Pinpointing the Perfect Payment Solution for a More Efficient Dining Experience

Why Payment Terminals Are Vital to Your Restaurant

Running a restaurant often feels like managing a complex symphony—balancing menus, staff, kitchen flow, and guest satisfaction. In the middle of this choreography lies a key element that can dramatically improve the final impression: the payment experience. That’s where choosing the right payment terminal becomes crucial. The days of bulky, outdated card machines are slipping into the past, replaced by sleeker and smarter devices designed for speed, reliability, and even deeper customer engagement.

But if you’re a restaurant owner, you might wonder: how do you pick a payment terminal that meets your unique needs without overspending or overcomplicating your processes? This article guides you through the must-have features, the potential pitfalls, and practical tips to ensure you land on a solution that feels just right for your establishment. Whether you manage a cozy neighborhood café or a high-volume urban eatery, the right payment terminal can speed up transactions, boost tips, and streamline operations in ways you might not have imagined.

Understanding Your Core Requirements

Before diving into any product demos or sales calls, define why you’re looking for a new payment terminal. Identifying the problem areas in your restaurant helps you zero in on the right device. Some common pain points include:

- Slow Checkout Times: If your guests often wait too long for the check, you may need a faster, more intuitive device—possibly with tableside payment features.

- High Error Rates: A system that double-checks orders or offers easy review for guests can cut down on billing mistakes.

- Long Lines at the Counter: If you have a fast-casual format, a single stationary terminal might create unnecessary queues.

- Lack of Modern Payment Options: More diners expect to pay with mobile wallets or contactless methods these days.

Once you’ve noted your top concerns, rank them. Maybe speed is your number-one priority, with contactless payments a close second. Or perhaps integrating loyalty programs at the point of payment is essential for you. These specifics will guide your entire selection process, ensuring you invest in a terminal that truly solves your challenges.

Examining the Must-Have Features

Like a good menu, your chosen payment terminal should offer just the right ingredients for your establishment. Let’s break down key features that can streamline operations and elevate the customer experience:

- Tableside Payment Capability: Many modern solutions let diners pay at the table via QR codes or wireless handheld devices. This speeds up checkouts, freeing servers to focus on hospitality rather than playing “card machine tag.”

- Contactless and Mobile Wallet Acceptance: Whether it’s Apple Pay, Google Pay, or tap-to-pay credit cards, guests increasingly prefer contactless options. Make sure your device is future-proof by supporting these technologies.

- Intuitive Interface: A touchscreen or user-friendly display helps staff quickly finalize transactions. Some devices also offer clear tipping prompts, often raising average gratuities.

- POS Integration: If you already have a point-of-sale system, confirm that your new terminal can sync sales data automatically. No one wants to manually enter figures at the end of a busy shift.

- Offline Functionality: Restaurants can’t afford downtime when the Wi-Fi dips. If you’re in an area with shaky internet, consider a device that can handle offline transactions.

- Security and Encryption: Encryption standards (like EMV compliance) protect card data. Reputable solutions also offer tokenization, reducing the risk of breaches or fraud.

Keep your daily workflows in mind: do you need a portable device that each server carries? Or is a stationary terminal at a checkout counter enough? Answering these questions is fundamental to making an informed decision.

Should You Opt for a Smart Payment Terminal?

Smart payment terminals differ from the traditional machines in that they have touchscreen displays, connect via Wi-Fi or cellular networks, and often support apps or additional services like loyalty integration. They act more like mini-computers, offering advanced capabilities such as:

- On-Screen Promotions: You can highlight daily specials or offer quick upsells at checkout.

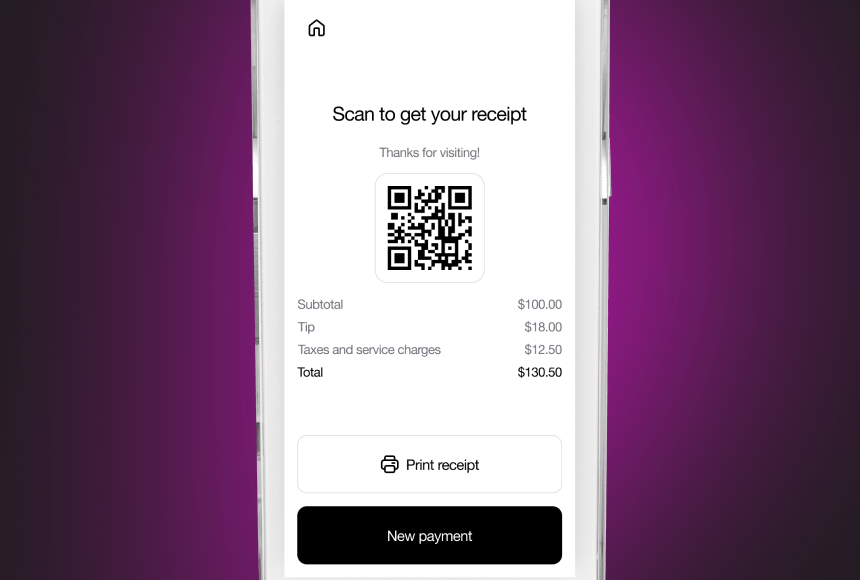

- Digital Receipts: Guests can choose to receive their receipt via email or text, cutting down on paper and printing costs.

- Feedback Gathering: Some solutions let diners rate their experience right after paying.

According to the National Restaurant Association (Pay-At-The-Table Solutions), a growing number of establishments credit these smart devices with faster table turnover and stronger tip averages, especially during rush hours. While they can be pricier than basic models, the potential operational benefits might justify the cost for many restaurants.

