Driving Down Costs and Boosting Efficiency Through Tech

Why Digital Transformation Is More Than a Buzzword

Walk into almost any busy restaurant, and you’ll see technology taking on a growing role. From online reservations to QR code menus, the industry is moving past pen-and-paper methods at lightning speed. One particularly transformative trend is how payment is handled. Not too long ago, you’d have a single card machine for the entire floor, perhaps with servers queuing up to settle multiple bills. Now, advanced payment terminals — known in French as terminaux de paiement électronique — go far beyond standard card reading. And that’s just part of the story.

Alongside the rising tide of new devices come questions: “Are we overcomplicating things? Will this actually save money, or just pile on extra fees?” In fact, when chosen well and integrated thoughtfully, modern payment terminals and digital payment solutions can unlock substantial savings for restaurateurs. Let’s delve into how these cost reductions manifest, where you can spot them, and how to ensure your investment pays off.

Eliminating Paper, Printer, and Admin Hassles

You might see receipts as mere bits of paper, but the costs can stack up over time. Traditional card machines often spit out multiple slips for each transaction, and if you’re open all day, that’s a small forest of paper each week. But that’s not the only expense:

- Printer Repairs: Receipts get jammed, ink runs out, and hardware breaks down. Over time, small repairs or replacements add up.

- Manual Reconciliations: If you’re still keying in card data or tips at the end of each shift, that’s precious admin time that could be spent on more pressing tasks.

- Storage Costs: If you’re archiving physical receipts (perhaps for disputes or audits), that can require space and organisation — not free, especially in a restaurant where every inch matters.

By shifting to a payment terminal that allows digital receipts (sent via email or text), you cut much of that waste. Diners who really want a paper copy can still have one, but the default is paperless, saving you money on consumables and maintenance.

Digitalised systems also automate daily takings data. Instead of staff spending an hour cross-checking receipts, your device can feed transaction records directly into your POS. Less staff time spent on manual data entry means lower labour costs and fewer human errors.

Faster Checkouts Mean Faster Table Turnovers

One major cost factor for any restaurant is seat occupancy time. If your guests linger just because it takes ages to settle the bill, you lose the chance to seat the next party. That’s effectively money leaking away. Modern, streamlined payment terminals let you handle payments at the table in seconds.

- Contactless Speed: Tapping a card or scanning a phone is far quicker than fiddling with chip-and-PIN for every guest.

- On-Screen Bill Splitting: Many advanced payment terminals let you split the total among diners without separate manual transactions, cutting down precious minutes during busy periods.

Even a five-minute saving per table can stack up over a busy lunch service. In fact, a McKinsey analysis (Retail insights) highlights how small operational efficiencies, multiplied across many transactions, lead to significant daily revenue gains. When your payment solutions reduce the time diners are waiting for the bill, you boost your turnover potential.

Lower Banking and Interchange Fees

It’s not uncommon for restaurant owners to assume that more advanced, connected payment terminals come with heftier transaction fees. Yet in many cases, these modern payment processors can offer competitive rates — sometimes better than legacy providers. Why? Because digitalisation often goes hand-in-hand with streamlined operations on the processor’s side too.

Of course, you need to investigate the fine print:

- Negotiated Rates: If you handle high volumes, you might be able to secure better interchange rates with certain providers.

- Monthly vs. Pay-Per-Transaction Plans: Some solutions charge a flat monthly fee plus lower per-transaction costs, which could suit high-traffic venues better.

- No Hidden Extras: Watch out for surcharge fees for refunds or chargebacks. A transparent provider can help you plan your budgets accurately.

When you combine smoother table turnover with possible fee savings, the combined effect can be remarkable, especially over the long run.

Making Tipping More Transparent

In many restaurants, tips are a big part of your servers’ motivation — and your labour management. Traditional card terminals usually bury the tip prompt or require manual input from the server. That can lead to lost opportunities when guests feel too rushed or uncertain to add a gratuity.

A user-friendly digital payment terminal solution can guide diners toward leaving a tip with a simple, on-screen suggestion. They see recommended percentages (e.g., 10%, 12.5%, 15%) or can input a custom amount. It’s polite, subtle, and often leads to higher tips. Over time, these extra gratuities help keep your staff content and reduce turnover costs in the form of recruitment or training for new hires.

