Practical Strategies to Streamline Your Restaurant’s Payment Operations

Why Payment Systems Matter More Than Ever

In the fast-paced realm of UK hospitality, the payment process is so much more than a mundane end to a meal. It’s the final interaction your customer has with your restaurant, so it can leave a lasting impression—for better or for worse. A smooth, efficient payment system can boost your reputation, encourage repeat visits, and secure those all-important five-star Google reviews.

Whether you run a local bistro or manage multiple venues, you’ve likely encountered a range of payment pain points. From card machine glitches to confusion about tips and service charges, the struggle is real. But these days, technology offers some beautifully simple ways to ease those burdens. If you’ve spent even a week in this industry, you know every moment counts: you don’t want staff fiddling around with lengthy payouts or diners waiting impatiently just to settle the bill. Below, we’ll break down typical challenges and share methods to make that payment process feel as seamless as possible.

Spotlight on Common Payment Pain Points

Let’s start by recognising the recurring headaches that come with accepting payments in a restaurant. Acknowledging them is the first step toward finding an effective solution. Here are the issues many UK restaurateurs encounter on a daily basis:

- Long Wait Times for Payment: Diners who are ready to leave don’t enjoy calling for the bill multiple times. Every minute extra they spend waiting is a minute of potential frustration or lost table turnover.

- Unclear Service Charges and Tips: It can get awkward when customers are unsure whether service is included or if they should add a tip. Transparency and clarity mean everyone feels comfortable.

- Manual Reconciliation: Manually matching and consolidating daily card transactions, cash, and voucher payments can be a time drain. If tips get involved and each staff member is due a portion, it’s even more tedious.

- Technical Glitches: That sinking feeling when your card machine decides to cut out on a busy Saturday evening can ruin both diner rapport and staff morale.

- Delayed Cash Flow: Depending on your current setup, you might be twiddling your thumbs for days before funds settle into your business account. This can hinder your ability to pay bills on time or invest in fresh inventory.

Building Trust Through Transparent Payouts

It’s not just about the moment a customer taps their card. It’s also about what happens after—the journey of funds from a customer’s account to yours. The key to financial stability and staff morale lies in transparent, speedy payouts. Here’s why:

- Budget Planning: Quick and predictable payouts let you map out expenses and staffing budgets without scrambling for last-minute cash flow solutions.

- Staff Satisfaction: When you have a clear view on tips and service charges, your staff know precisely when and how they’ll receive their share. This transparency nurtures a trustworthy working environment.

- Reduced Admin: The fewer spreadsheets you have to wrangle at midnight, the better. Automated payment and tipping systems let you focus on the core of your business—serving fantastic food and a stellar dining experience.

According to UK Finance (https://www.ukfinance.org.uk/), contactless and online payments continue to gain popularity across the UK. This trend underscores the importance of efficient, digital-friendly payout processes. With the right tools, you can reconcile payments effortlessly, ensuring every penny is accounted for.

Solutions That Simplify Your Life

An ever-growing range of technology tools is transforming the restaurant scene, and payment solutions are no exception. Whether you operate an independent café or oversee multiple sites, implementing the right platform can save you money, time, and countless headaches.

Below are key considerations when exploring how to simplify the financial side of your business:

1. Embrace Cloud-Based Systems

Outdated payment terminals tethered to clunky systems can hold you back. By contrast, cloud-based solutions offer real-time transaction updates, remote access to sales reports, and straightforward integration with your existing software stack. You can track your takings, view live sales, and even process refunds from anywhere—no more waiting until you’re physically present.

