How to Turn Your Restaurant’s Payment Transactions into Guest Insights

Why Your Payment Data Deserves a Second Look

Picture this: a busy Friday night in your restaurant. Diners come in waves, servers bustle about, and your payment terminal lights up with each swipe and tap. Once the dust settles, most owners mentally move on to the next service. After all, it’s just a bunch of numbers, right?

But what if your payment data were more than a collection of receipts? What if it gave you a detailed map of your guests’ preferences—everything from when they typically dine to which entrées they absolutely love to reorder? In today’s restaurant landscape, unlocking the value of payment data can be a game-changer, helping you improve service, tailor your menu, and even boost profits. According to the National Restaurant Association, restaurants that use data analytics effectively can see noticeable increases in revenue and customer satisfaction. So why not take advantage of this wealth of information?

Understanding the Essentials: What Payment Data Actually Shows

Before diving into strategies, let’s break down what your payment data can tell you. Whether it’s credit card transactions, digital wallet payments, or QR code scans through a platform like sunday, you’ll find hints about guest habits. Here are some of the most common insights:

- Peak Hours and Days: Identifying when your tables turn over fastest gives you a clue about staffing and ordering needs.

- Popular Menu Items: An uptick in payments for specific dishes signals bestsellers, helping you refine your menu for higher profit margins.

- Average Check Size: If your transactions point to a consistent increase on weekends, that’s a perfect time to experiment with new promotions or limited-time offers.

- Preferred Payment Methods: Tracking how many guests pay with contactless methods vs. cards can guide you in optimizing your checkout process.

Still, these are only the appetizers. Dig deeper, and you’ll see patterns that help you craft a personalized experience, build loyalty, and drive steady growth.

Discovering Who Your Guests Really Are

When someone pays their bill, that transaction isn’t just a financial exchange—it’s a window into guest behavior. By examining the data behind those numbers, you can identify:

- Regulars vs. One-Timers: Frequent visitors might come for lunch every Tuesday, pop in to grab a quick bite on weekends, or always bring friends to celebrate special occasions.

- Group Size and Spending Habits: Do couples usually spend more on appetizers and desserts, or is it the large parties who drive your bar sales? This helps you plan your layout and staff accordingly.

- Time Spent Dining: Knowing how long your guests typically stay can help you pace your service better, reducing wait times and improving overall satisfaction.

- Peak vs. Off-Peak Diners: A data-driven approach helps you craft targeted offers to fill those quieter Monday afternoons or Sunday nights.

Armed with these insights, you can adapt your operations—whether it’s staffing, menu design, marketing campaigns, or promotional events—to better match your customers’ personalities and preferences.

Turning Numbers into Narratives: The Power of Guest Personas

As you collect and analyze payment data, you gradually build a story about the different types of diners who walk through your door. Think of each persona like a unique recipe—composed of spending patterns, visit frequency, time spent on-site, and even tipping habits. For example:

- The Savvy Brunch Crew: They come in around 11 a.m., stay for about an hour, and average a moderate tab with coffee refills and possibly a shared dessert. If this group’s size is growing, you might expand your brunch menu or offer special coffee blends.

- The Weekend Celebrators: Arriving on Friday and Saturday nights, these guests often order multiple courses, specialty cocktails, and top it off with a lavish dessert. They’re primed for upselling—think about highlighting limited-edition drinks or pairing suggestions to enhance their experience.

- The On-the-Go Lunchers: Especially common in busy downtown areas, these guests are in and out in under 30 minutes. They appreciate speedy service and easy split checks. Streamlined checkout options like QR code payments can make all the difference for them.

Building these personas isn’t about pigeonholing your guests. It’s about identifying trends so you can create targeted strategies. Do you see a rise in large group reservations? Advertise family-style meals. Do you notice a slump in weekday happy hour? Offer special discounts or themed nights to bring them in. Payment data, when interpreted well, helps you craft an authentic, profitable dining experience.

Digging into the Technical: Collecting and Organizing Payment Data

Of course, gleaning these insights requires a reliable way to record and interpret transactions. With modern POS systems, you can easily track key metrics—sales, tips, tab sizes, even time stamps—then export the raw data into an analytics tool. The data might seem overwhelming at first: spreadsheets, columns of transactions, itemized lists of every mediocre cappuccino and extra side of fries. The key is to organize it in a way that’s digestible.

