A Practical Approach to Tackling Concerns Around At-Table Payment

Why At-Table Payment Sparks Strong Reactions

Have you ever introduced a new dish that you knew would delight diners, yet your kitchen staff still worried it might complicate the workflow? Modernizing your restaurant’s payment process often triggers a similar reaction. Many owners and servers see at-table payment as a big shift that could unsettle their established system.

But let’s face it: the conventional pay-at-the-counter or “drop the check and come back later” approach eats up precious time, adds more footsteps to a server’s route, and can prolong table turnover. Meanwhile, more guests expect to pay swiftly—sometimes even contactlessly—especially after so much buzz about modern restaurant technology. The pushback against at-table payment is common, and it can feel daunting. Yet once you explore the real reasons behind these objections, you’ll see that each concern can be addressed calmly and, more often than not, with positive outcomes.

Objection #1: “It’s Too Complicated for Guests and Staff”

Complexity is the most frequent fear. Many owners imagine confused guests squinting at QR codes, or staff members fumbling with a handheld device. The last thing you want is a line of frustrated diners or a frazzled team that can’t navigate new technology.

But let’s dig deeper: restaurants are already buzzing with complicated equipment—espresso machines, ovens with fancy settings, and reservation apps. Adding a user-friendly at-table payment system shouldn’t be more complex than any other modern tool you already use.

- Transparent Setup: A well-implemented solution typically integrates with your existing POS. You won’t need an entire tech overhaul, just a simple pairing or QR code link.

- Clear Instructions for Guests: You can place a small card on each table with a concise, step-by-step guide: “Scan the code, view the bill, pay with your preferred method.” Most people already use their phones for tasks like checking in for flights, so scanning a code is second nature.

- Staff Training Made Easy: Offer brief training sessions, or let team members do a few practice runs at a dummy table. Because the interfaces are often quite intuitive, servers typically pick up the routine quickly.

The key is to simplify, not complicate. With minimal guidance, staff get comfortable, and guests soon view at-table payment as more convenient than the traditional method.

Objection #2: “It Feels Impersonal and Hurts the Dining Experience”

Many restaurant owners take pride in human interaction. They worry that handing over a tech-based payment option—like scanning a code—disrupts that personal touch. After all, the face-to-face rapport between server and guest can make or break a meal’s vibe.

Yet adopting digital processes doesn’t mean you lose your restaurant’s heart. In fact, it often amplifies the personal side:

- Reclaim Valuable Time: By eliminating the back-and-forth with checks and credit cards, servers can spend more time checking on guests, talking about the menu, and ensuring everyone’s needs are met.

- Offer a Tailored Goodbye: Instead of rushing to process payments, staff can wrap up the meal by asking how the dining experience was, giving final dessert or beverage suggestions, and thanking guests without dashing off to handle another credit card transaction.

- Personalized Follow-Up: After they pay, guests can be prompted to leave a quick online review or rating right there at the table, reinforcing a sense of connection and immediate feedback.

The technology is merely a tool. It frees you up to be more of a host. If anything, at-table payment allows you to inject more warmth into the guest experience by reducing manual tasks.

Objection #3: “Our Regulars Prefer the Old System”

Longtime patrons might initially resist what they perceive as an unnecessary change. “If it ain’t broke, why fix it?” they’ll ask, especially if they’ve been coming to your place for years. You know these loyal faces well, and you don’t want to alienate them.

Before dismissing at-table payment, consider how you already evolve your menu, decor, and operations over time. Your regulars adapt, even if they balk at first. Typically, as soon as they discover the convenience of scanning and tipping with minimal fuss, they’ll embrace it. Here’s how you can smooth the transition:

- Stay Flexible: Offer both at-table payment and the “traditional” way for those who insist. This dual approach eases them into the idea without pressuring them.

- Demonstrate the Speed: Show them how fast they can settle up when they’re on a tight schedule or want to head home. Many regulars appreciate saving a few minutes.

- Collect Early Feedback: Ask them how they feel about it. A simple, “What do you think of our new payment option?” can go a long way in making them feel valued. Often, you’ll hear surprising enthusiasm once they’ve tried it.

Change can be intimidating, but step-by-step adoption and transparent communication reassure even your most traditional guests.

Objection #4: “It’s Not Secure Enough”

Restaurant owners often raise eyebrows at new technology because of data security concerns. A phone scan or wireless card terminal can sound less secure than the old routine of swiping at the register. In reality, modern at-table payment solutions—when properly implemented—usually offer high-level encryption and comply with rigorous industry standards.