Meanwhile, the transparency — both for staff and for management — means you spend less energy on end-of-day tip reconciliation. Everyone sees the tip data in real time, which fosters trust.

Reducing Errors and Chargeback Risks

Cash handling can introduce counting mistakes, while manual card entry might lead to typos or misunderstandings. And no one wants to deal with a disputed transaction a week after a busy shift. Digital payment terminals typically come with:

- Encrypted Transactions: Minimising fraudulent claims or the chance of stolen card data.

- Automated Receipts: Clear documentation for both parties. If a dispute does surface, you have a detailed, time-stamped record, speeding resolution.

- Real-Time Inventory Links: Some advanced solutions even track menu items sold, reducing confusion over what was billed. Fewer mistakes mean fewer refunds.

Every transaction that’s glitch-free saves you the headache — and potential monetary loss — of dealing with errors or contested bills.

Optimising Staff Allocation and Productivity

When a payment terminal speeds up payments, your servers don’t spend as much time acting as mobile cashiers. Instead, they can assist more tables, handle queries quickly, and even upsell an extra round of drinks or a dessert. The net effect is improved table coverage without necessarily hiring more staff.

Plus, with certain digital payment terminals, if your point-of-sale or table management system is integrated, servers see live updates on table status. That helps them plan their routes, know which diners might be about to settle, and coordinate with the kitchen more effectively. Less wasted motion across the dining room can significantly reduce labour costs over time.

Streamlined Accounting and Real-Time Sales Data

One of the biggest benefits of digital payment terminals is automation for accounting tasks. Instead of counting receipts late at night, you can pull up a dashboard showing total sales, card breakdowns, and even items sold if you have a connected POS.

- Fewer Manual Bookkeeping Hours: Automatic data feeds save you from punching numbers into spreadsheets, or reconciling multiple sources of information.

- Accurate Reporting: No more guesswork on daily card takings. The system logs transactions in real time, so you can quickly identify any anomalies.

- Better Forecasting: If the terminal merges with your analytics, you can spot peak times, popular dishes, or average spend per head. That insight informs smarter inventory orders and staff scheduling.

All that labour and brainpower you save can be channelled into more strategic concerns, like planning your next menu refresh or launching a new promotional event.

Implementing On-the-Spot Payments

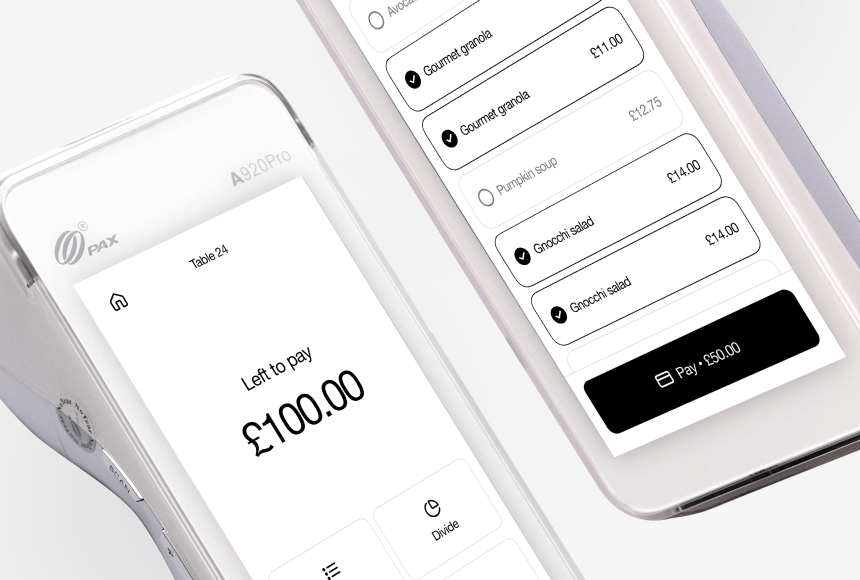

For some restaurants, the biggest cost saver lies not just in adopting a fancy new card machine but shifting the entire payment culture. Having payment terminals that you carry to the table helps. Letting customers scan a QR code to pay on their own phone (as in the Sunday model) can amplify those benefits further.

With QR payment in particular, your staff no longer needs to manage the transaction at all:

- No Queuing for a Device: Multiple customers can pay simultaneously at different tables.