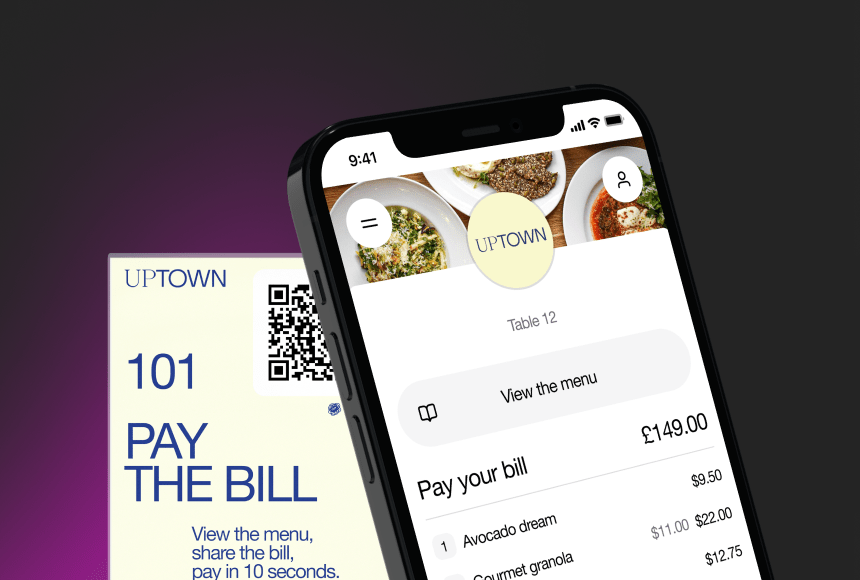

2. Integrate QR Code Payments

Diners appreciate convenience. That’s one reason solutions like sunday are catching on, as they let customers scan a QR code to pay or tip, right at the table. This eliminates the awkward “Can I grab the card machine?” dance and empowers diners to settle their bill on their own terms. QR code payments often integrate seamlessly with your accounting system, funneling the funds into your restaurant’s account without delay. Plus, these platforms can make it simpler for diners to leave a review online, so you’re potentially boosting your online presence while you collect payments.

3. Look for Real-Time Analytics

Pinpointing when your restaurant is busiest, which payment methods are most common, or what your average strike rate on tips might be can drastically impact future decisions. Real-time dashboards give you a bird’s-eye view of how your business is performing day to day. When combined with simple forecasting tools, data-based insights can help you adjust staff schedules, expand menu favourites, or manage stock better.

4. Streamline Your Settlement Process

Ask yourself: “How quickly do we see funds from our card payments, and do we understand all the fees?” A well-chosen provider can offer next-day or even same-day settlements, helping you stay on top of cash flow. The right payment partner should also provide transparent fee structures so you’re not scratching your head over hidden costs. This helps you plan with confidence. Nobody likes nightly surprises in the world of finance.

5. Automate Tip Distribution

Tip collection in the UK can be tricky, especially if you employ both front-of-house and back-of-house staff. You want a system that can safely distribute tips, ensuring fairness and transparency for your team. A digital platform that tracks staff hours, role responsibilities, and allocations can eliminate those uncomfortable end-of-shift huddles over tip jars. Your staff can trust the process and you’ll make your accountant’s life a lot easier.

Case Study: The Cozy Corner Bistro

Let’s take a peek at a hypothetical café called The Cozy Corner Bistro, a quaint spot known for hearty Sunday roasts and mouthwatering pies. The owner, Emma, felt mounting frustration with her outdated card machine and manual reconciliation. Every evening, she spent an hour matching receipts against her daily sales records, figuring out which staff member ought to receive a share of tips, and worrying about errors creeping in. Meanwhile, weekend queues formed at the till while staff were preoccupied handing out separate card readers.

After implementing a cloud-based payment terminal with QR capabilities, Cozy Corner Bistro’s workflow changed completely:

- Customers checked out using their smartphones, scanning a QR code at the table and settling bills instantly.

- The cloud-based dashboard synced with Emma’s accounting software, letting her see in real time how many orders had been processed and how the tips were shaping up across each day part.

- Tips were automatically tallied and allocated to front-of-house staff, with a portion going to the kitchen team. Staff morale—and retention—shot up.

- The integrated solution also prompted diners to leave a Google review. Within months, new customers cited those positive reviews as a deciding factor to visit.

Now, Emma gets to reclaim her after-hours. She has more time to focus on crafting winter-themed menus, forging local supplier relationships, and brainstorming fresh marketing ideas. And the best part? Customers notice how slick and quick bill payments are. That leads to word-of-mouth recommendations and a healthy bottom line.

A Quick Look at Payment Data

If you’re still on the fence about making a switch, consider some telling data. Take a glance at a fictional table that outlines typical improvements restaurants often observe when they streamline their payment processes:

| Metric | Before | After Streamlining |

|---|---|---|

| Time Spent Reconciling Each Day | 60 minutes | 15 minutes |

| Average Tip Percentage | 5% | 8% |

| Customer Wait Time for Payment | 10 minutes | 2 minutes |

When you multiply those time savings and tip boosts by 365 days a year, the benefits are considerable. Although the table is just a snapshot based on typical user feedback, it showcases the ripple effect that modern payment solutions can have.