Some tips for solid security:

- Choose PCI-Compliant Solutions: Make sure you opt for a system that follows Payment Card Industry Data Security Standard (PCI DSS) guidelines. This step alone handles a majority of security concerns.

- Don’t Store Sensitive Data: Many at-table payment methods simply process the transaction in real-time without storing credit card details on your own servers.

- Regular Software Updates: Keep your technology current. Patches and updates often fix newly discovered vulnerabilities.

Ultimately, a well-chosen at-table payment system can be just as, if not more, secure than the traditional route. Consider that handing your credit card to a busy server or leaving it in a folder also carries risk. Digital solutions add encryption layers that protect your customers and you.

Objection #5: “We’ll Lose Out on Tips”

The tipping culture is alive and well in the US. So, it’s logical to wonder if scanning a QR code or swiping on a mobile device might dampen a guest’s enthusiasm for tipping. Some owners fear that removing the friendly handoff of a check could reduce the odds of decent gratuities.

In practice, many restaurants see the opposite result. Why?

- Prompted Gratuity Options: Digital checkouts typically suggest tip amounts—18%, 20%, 25%, or custom—right on the screen. That gentle prompt often nudges diners toward more generous tips.

- Smoother Interaction: Because the end-of-meal friction is reduced, guests often feel more positive about the overall experience—and happier diners usually tip better.

- Less Error, More Transparency: When the bill is itemized and clear, customers trust the total more. In many cases, this transparency fosters goodwill.

Of course, results vary by restaurant style and price point, but the data from Restaurant Dive’s 2022 Tech Survey shows that many operators who implement digital payment systems report stable or even increased tip levels. Far from a threat, at-table payment can become a tipping ally.

Objection #6: “We Don’t Have the Budget for Tech Upgrades”

Cost is a familiar roadblock. You’ve got a thousand budget items on your mind, from fresh produce to staff wages. Introducing another expense for new technology can feel like a strain. But let’s think beyond the initial outlay:

- Time Saved Is Money Earned: Every minute your servers aren’t running credit cards to a back station is a minute they can spend upselling, tending to more tables, or engaging with guests. Greater efficiency frequently translates into higher revenue.

- Reduced Hardware Requirements: If you opt for QR codes, you may not need bulky (and expensive) credit card terminals at every station. A simple code on each table, plus a stable internet connection, might be all you need.

- Streamlined Labor: If at-table payment shortens the average duration of each meal, you can serve more guests in fewer hours. Over time, that extra revenue can offset any monthly software fees or hardware investments.

Many solutions—even robust ones—offer subscription models or flexible pricing that scale with your needs. Factor in the long-term savings on time and increased table turnover, and the math often makes sense quickly.

Objection #7: “My Staff Will Resist the Change”

Your servers and managers are the frontline. If they’re uneasy, it will show up in how they present the payment option to guests. So, what if your staff simply doesn’t want to learn a new system or sees it as a threat to their role?

Try these strategies:

- Engage Early: Before you sign up for anything, get input from your team. Show them demos or mock-ups. Ask for honest feedback.

- Highlight Benefits for Staff: Emphasize how at-table payment means fewer runs to the register, fewer errors, and less mental strain during rush hour. Staff can focus more on what they enjoy: hosting and connecting with guests.

- Provide Incentives: If you see that tips are increasing due to the new system, reward staff with a small incentive for adopting it quickly and wholeheartedly.

Often, resistance melts away once servers realize they gain more time to be true hospitality professionals—rather than card shufflers.

Objection #8: “We’ll End Up Alienating Our Older Patrons”

There’s a common assumption that older adults aren’t tech-savvy and will refuse to adapt. In reality, many individuals over 60 are quite comfortable using smartphones. According to a 2021 Pew Research Center study, about 61% of Americans over 65 own a smartphone, and that number has grown every year.

Even for those who are less comfortable with apps, a simple scan can be easier than rummaging through a wallet for the right card. For those who genuinely prefer a more traditional approach, you can:

- Offer Alternatives: Keep a simple handheld card terminal on hand. They can still pay at the table but without relying on QR codes if they prefer.

- Guide Them Gently: Servers can walk them through the steps if they’re willing to try. “Here, just point your camera at the code—see, it pops right up!” That friendly nudge can demystify the process.

