Ensuring a Smooth Payment Flow for UK Restaurants This Holiday Season

The festive season can be a hectic time for restaurants across the UK, bringing a surge in footfall and a flurry of payments. To keep queues moving and diners happy, it’s crucial to streamline every step of the restaurant payment process. By optimising your card machine setup and harnessing digital options like QR codes and app-based solutions, you can provide quick checkouts, collect tips seamlessly, and even encourage more online reviews. Clear staff management, proactive customer communication, and reliable technology will further protect your total revenue during the holiday rush. Adopting these practical strategies can help convert holiday visitors into loyal customers all year round.

1. The Festive Rush: A Real Culinary Marathon

For UK restaurants, the holiday period is more than just another busy season—it’s a culinary marathon. From the first Christmas bookings in mid-November to late-night New Year’s celebrations, you’re managing higher table turnover, a steady flow of Christmas parties, and customers with high expectations for speed and service. It’s both thrilling and challenging.

According to OpenTable, restaurant reservations in December often jump by double digits compared to other months. Many eateries see up to a quarter of their annual income generated over this roughly six-week window. This makes an efficient payment process essential. Even minor bottlenecks—queues for card machines, confusion about how to split bills, or difficulty adding a tip—can lead to frustrated patrons, and your staff likely doesn’t need extra stress amidst all the tinsel and crackers.

When a large group celebrates the office party, or families catch up for a cosy meal, no one wants to be stuck waving a debit card at a server or waiting endlessly for the final payment process. The faster and smoother it is, the quicker they can leave happy—and the more tables you can turn, generating greater revenue. In many ways, a swift, stress-free close to their dining experience is your final chance to make a great impression.

2. Why Payments Matter in the Holiday Hustle

One might ask: “Since the restaurant is already busy, isn’t a small efficiency gain in payments marginal?” The answer is a resounding no. When your premises are packed, every minute spent slaving over a slow card machine or searching for the right receipt is a minute you can’t put toward the next customers—those extra diners who turn your festive season from good to great.

During the holiday hustle, effective payments deliver:

- Faster Table Turnover: Guests appreciate not having to wait for the bill. It frees up space and allows you to accommodate more parties in a single evening.

- Higher Spending Potential: Patrons who aren’t anxious about lengthy wait times are more open to dessert orders, second rounds, or a celebratory bottle of fizz.

- Better Tips: A seamless checkout typically translates into happier customers, which often leads to more generous gratuities for your staff.

- Improved Reputation: A chaotic payment experience can overshadow an otherwise lovely family lunch. A breezy process leaves diners with a positive final impression, which encourages repeat visits and recommendations.

With a robust and flexible payment system, your team has the energy to focus on delivering holiday cheer, instead of wrestling with malfunctioning technology or complicated splits. This reliability becomes even more vital when you consider the pressure staff are under during the festive peak.

3. Upgrading Payment Methods: From Card Machines to QR Codes

Gone are the days when you had to rely on the slow beep of an old-school card machine. Today, restaurants have an array of payment tools that cater to modern diner expectations. While you should never completely ditch your traditional card machine (as some patrons still prefer chip and PIN or contactless), a multifaceted approach ensures swifter service.

The most significant development? QR code payments. With a quick smartphone scan, customers can view their bill in real time, calculate their share if it’s a group outing, decide on a tip, and pay instantly online. No more passing a machine around the table or rummaging around for loose change. Plus, offering QR code solutions can help you capture more feedback or Google reviews on the spot, thanks to easy integrated links. Solutions such as sunday enable this kind of slick experience, letting customers settle their accounts in seconds and even drop a review that helps your business attract future diners.

Outside of digital payments, some restaurants also explore mobile wallets (Apple Pay, Google Pay, etc.). These allow customers to tap their phone on a modern card reader or pay online. Especially during a busy holiday service, mobile wallets and digital payment tools can be lifesavers if your restaurant’s Wi-Fi connection is stable.

3.1 Practical Advantages of Leading-Edge Payment Options

New payment technologies can transform your entire front-of-house experience. In a scenario where you have multiple holiday parties seated throughout your dining room, staff can hop between tables with ease, verifying bills through a device without having to leave guests waiting while the card machine “goes on tour.”

It’s not just about speed, either. Digital solutions reduce human error because the bill is accurately displayed, split options are automated, and staff aren’t crunching numbers on the fly. They also offer reassurance for guests expecting a frictionless dining experience, especially the younger crowd who shy away from carry-around cash or archaic bank processes.