Overcoming Resistance to Change

Upgrading your payment methods can feel daunting. Many owners worry about training staff, deciphering new fee structures, or switching providers. Thankfully, modern systems are designed to be user-friendly. Your team can usually become proficient in just a few sessions—or sometimes in a single shift. By emphasising benefits like shorter wait times, higher tips, and reduced stress, you can secure widespread support and avoid confusion.

Small shifts in mindset also help. Imagine you’re perfecting a recipe: each tweak brings you closer to that ideal balance of flavour. Similarly, refining your payment approach is an ongoing process. You adapt as you go, sampling solutions here or adding new digital features there, all to ensure your “recipe” suits you and your guests just right.

Encouraging Google Reviews and Word of Mouth

When a diner is in a good mood and everything goes smoothly, they’re in the perfect frame of mind to leave a friendly review. By integrating the payment experience with a nudge for social proof, you can capture that positive buzz. And it’s not all about showy web presence either: strong ratings directly drive foot traffic. The UK’s restaurant scene flourishes on recommendations, and an elegant payment system can tip the scales from a four-star to a five-star review.

Many modern payment solutions—like sunday—include the option for diners to leave an online review immediately after paying. In that small window, momentum is on your side. If you add a short, warm message along the lines of, “We hope you enjoyed your meal. Would you consider sharing your thoughts?” you’ll be surprised at how many respond positively. This is especially true if you’re focusing on a quick, hassle-free experience that customers can appreciate.

Key Takeaways for UK Restaurateurs

The UK’s dining culture is evolving fast, and so are customer expectations. Today’s diner wants convenience, clarity, and speed—no more waiting around for a card machine to connect. They also want to feel comfortable leaving a tip without guesswork. By streamlining your payment process, you’re also freeing up valuable staff hours, reducing errors, and improving staff satisfaction. Here are a few central points to remember:

- Transparency Fosters Trust: Whether it’s about how you split tips or your speed of payment, being open with your staff and customers builds loyalty.

- Technology Simplifies Admin: Cloud-based solutions and QR code payments remove the tedium of manual reconciliation, freeing you to focus on what you do best: delighting guests.

- Positive Experiences Encourage Reviews: By reducing stress around payments, you create a comfortable environment that inspires diners to leave glowing feedback online.

- Speedy Payouts Boost Cash Flow: Next-day or same-day settlements make it easier to handle bills, wages, and stock, so you’re never caught short.

- Data Insights Lead to Smarter Decisions: Understanding your busiest times, tip trends, and customer preferences helps you optimise staffing and menus.

Looking Ahead to Continuous Improvement

As the UK restaurant industry continues to evolve, your payment system can be more than just a necessary tool—it can be an advantage. By integrating quick and transparent methods, you’ll notice better staff morale, improved customer satisfaction, and a stronger financial position.

When choosing your solution, think about the bigger picture: Will it integrate smoothly with your current systems? Is the pricing transparent, or are you likely to encounter hidden fees? How quickly do you receive your funds? And crucially, does this approach make life easier for everyone involved?

From single-site cafés to bustling chains, payment processes impact every facet of your business. The right platform can create that satisfying sense of calm and clarity most of us crave in a hectic industry. It’s the difference between chasing the next table and having the time to chat with your regulars—or plan that next brilliant innovation for your menu. If you equip yourself with the right tools, implementing them will feel far less complicated than you might imagine. It’s like mastering a staple dish; once your technique is locked in, you can focus on the finishing touches that wow your guests.

Ultimately, an optimised payment process allows you to dedicate more energy to the experience on the plate. That, in turn, fosters more loyal customers—and that’s the recipe for a thriving restaurant. By tackling hidden fees, ensuring staff get paid fairly and promptly, and making bill payments a breeze, you’ll help your business stand out in a crowded market. And if you choose a forward-thinking solution that places user experience at the heart of every step, you’ll be well on your way to a simpler, more prosperous future.

Find out more today

Drop us your details below and we’ll reach out within the next 24

The fastest way to pay in restaurants

- Scan the QR code

- View the menu

- Split the bill

- Add a tip

- Pay in 10 seconds

- Leave a review