- Full Customer Control: Diners handle their own tip choices and receive digital receipts. Meanwhile, your servers can greet the next table, clear plates, or deliver another meal.

In this scenario, the payment terminal might become a backup or an alternative for those reluctant to scan a QR code. Either way, the synergy between an advanced terminal and a contactless phone-based solution can bring maximum flexibility and minimal friction at checkout.

Are There Downsides or Investment Risks?

Of course, any new tech comes with considerations:

- Upfront Costs: High-end payment terminals carry a larger price tag or monthly fee. Make sure you project how fast the time savings and operational gains might offset that outlay.

- Training Curve: Staff must understand how to navigate the new device and teach customers if they’re unsure. Allocate training time and let servers practice during slow hours.

- Potential Downtime: Relying heavily on digital solutions means you need strong Wi-Fi or mobile data coverage. A fallback plan (like a spare device) is prudent.

However, these risks can be mitigated with a bit of planning and a robust vendor choice. The long-term savings in labour, supplies, and increased capacity can easily outweigh early inconveniences.

Tracking Your Return on Investment

To confirm the real-world impact of switching payment terminals or adopting additional digital payment methods, keep an eye on these metrics:

- Average Payment Time: Does each bill now close out faster than before? If you’re consistently shaving off minutes, that’s a plus.

- Table Turnover Rate: Compare peak shift data from before and after implementation. Even a slight bump could translate into notable extra revenue weekly.

- Tip Percentage: Check if the share of diners leaving gratuities, or the average tip size, has risen since you introduced a tip-friendly interface.

- Paper and Supply Costs: Document how much you spent monthly on receipt rolls, printer maintenance, or other related items before, and see if that figure has dropped.

- Labour Efficiency: Observe if staff spend fewer hours reconciling sales or handling administrative tasks, letting them handle more tables without added personnel.

These data points will illustrate the synergy between digital payment and real cost savings. You’ll know precisely where and how you’re benefiting, allowing you to fine-tune your approach for even better results.

Focus on the Bigger Picture

Ultimately, a streamlined, modern payment terminal or a QR-based payment system does more than chip away at small costs. It shapes the impression your restaurant leaves on diners. A frictionless exit feels like a natural end to a carefully orchestrated meal, leaving guests satisfied and likely to come back — or to mention your place to friends.

And yes, the immediate, tangible savings in paper, staff time, and overhead are nothing to scoff at. But the intangible effect on customer perception can be just as significant. In a competitive hospitality market, every little advantage counts, from speed to style.

So if you’re contemplating how to cut costs without sacrificing service, consider exploring advanced payment terminals or new digital payment flows. It’s one of those changes that might feel small day-to-day but can drastically reshape your bottom line and brand reputation in the long haul.

The Choice Is Yours

Every restaurant is different, whether you’re a cosy local bistro or a high-traffic chain. The common denominator is that technology can slash costs and complexity when it’s matched thoughtfully to your workflow. By embracing a capable, user-friendly payment terminal and pairing it with a strategic approach to digital solutions, you could see real financial dividends — not to mention less stress during the busiest shifts.

To recap:

- Paper Costs Go Down: Relying on digital receipts saves on supplies and maintenance.

- Checkout Becomes Quicker: Faster payment means faster table turnover, leading to higher revenue potential.

- Tips Often Climb: Clear tip prompts and simpler processes encourage diners to give a little extra.

- Staff Get Time Back: Automated reconciliation and self-service checkout reduce manual tasks, so employees can focus on guest experience.

- Errors and Fraud Risks Shrink: A precise digital record means fewer chargebacks and disputes.

All these add up to improved margins and a healthier operation, while letting your front-of-house team and kitchen keep doing what they do best: delivering memorable meals to satisfied customers.

When you’re ready to explore the next step in payment innovation, keep a clear checklist of what matters most to your business. And remember, solutions like Sunday can integrate seamlessly with new or existing payment terminals, further removing friction from the payment experience. Because saving money shouldn’t be complicated — it should be as effortless as a final, friendly wave goodbye from a delighted diner.

Find out more today

Drop us your details below and we’ll reach out within the next 24

The payment terminal to make your operation simpler.

Connected to your POS, we offer the only payment terminal specifically designed for restaurants.