4. Streamlining Your Payment Workflow

Setting up a robust payment workflow is akin to designing a well-executed menu. There should be clarity, consistency, and easy navigation for both staff and diners. But how do we achieve that more concretely?

- Choose the Right Hardware and Software: Use fast, reliable card machines with contactless capability. For QR code or mobile payments, ensure your internet connection is stable and invest in user-friendly interfaces that diners can understand instantly.

- Train Your Staff Thoroughly: If your team isn’t confident with the tech, your patrons won’t be either. Offer short but focused training sessions where they can try out test transactions, see how tips are added, and learn how to guide customers who might be new to the experience.

- Provide Clear Signage and Guidance: Place discreet but visible notices at each table or near the point of sale indicating payment options. Demonstrate how to scan a QR code or let diners know they can pay via their phone if they prefer. The more confidence diners feel, the quicker they’ll settle up.

- Optimise Your Digital Menus (If Used): If you combine digital menus with digital payments, ensure the interface is intuitive. Diners may want to review the bill, see allergy information, or add last-minute items before paying—make that simple.

- Test and Troubleshoot: Pre-festive-season, try out your payment flow during a less busy day. Iron out any kinks to avoid last-minute tech headaches when the Christmas crowd is at your doorstep.

By nailing each of these areas, you’ll cut down on confusion and keep those payments moving fast. Think of it like plating a meal: if everything is prepared in the right order with the right sequence, the final presentation is simple yet impressive.

5. Handling a Sudden Payment Surge

When large groups settle up at once—particularly around peak times near Christmas or New Year’s Eve—your front-of-house might face a payment traffic jam. Let’s paint a picture: it’s 9 pm on a Friday in December, three tables ask for their bills simultaneously, and each group wants to split the bill differently. This scenario can spiral into chaos if you’re not prepared.

Here’s how to keep calm when the pressure piles on:

- Designate a Payment Specialist: In your staff lineup, designate one or two individuals who are especially efficient with the payment process. They can hustle from one table to the next, systematically clearing payments.

- Encourage Self-Service for Large Groups: A QR code-based payment option, such as one offered by sunday, allows customers to handle the split themselves. They can each pay their share without the server having to do complicated mental gymnastics.

- Stagger Bill Requests: Politely ask one group to wait a moment while you finalise the next. Let them know you’ll be ready for them in just a minute, and then move swiftly—your transparency keeps them patient.

- Anticipate Group Splits: If you suspect a large group will request multiple payment methods, pre-empt that conversation. Ask them early in the evening if they plan to split. By the time dessert is finished, you’ll have a system in place, whether a separate tab or a link to a group payment portal.

The holiday season is short, but each minute can make a huge difference to your profits. Planning for the worst-case scenario means you’ll be ready to handle anything the festive rush throws at you—and your staff will thank you for it.

6. Ensuring Customer Comfort: Communication and Transparency

Even the best systems fall flat if customers aren’t sure how to use them. From the moment diners sit down, provide gentle clarity on how to settle their tab. Think of it like explaining the specials menu—but for payments.

In busy settings, diners appreciate having control. If they see a QR code on the table, they’ll know they can pay whenever they’re ready. If they want a server to bring a physical card machine, they only need to ask. The empowerment of choice can lead to smoother turnarounds and more smiles.

To maintain a sense of trust:

- Show Genuine Empathy: Acknowledge that it’s a hectic period and you want to make things as straightforward as possible. Encouraging staff to respond with a warm, helpful tone fosters a positive atmosphere that rubs off on customers.

- Explain Invisible Steps: If the digital process takes a few extra seconds while the system updates, let guests know. Silence and a spinning wheel can make people uneasy. A simple “It’s just retrieving the final total now” can do wonders for peace of mind.

- Offer Choice: Remember that some older customers or those less tech-savvy might prefer a traditional card machine. Offer it with a smile, but let them know a contactless or QR-based transaction might be faster if they wish to avoid waiting.