The fear of alienating older patrons often turns out to be overblown. As long as you keep an alternate method available, you won’t lose their loyalty.

A Word About sunday and Other Smart Solutions

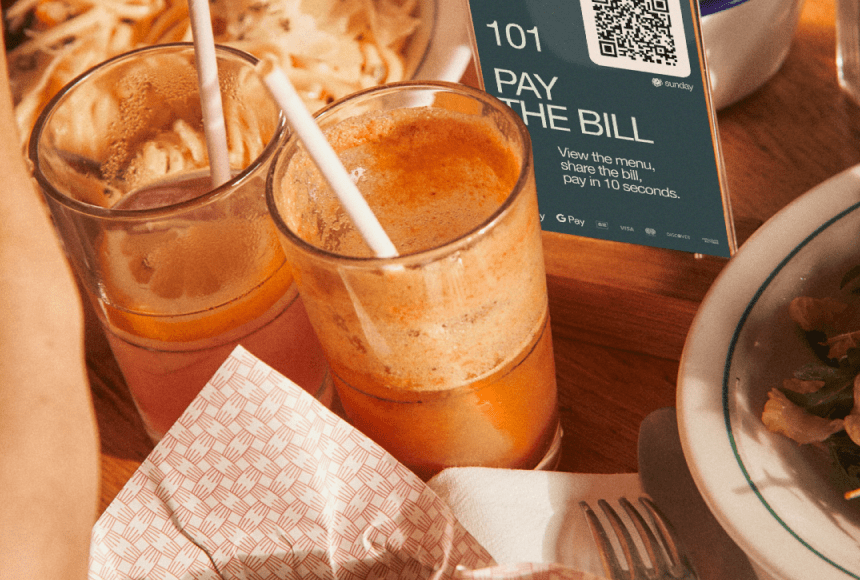

At this point, you might wonder if there’s a specific platform that handles all these concerns—security, ease of use, affordability, guest satisfaction, and staff buy-in. One such solution is sunday, which offers at-table payment via QR codes, integrated tipping options, and even a prompt for guests to leave a Google Review once they pay.

The beauty of a system like sunday lies in its simplicity. Setup is straightforward, your servers get a clear roadmap, and diners can pay whenever they’re ready—no card exchange, no lines at the register. Because so many objections to at-table payment revolve around complexity, cost, and guest experience, a solution that’s designed to be user-friendly helps neutralize these concerns.

To see how the broader restaurant community feels about these technologies, you might check out the National Restaurant Association’s insights on contactless trends. Many operators share anecdotes of smoother front-of-house operations and improved guest feedback after going contactless or adding at-table payment options.

Practical Strategies to Calm Fears

To wrap up, let’s go straight to the heart of what you can do when objections pop up. Here’s a handy checklist:

- Explain the “Why” Clearly: Outline the benefits—faster table turnover, higher tip potential, fewer errors—to both staff and patrons.

- Test During Downtime: Launch your at-table payment system on slower nights. Let everyone get familiar before the weekend rush.

- Train, Train, Train: Provide quick, hands-on demos. Encourage your staff to practice scanning and paying themselves, so they can guide guests with confidence.

- Offer Gentle Guidance to Guests: Place simple instructions on tables, and have servers casually mention, “Feel free to pay using the QR code at any time.”

- Stay Flexible: Give diners the choice between at-table or the familiar route. Eventually, most will choose speed and convenience, but nobody feels forced.

- Collect Feedback Immediately: Ask servers to note any recurring issues. Fix them fast. Show staff and patrons you care about refining the experience.

A Fresh Perspective on Payment

Adopting at-table payment may feel like a leap of faith. Objections come from genuine places: fear of losing personal warmth, budget concerns, staff pushback, security questions. But each worry has a practical resolution. By acknowledging what makes people uneasy and then thoughtfully addressing those points, you can usher in a new era of efficiency without sacrificing the authenticity and hospitality that define your restaurant.

If you stay flexible, keep lines of communication open, and choose a solution designed to be intuitive and secure, you’ll soon find that at-table payment is more of a guest-pleaser than a guest-chaser. You’ll free up staff to do what they do best, give your customers the quick and accurate service they crave, and maintain that special personal touch at every table. It’s a recipe for smoother, more profitable operations—one worth cooking up in any restaurant that’s ready to evolve.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

“Check please” is a thing of the past.

With our integrated QR codes your customers pay in seconds, straight from their table.