Here are a few best practices:

- Set a Format: Decide on a standard way to label your data (e.g., “Lunch – 12 p.m. to 3 p.m.,” “Family Party – 5 or more guests,” etc.) to make sorting and filtering easier.

- Track Multiple Metrics: Go beyond the bill total. Track tip percentage, payment method, item breakdown, and your guests’ average stay time.

- Schedule Regular Checkups: Review your data weekly or monthly. Patterns might change with seasons or special events, and staying current is crucial.

Organized data is much easier to analyze, and that means it’s easier to act on. Even if you’re not a data whiz, you’ll find tools and consultants—possibly from within the restaurant industry—who can help you set up user-friendly dashboards and reports.

A Sample Scenario: Noticing the Rise of Local Families

Let’s walk through a practical example. Suppose you notice a slight uptick in early evening transactions—say, around 5:30 to 7:00 p.m. The bills suggest that diners are purchasing multiple kid’s meals, fewer alcoholic beverages, and occasionally ordering sides of pasta or mild-flavored dishes for picky eaters.

Suddenly, you have a clear insight: local families with younger children have started frequenting your restaurant. At face value, it’s just additional revenue. But if you dig deeper, you might decide to:

- Introduce a Kid-Friendly Menu: Smaller portions, healthier options, or fun dessert specials can turn these families into regulars.

- Offer Early Bird Specials: A small discount or combo meal can entice families to choose your restaurant over the entire row of eateries on the block.

- Train Staff for Family Dining: Inspire your servers to give kids a little extra attention, perhaps crayons or coloring sheets—making the parents’ experience smoother.

- Adjust Your Layout: Arrange more tables for four or six during early evening hours to accommodate groups with children.

All of this spawns from careful observation of your payment data. The ability to respond rapidly to emerging trends not only keeps guests happy but often gives you a head start against local competition.

An Easy Recipe for Data Analysis

Not sure where to begin? Here’s a simple, three-step approach to making sense of raw payment data, topped with a touch of friendly advice:

- Extract the Data: Whether from your POS system, reservation platform, or contactless payment solutions like sunday, start by compiling all your transactions into one place. Generate a monthly or weekly sales report to see the bigger picture.

- Segment and Filter: Look at dayparts (breakfast, lunch, dinner, late-night), group size (solo diners, couples, families, large parties), and check size. This segmentation helps you see unique patterns you might miss otherwise.

- Pinpoint Trends: Lay out a timeline, check for spikes or lulls in sales, and notice if certain menu items, times of day, or payment methods connect to stronger revenue and higher tips.

By following these steps, you’re creating a foundation you can build on. Like making your stock from scratch, it takes a bit of preparation upfront, but the reward is a richer, more flavor-packed result.

Leveraging Payment Data for Restaurant Growth

Once you have concrete insights, the real fun begins—planning how to leverage this data for growth. Below are some strategies to consider:

- Menu Engineering: If certain items see strong sales consistently, consider featuring them more prominently or bundling them with complementary sides or drinks.

- Loyalty Programs: Reward frequent visitors with personalized offers—like a free appetizer after their fifth visit. Even a simple digital punch card can have an impact on repeat business.

- Dynamic Pricing: Some restaurants (particularly in big cities) test the waters with peak and off-peak pricing. If your data shows that people love your brunch but it’s underpriced compared to the dinner menu, consider calibrating your pricing to match demand and ingredient costs.

- Staff Optimization: Does your data show a rush right before 8 p.m.? Adjust your servers’ schedules to ensure adequate coverage during that window.

Think of each data-led adjustment as a thoughtful seasoning—subtle shifts that can dramatically enhance the flavor of your guests’ experience and your bottom line.

Common Pitfalls and How to Avoid Them

Working with payment data can be incredibly useful, but there are potential missteps. Let’s highlight the ones worth guarding against:

- Overlooking Seasonal Variations: Don’t forget that holidays, local events, and even weather patterns can temporarily influence your traffic. Compare against the same periods in earlier years to see if the changes are part of a broader trend.

- Ignoring the Human Element: Data is only half the story. Combine it with face-to-face feedback—ask your servers what they’re observing, check social media reviews, and gather post-payment feedback if available.