Evaluating Cost vs. Return on Investment

Cost is always a sticking point. However, focusing solely on initial price can be misleading. A cheaper terminal might require more staff hours, cause longer wait times, or offer limited capabilities that hamper growth down the road. On the other hand, a more robust device could translate into:

- Faster Service: Speedy transactions help seat more customers during peak times.

- Fewer Mistakes: Automated checks and itemized digital receipts reduce billing errors.

- Increased Tips: Visible tip prompts can boost gratuities by 2–5% on average, as reported by various industry studies.

Consider both the short-term and long-term returns. If your new terminal cuts check-out times by even three minutes per table, you might seat an extra wave of guests each day. In a busy restaurant, that can mean substantial additional revenue.

Asking Key Questions Before You Decide

To avoid buyer’s remorse, go into vendor discussions armed with a few crucial questions:

- Does It Integrate with My POS? Confirm if the device syncs with your existing system. If not, ask about bridging options or APIs.

- What Are the Transaction Fees and Monthly Charges? Some providers charge a flat monthly rate, others take a cut per transaction, and some do both.

- What About Support and Updates? Will you get 24/7 support, or do they only respond during business hours? Are software updates automatic?

- Can It Handle Offline Payments? If your Wi-Fi goes down mid-service, can the terminal store transactions until you’re back online?

- Is There a Contract Term? Be wary of solutions locking you into multi-year contracts with high termination fees. Flexibility is key.

These questions not only clarify the practicalities but also reveal the vendor’s commitment to reliability and customer care.

What About QR Code Payment?

Beyond physical terminals, consider whether you want to support QR code payments. Platforms like sunday let diners scan a code at their table to access their bill, tip, and pay without needing a separate device for each table. This can lighten your staff’s load and reduce hardware costs. It also moves the entire checkout experience onto the customer’s phone—an interface they’re already familiar with.

- Less Equipment to Maintain: No special handheld device is necessary. Just place a QR code on the table or receipt.

- Fast Gratuity Selection: Since everything’s on the diner’s screen, suggested tipping amounts become a breeze.

- Self-Service Speed: Customers can finalize payment the moment they’re done, speeding turnover and letting servers focus on new arrivals.

Of course, not every demographic is equally comfortable scanning codes, so offering both a standard card reader and a QR code option might be a happy middle ground.

Improving the Customer Experience

Any payment solution you pick should simplify life for both your team and your diners. An easy, intuitive checkout bolsters the entire experience, from the first bite of an appetizer to the final settlement of the bill.

Picture this: a server drops off a dessert sampler while quickly mentioning, “Whenever you’re ready, just tap your phone or scan the QR code to pay.” Guests love feeling in control of their dining pace, and your staff appreciates fewer back-and-forth trips with a bulky terminal. In many cases, a frictionless payment can even encourage diners to linger for dessert or a second round of drinks, knowing they won’t be stuck waiting an eternity to cash out.

Real-World Anecdote: A Busy Brunch Spot

Imagine a bustling brunch spot in a city center. Long lines form every weekend as guests wait to snag a table. The manager upgrades from a classic pin-pad terminal to a modern payment device that also supports contactless cards and on-screen tipping. Within the first month:

- Wait Times Decrease: Because servers can quickly handle payments at the table or guide diners to a QR code, tables free up several minutes sooner.

- Tips Rise Slightly: On-screen suggestions lead some guests to tip 18% or 20% instead of the occasional 15% they might have left on paper receipts.

- Higher Staff Morale: Servers spend less time wrestling with receipts and card misreads. They channel that energy into checking on new arrivals or upselling a pastry of the day.

The end result? The brunch spot seats more customers on a typical weekend, sees fewer frustrated faces at the door, and enjoys a small bump in revenue. All because they chose a payment tool tailored to their fast-paced environment.

Sealing the Deal: Steps to a Smooth Transition

Once you decide on a payment terminal or a QR-based approach, how do you ensure a pain-free rollout? Keep these tips in mind:

- Train Your Staff Thoroughly: Show them how the device works and why it benefits them. Emphasize faster turnarounds, potential tip boosts, and fewer errors.

- Start Small: Test it on a few tables or during off-peak hours. Gather feedback, troubleshoot any quirks, and incorporate suggestions before going full scale.

- Communicate with Diners: A short line on the menu or a tabletop sign can clarify the new payment option. If it’s QR-based, an instruction like “Ready to pay? Scan here!” is often enough.

- Evaluate After a Trial Period: Check if table turn times improved, if staff feel less stressed, and if tip percentages inched upward. If you see positive metrics, you know you’re on the right path.

A little proactive planning can transform the novelty of a new payment tool into an everyday asset that pleases your staff and your patrons alike.

The Bottom Line on Payment Terminals

Selecting a payment terminal doesn’t have to be overwhelming. It’s about matching the device’s capabilities—be it contactless support, easy tip prompts, or swift table turnover—to your restaurant’s unique style and pace. For some, a simple contactless terminal might suffice; for others, a robust smart terminal or a QR code solution like sunday can deliver a deeper transformation in how you handle each check.

Ultimately, the best measure of success is how well the system integrates with your daily flow. If you notice shorter lines, calmer staff, and happier diners who pay and depart with minimal fuss, you’ll know you’ve made the right choice. And in a competitive industry where every minute counts, that smooth, efficient last step can spell the difference between average service and a truly memorable dining experience.

Find out more today

Drop us your details below and we’ll reach out within the next 24h

The payment terminal to make your operation simpler.

Connected to your POS, we offer the only payment terminal specifically designed for restaurants.