Making Sense of Pre-Payment: Balancing the Benefits and Drawbacks

Why Pre-Payment Is Generating Buzz

Picture your restaurant on a busy evening. Diners trickle in, servers juggle orders, and the kitchen hums with activity. Now imagine if some (or even all) of those meals were already paid for before anyone arrived—either online or via a mobile platform. Some restaurant owners see this as a big leap forward in efficiency, while others are more cautious. So which is it: a game-changer or a high-risk strategy?

Statistics from BigHospitality suggest a growing consumer appetite for digital convenience. With contactless transactions reaching new heights, the notion of paying upfront continues to intrigue both diners and operators. But does pre-payment fit every concept—whether it’s a quick lunch café or an upscale evening venue? Let’s explore the pluses and pitfalls to help you decide.

1. The Essence of Pre-Payment in a Restaurant

Pre-payment is when customers settle the bill before they dine or pick up their order. Typically, this happens online—perhaps through a restaurant’s website or app. Diners choose their menu items, pay securely, and arrive with the financial side already handled. Sometimes it’s a deposit, sometimes it’s the entire cost of the meal.

- Reduced payment friction: Because the transaction is out of the way, there’s no card machine dance or frantic bill-splitting at the end.

- Stronger commitment: If someone has already paid, no-shows could drop, and you gain a more accurate view of your evening’s demand.

- Varied approaches: Some restaurants only require pre-payment for large tables, special events, or peak hours. Others do it year-round for all bookings or even takeaways.

Yet it isn’t all straightforward. Accepting payment before the meal can alter how you plan menus, handle refunds, and manage the guest experience. So, is it worth it? Let’s take a closer look.

2. The Advantages of Offering Pre-Payment

From minimising no-shows to speeding up table turnover, pre-payment can tackle some of the biggest headaches in hospitality. Here’s where it shines the brightest.

2.1 Minimising No-Shows and Last-Minute Cancellations

Few things frustrate restaurant owners more than vacant tables from guests who reserved but never arrived. By taking payment in advance—even if it’s just a partial deposit—you establish a sense of commitment.

- Fewer empty seats: Customers are less likely to skip out if they’ve already spent money.

- Clearer forecasting: You can order fresh ingredients or allocate staff more precisely, reducing costly waste.

- Quick refunds for valid reasons: If a guest cancels early, you can process a swift refund or partial credit. You maintain goodwill without losing revenue on last-minute no-shows.

This approach might also appeal to corporate groups. Companies often prefer paying for group meals in advance to skip last-second hitches—leading to smoother planning for both parties.

2.2 Speeding Up Service and Turnover

How often do customers linger over the final bill, especially on busy nights? Pre-payment nips that delay in the bud. Once guests finish their meal, they can simply head out at their leisure.

- Reduced payment traffic: Your staff no longer need to carry a card terminal around or wait for each customer to settle. They can redirect their energy to greeting new arrivals or assisting the kitchen.

- Less confusion over checks: Big groups who’d normally split the bill (and your server’s patience) can pay in advance in separate transactions. This fosters a smoother end to the dining experience.

- Faster table turnover: If you’re running a high-volume eatery, you can seat more guests per service, boosting daily revenue potential.

For diners, the final moments of a meal feel pleasantly frictionless. Nobody has to wave down a busy server. By cutting out this wait, you craft a lighter, more modern vibe, which can heighten customer satisfaction.

2.3 Improving Cash Flow

When people pay upfront, the funds enter your account before a dish is even served. This can ease cash flow pressures—especially helpful for smaller or newly opened spots juggling overheads and stock purchases.

- Order inventory confidently: Knowing a portion of your revenue is already in, you can invest in fresh produce, premium cuts, or seasonal ingredients without fretting about covering costs.

- Smoother budgeting: You can forecast weekly or monthly income with more accuracy, forging a robust financial footing. No more second-guessing if you’ll cover rent or wages.

While not every restaurant invests their daily takings immediately, having early payments can be a game-changer—particularly in turbulent economic climates where stable cash flow is king.

