makes your place special. Rather, it’s about adding a modern flair—like plating a classic dish with a contemporary garnish.

Where Do You Go from Here?

As a restaurant owner, your days are already jam-packed with inventory orders, staff management, and behind-the-scenes hustling. Introducing new technology can feel like adding another complex item to your prep list. The key is to choose a solution that fits effortlessly into your workflow.

This is exactly how sunday positions itself: an intuitive, QR-powered payment tool that’s easy to plug into your current system. You could be a small café or a high-end steakhouse—either way, the formula remains the same: enhance speed, convenience, and guest satisfaction. If you appreciate the idea of decreased friction for your customers and the possibility of boosting your staff’s tip earnings, exploring contactless QR or tap solutions should be high on your to-do list.

It’s not just about keeping up with the latest trend; it’s about building a more sustainable, guest-focused business model. When the payment experience is smooth, memorable, and even a touch delightful, it’s more than just a transaction. It becomes a final act of hospitality—a moment that leaves a pleasant aftertaste, encouraging your guests to return soon.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

“Check please” is a thing of the past.

With our integrated QR codes your customers pay in seconds, straight from their table.