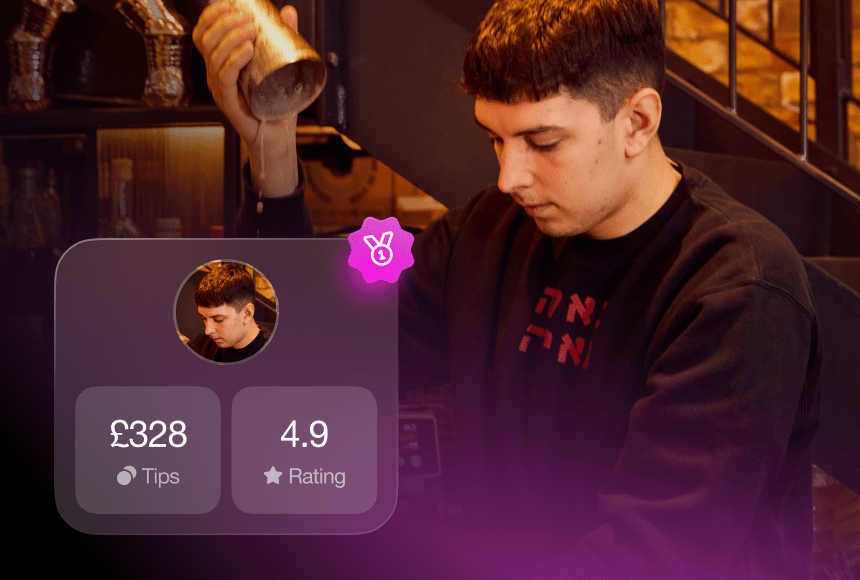

7. Don’t Forget Tipping and Feedback

The holiday season often puts people in a giving mood. When you make tipping easy, you reward your staff with extra income. Digital payment solutions that allow diners to add a tip in just one click can significantly increase gratuities—nobody has to rustle up the right coins or do mental maths for percentage tipping.

Additionally, consider capturing immediate reviews or feedback as part of the payment journey. For instance, through solutions like sunday, a quick prompt can appear after the payment is confirmed: “Care to leave a quick Google review?” Satisfied diners who had an excellent experience may be more willing to rave about their meal at that moment than hours or days later. A small nudge can help build your online reputation, which is especially powerful if you’re hoping to capitalise on post-festive interest in the new year.

Just be mindful to keep it polite and optional. People don’t want to feel forced to tip or review. A gentle prompt goes a long way.

8. Managing Staff Morale and Efficiency

Behind every brilliant payment system is a well-organised team. During the holiday rush, servers, bartenders, and kitchen staff endure long hours and countless interactions. Fatigue can easily set in, leading to mistakes and slower turnarounds.

To keep spirits high:

- Offer Micro-Breaks: Let your staff grab a quick cup of tea or a glass of water when they need it. Short breaks can prevent burnout during a hectic shift.

- Provide Incentives: Consider a small contest or reward for the server who handles the most positive feedback in a week or the fastest, error-free payment transactions. Keeping it lighthearted can motivate the team to embrace the new system.

- Rotate Roles: If possible, rotate staff members between different tasks—serving drinks, taking orders, settling bills—to help maintain engagement and reduce monotony. However, ensure the staff are cross-trained sufficiently before peak season.

- Hold Pre-Shift Briefings: Update everyone on possible large bookings that day, any menu changes, and whether the restaurant is expecting a surge at a particular time. Communication prevents surprises that slow things down.

When staff feel confident and looked after, they exude positivity. Customers pick up on that energy, which can turn a busy night into a truly festive experience for everyone involved.

9. Example Table: Traditional vs. QR Code Payment Flow

Using a quick comparison can illustrate how a line of diners might move through payment processes in different setups. Notice how the modern approach saves precious minutes and reduces friction.

| Stage | Traditional Card Payment | QR Code-Based Payment |

|---|---|---|

| Bill Request | Customer signals server, who prints the bill and brings it to the table. | Customer scans the code on the table whenever ready; bill displays automatically on their phone. |

| Bill Checking | Group clarifies shared items, tries to figure out each share. Staff calculates any group splits. | Each diner can view an itemised total, splitting or paying for individual items with no staff intervention needed. |

| Payment Execution | Server returns with a card machine. Each person taps or inserts card, one by one. Or staff might have to manually input amounts for group splits. | Each person completes payment on their phone, adding a tip digitally if desired. No server wait time. |

| Review and Tip | Server verbally asks if patrons want to tip. Putting in the tip might involve more button presses on the machine, or someone rummaging for cash. | A single tap integrates the tip automatically. Optional Google Reviews can also be prompted at this stage. |

| Total Time | Often 5–10 minutes for a large group with multiple splits. | 2–5 minutes at most, or even less if everyone pays immediately. |

This table demonstrates how a modern payment approach can free staff and reduce wait times, especially critical during the festive season.

10. Implementation Steps for a Smooth Holiday Payment Flow

To help you plan, here’s a brief blueprint any UK restaurant can adapt:

- Review Your Existing Setup: Examine your current card machine performance, contactless capabilities, and potential Wi-Fi issues. Note any recurring complaints or bottlenecks.