3. The Potential Drawbacks to Consider

Of course, there’s no such thing as a perfect system. Pre-payment can change diners’ perceptions and introduce fresh challenges for your workflow.

3.1 Higher Risk of Customer Pushback

Some diners might balk at paying up front. They could view it as distrust from the restaurant or worry about losing money if plans shift.

- Misunderstandings: If you don’t clarify how cancellations or refunds work, frustration can escalate. Suddenly your restaurant is painted as inflexible, even if you have a fair policy in place.

- Luxury dining connotations: In high-end tasting menu establishments, pre-payment is common for exclusive experiences. But in casual eateries, it might feel alien to certain customers. The mismatch can deter walk-ins or spur negative word-of-mouth if not communicated elegantly.

Striking a balance is essential. Transparent disclaimers and a friendly tone can reassure guests, preventing them from feeling railroaded into a system they don’t fully understand.

3.2 Complexity in Handling Changes or Refunds

Let’s say a customer pre-paid for a table of four, but one friend cancels or decides to order a different main course upon arrival. Suddenly, you’re dealing with partial adjustments mid-service.

- Refund logistics: If you need to process a partial or full refund, how quickly can you handle it? Prolonged delays might irritate patrons.

- Menu modifications: Pre-payment often accompanies pre-ordering. But if diners change their minds last-minute, do you charge extra, or apply a credit to a future visit?

- Tech reliance: You’ll likely lean on integrated software to reflect real-time changes. If your system is glitchy or staff are undertrained, confusion abounds.

A feasible approach is to set clear rules: “Any dietary changes must be advised by 4 p.m. on the day,” or “Refunds for cancellations later than 24 hours prior are subject to a 50% charge.” This clarity helps staff manage expectations gracefully.

3.3 Perceived Barrier to Booking

While pre-payment can reduce no-shows, it may deter spontaneity. A casual browser might think, “I’m not committing money until I see the restaurant for myself,” or “What if I find a better last-minute option?”

- Impact on casual diners: People who wander in off the street might be turned off if they learn everything is pre-paid. That also reduces walk-in business.

- Complex messaging: If some days or times require advance payment but others don’t, the mixed signals can leave guests confused. Consistency is vital for brand messaging.

You may want to limit pre-payment to busy periods or certain bookings—like large parties or weekends—maintaining a flexible approach that feels welcoming instead of imposing.

4. Deciding Which Model Fits Your Restaurant

Pre-payment doesn’t have to be “all or nothing.” You can adapt the idea to your concept and typical customer base. Common variations include:

- Deposit-only system: Guests pay a fixed deposit per person (often non-refundable unless there’s a timely cancellation), with the remainder settled on the day.

- Partial pre-pay for special meals: For events or set menus, you might charge half the total cost upfront. This approach balances security for you and flexibility for the diner.

- Full pre-payment for large tables: Some restaurants enforce full advance payment for groups over six or eight, minimising the risk of big no-show losses.

By mixing and matching these models, you can fine-tune a strategy that safeguards your bottom line while still offering a warm welcome.

5. Using Tech Wisely: Making Pre-Payment Simple

Modern diners generally expect digital convenience—booking a table via app, checking out a QR code menu, or paying with a quick tap. Pre-payment aligns well with that mindset if it’s executed smoothly.

- User-friendly booking page: Provide a clear, streamlined web or mobile interface explaining the cost, deposit rules, and any extras. Confusion leads to cart abandonment.

- Automated confirmations: Once diners pay, they should receive an email or text detailing what to expect. Reassure them about how to adjust or cancel if needed.

- Integration with existing systems: Whether you rely on a card reader or a contactless platform like sunday, ensure everything syncs seamlessly. No one wants double-entry or contradictory receipts.

Too many steps or hidden fees could send potential customers scurrying away. Keep it intuitive, transparent, and accessible on various devices.

6. Communicating Your Policy Clearly

For guests to accept pre-payment, they need to feel comfortable with the terms. Good communication is everything.

- Website disclaimers: Display a concise “Booking T&Cs” section. Outline how refunds or date changes work. Emphasise any advanced notice requirements for cancellations.