- Failing to Keep Tabs on Privacy Regulations: Whenever you store or analyze guest payment info, confirm that your system adheres to data protection guidelines in your region. The last thing you need is a compliance headache.

A balanced perspective ensures you maximize the benefits of data while maintaining trust and respect for your guests.

The Bigger Picture: Data-Based Decisions and Customer Loyalty

At the end of the day, gleaning better insights from your payment transactions is about meeting your guests where they are. By refining your offerings, you make it easier for them to return and recommend your restaurant to others. According to a Deloitte study, guests are increasingly choosing restaurants that promptly cater to their personal preferences. Payment data is an uncomplicated, real-time way to gauge those shifting preferences.

Plus, a small shift in service or pricing can sometimes lead to a big change. Recognizing that most of your guests prefer convenience, you could emphasize speedy payment solutions like scanning a QR code to check out in seconds. Small but meaningful changes not only keep customers coming back but can encourage them to leave positive Google reviews—another aspect that sunday helps facilitate effortlessly. Each review boosts your visibility and attracts new diners, starting the cycle of collecting and learning from payment data all over again.

The Value of Consistency and Incremental Improvements

Analyzing payment data is less about eureka moments and more about continual refinement. You won’t necessarily discover one big secret that transforms your restaurant overnight. Instead, you’ll find small adjustments—like tweaking your weekend hours by 30 minutes or adding a new appetizer that hits the sweet spot in your guests’ spending range. Over time, these micro-changes accumulate into a major difference in profitability and guest satisfaction.

That’s how successful restaurants stay appealing. They keep a finger on the pulse, growing with their customers’ evolving preferences, rather than blindly guessing what might work next month or next year.

Why Payment Data Is Your Hidden Gem

Think of your restaurant as a well-run kitchen—every detail matters, from the moment a diner orders her first course to the final tap of a digital receipt. Payment data is like the sauce that ties all those elements together, highlighting where flavors are strongest and where the dish might need a touch more salt.

By leveraging these insights, you can home in on what’s most important—giving your guests a memorable experience. And that’s the crux of it. A better understanding of your diners lets you craft invitations they can’t refuse: the perfect table layout, promotions that fit their schedules, or new menu items that match their tastes.

When guests feel truly seen, they show loyalty in return. They’ll bring friends, share glowing reviews, and become ambassadors for your brand. In a crowded restaurant landscape, that’s a powerful competitive edge—fueled, of course, by the humble transaction data you work with every single day.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

Get the full, detailed picture.

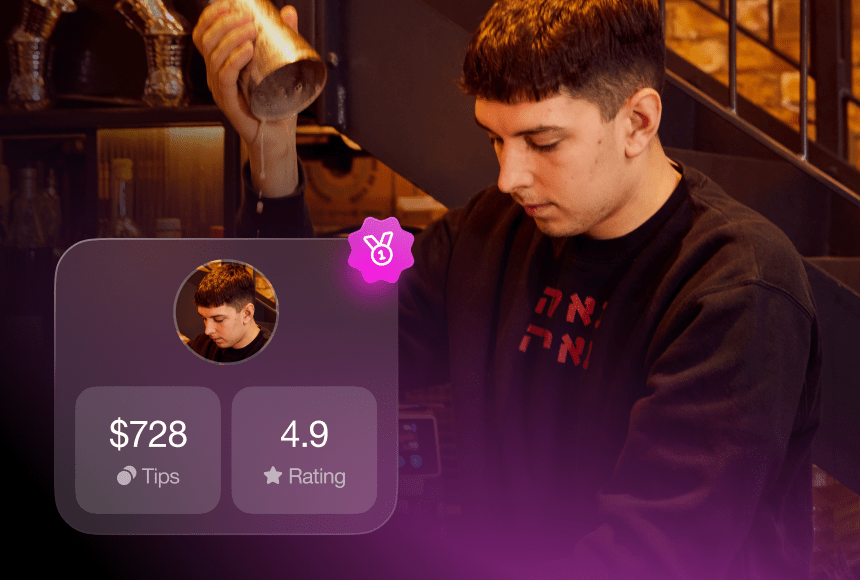

sunday elevates your business with insightful data, instant feedback and precise analytics.