- Explore Digital Payment Tools: Investigate QR code solutions, as well as compatibility with mobile wallets. Identify reputable providers known for user-friendly interfaces.

- Set Clear Payment Policies: Decide how you want to handle large group splits, tipping, and refunds. Put these policies in writing for staff reference when the restaurant is at capacity.

- Run Team Training Sessions: Devote time to practical walkthroughs with your staff—test the new payment methods, simulate group payment scenarios, and practise dealing with confusion or errors.

- Update Your Menus and Table Signage: Include prompts about your new payment methods. Position the QR code in a visible but tasteful spot, and print instructions for menu “flyers” if needed.

- Conduct a Trial Phase Before Peak Season: If possible, run a soft launch of your new payment flow a few weeks before the busiest nights. Gather feedback, tweak the process, and fix any technical glitches.

- Maintain a Support System: Ensure you have quick access to technical assistance from your payment provider, especially on weekends and likely peak days (e.g., the last Friday before Christmas, colloquially known as “Mad Friday”).

- Promote Your Upgrades: Mention on social media or in your booking confirmations that you’ve updated your payment process for a faster check-out. This can help set expectations and spark curiosity among your customers.

A structured rollout reduces headaches, meaning your team can focus on delivering memorable meals instead of trouble-shooting the technology behind the scenes. And by the time the holiday parties start pouring through the door, you’ll be well-prepared to delight them from starter to settlement.

11. Looking Ahead: Turning First-Time Diners into Regulars

The holiday season doesn’t just provide a short-term revenue boost; it’s also a golden opportunity to make a lasting impression. Many diners who visit during December might be coming in for the first time, and a seamless payment experience could tip the scales in your favour for repeat visits. After all, no one wants to revisit an establishment that felt disorganised just when everyone else was celebrating.

By streamlining payments, capturing feedback, and ensuring your staff remain energetic, you lay strong foundations for 2024. People often return to the spots where their family had a joyful Christmas Eve meal or an unforgettable set lunch in December. If that joyous memory includes an easy bill-splitting experience and zero frustration, they’ll be more likely to come back in January, February, and beyond.

Holiday diners who pay quickly and tip generously might even recommend your venue to friends who are planning business lunches or social events. Word of mouth remains one of the most potent forms of marketing, and positive final impressions can spread like the aroma of roasting chestnuts. So think beyond the immediate sales figures to the ongoing relationships you’re nurturing with every transaction.

Frequently Asked Questions (FAQ)

1. What if my restaurant’s Wi-Fi connection is unreliable?

If your network tends to drop, invest in a dedicated, secure connection for your payment system. Wired connections to your card machine remain a fallback, and keep a backup plan of offline payment authorisation if your provider offers it. Checking with local telecom services for upgrades or boosters can also offer a fairly quick fix.

2. Are customers hesitant to pay via QR codes?

In the UK, QR codes became more prevalent during the COVID-19 pandemic for menus and payments, so most people are now comfortable with them. As long as instructions are clear (or the interface is straightforward), you’ll likely see minimal resistance. Offer an alternative for those who prefer a physical card machine, but highlight the convenience of digital payment for quick departure.

3. How can I encourage customers to leave tips without coming across as pushy?

Keep the tone friendly and optional. Digital platforms typically present a tipping prompt with set percentages or a custom “Other” field. A brief note like “Feel free to leave a tip if you enjoyed your experience” is enough. Many diners appreciate the suggestion but do not like to feel pressured. Allow an easy opt-out.

4. Which times in December are usually busiest for payments?

Office parties often peak on Thursdays and Fridays in early to mid-December. The final weekend before Christmas can also be chaotic as families get together. Lunch services on weekdays can surge when businesses treat staff to festive meals, and New Year’s Eve is of course another intense day. Having a strong plan for these crunch times can make a world of difference.

5. Should I set up a separate payment area in my restaurant?

A separate payment desk can help in certain high-volume venues, but for most small to medium restaurants, it can be more efficient to equip your staff with portable devices or rely on QR codes at tables. This way, diners aren’t obliged to queue elsewhere, and you reduce overall foot traffic around the premises.

Ultimately, if you prepare diligently and invest in the right tools, your restaurant can breeze through the festive rush. Prioritising a frictionless payment flow is a thoughtful gift to both your customers and your hardworking team—a present that keeps on giving well into the new year.

Find out more today

Drop us your details below and we’ll reach out within the next 24

Get the full, detailed picture.

sunday elevates your business with insightful data, instant feedback and precise analytics.