- Friendly messaging: Phrase things in an inviting tone—“Secure your booking with a simple pre-payment!”—rather than a stern demand for money upfront.

- Staff training: If someone calls to inquire, your team should calmly walk them through the process, reiterating the benefits (like guaranteed availability) rather than focusing on the “must pay” aspect.

Through honest, open communication, you build trust. Diners see that you’re not trying to trap them or cause unnecessary hassle—you’re simply building a more reliable system.

7. Tracking Results and Adjusting

Once you introduce pre-payment—whether for a certain booking type or day—keep an eye on the data. Are cancellations truly decreasing? Have booking numbers shifted? Did your average spend per head climb because people booked set menus in advance?

- Monitor no-shows: Record how often someone fails to turn up, then compare it to the period before you introduced pre-payment. This indicates if your approach is working.

- Check feedback: Solicit short post-visit surveys or track online reviews. Are customers praising the convenience, or are they hesitant about paying before arrival?

- Be open to tweaks: Maybe a 48-hour cancellation window is too long, or you need a gentler deposit policy for weekdays. Fine-tuning helps maintain a balance between your financial security and customer happiness.

Success can come gradually. Over time, you’ll discover the sweet spot where the system runs smoothly, diners feel comfortable, and your revenue reaps the benefits.

The Bottom Line: Is Pre-Payment Right for You?

Pre-payment can be a shrewd move, reducing no-shows, stabilising cash flow, and elevating the dining experience by eliminating awkward check settlements. However, it’s not a foolproof recipe. Setting rigid payment terms could alienate spontaneous eaters or casual lunchers. And if refunds become messy, you risk damaging your reputation.

The trick lies in tailoring pre-payment to your specific brand, clientele, and operational style. Some restaurants opt for partial deposits, others for full pre-payment, while certain venues only require it for special events. No matter the model, clarity and communication are vital: you want diners to see the benefits rather than chafing at constraints.

Ultimately, a thoughtful approach—supported by reliable tech solutions such as sunday for swift digital payments—can transform pre-payment from a controversial idea into a strategic boon. You reduce financial surprises, plan better for each shift, and offer a modern experience that many guests have come to expect. If done well, pre-payment can prove to be a cornerstone in your restaurant’s growth strategy, especially in a rapidly evolving market where certainty is a precious commodity.

Find out more today

Drop us your details below and we’ll reach out within the next 24

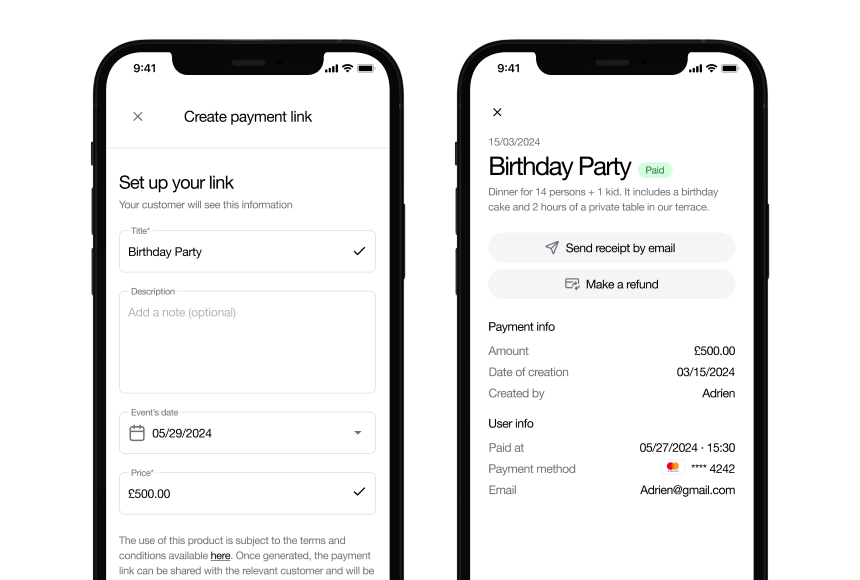

Get paid in advance in a couple of clicks.

Make groups prepay with a simple payment link and cut down on admin work.