Cashless Checkouts Are Becoming the Norm: Is Your Restaurant Ready?

Changing Habits: Why Diners Embrace Digital Bills

Restaurant owners often describe a bustling dinner service like an intricate choreography—servers weaving between tables, the kitchen synchronising orders, and guests enjoying the buzz. Now imagine adding an extra step: collecting a piece of paper, waiting for a guest to rummage in their wallet, returning to pick up slips and loose coins. That moment of waiting can slow the dance. In the UK’s fast-emerging, post-pandemic dining landscape, guests no longer expect—or often even want—physical receipts or rummaging for cash. They want immediate digital solutions.

Since 2020, more and more restaurants in Britain have seamlessly integrated digital payment methods. QR codes on tables, digital bills sent to customers’ smartphones, and contactless card machines have replaced traditional bills and cash payments in many venues. According to a Payment Markets 2022 report, the use of contactless payments soared in the UK, with a significant portion of all in-person card transactions now happening via tap-and-go methods. Diners who have grown accustomed to frictionless experiences everywhere from retail to transport expect the same convenience in restaurants.

The term “digital bills” goes far beyond just sending the total to a tablet screen; it’s a holistic move towards a cashless ecosystem. Restaurants of all shapes and sizes—from local cafés to fine dining establishments—are shifting to QR code payments that go straight to a guest’s phone. And the rationale is simple: digital bills offer speed, efficiency, accurate record-keeping, and a reduced margin of error. But they also do something arguably more crucial: they deliver a superior guest experience. Let’s explore why cashless checkouts have made the leap from a nice extra to an outright expectation.

Speed Meets Satisfaction: How Digital Payment Improves Service

Picture the final moments of a meal. Your guests have just enjoyed a sumptuous dinner. As a restaurant owner, you want their last impression to be as positive as the first. When people are ready to pay, the clock starts ticking. The longer they wait for the bill, the more frustration can creep in. The faster you handle this final interaction, the better your chances of delivering a memorable experience—one that translates into positive online reviews and repeat visits.

Digital bills come to the rescue here. Instead of flagging down a server or waiting for a payment terminal to arrive, guests scan a QR code or receive a link directly at the table. They check their total, tip if they choose, pay in a few taps, and off they go. This can shave precious minutes off the average table turnover time, which in turn boosts your bottom line. According to some industry estimates, speeding up a payment transaction can reduce the overall table time by up to 10–15%. It might not sound huge, but cumulatively, that’s a significant difference—particularly on busy nights.

Moreover, digital payments reduce the chance of inaccuracies. Cash transactions require careful counting, while paper bills can be lost or misplaced. By automating the process, the margin for error shrinks. This reliability leaves your guests with a sense of confidence and saves you from reconciling mistakes after closing time.

Confidence, Cleanliness, and Convenience

Beyond speed, there are other benefits that have ramped up restaurant owners’ interest in cashless checkouts. Since 2020, concerns about hygiene and contact have grown among patrons. Handling physical money, exchanging receipts, and carrying banknotes in pockets can feel outdated and, to some guests, even unsanitary. Restaurant-goers prefer the convenience of contactless menus, contactless payments, and minimal physical exchange.

A quick scan of data from the last three years shows a clear upward trend in digital adoption. Even diners who were once hesitant about scanning QR codes for payments often find themselves impressed by how seamless the process can be. And that convenience factor matters. An intuitive digital bill interface is not only quicker; it also allows for immediate actions:

- Quickly adding a tip (guests can choose a preset or custom amount)

- Splitting bills (easily dividing the total for groups)

- Leaving a quick review (some systems link directly to online review platforms)

- Redeeming loyalty points (integration with loyalty apps or programs)

This all-in-one approach increases guest satisfaction and keeps them engaged with your brand even after they’ve left the table. A diner might say, “Checking out was so simple; I wish every restaurant used this.” And in many corners of the UK, that wish has quickly become reality.

Harnessing Automation: Reducing Errors and Saving Time

Let’s face it: busy shifts are a whirlwind, and mistakes happen. Handwritten orders can be misread, the bill might be calculated incorrectly, or a server might accidentally forget to add that final drink. Digital systems eliminate these pitfalls. Integrated solutions can automatically track every dish and drink that leaves your kitchen or bar. The result? Fewer manual tasks and a significant drop in errors.

This not only boosts accuracy but also saves your staff time—time they can use to engage with guests or take care of core duties. By streamlining the checkout process, you free your personnel to do what they do best: offer hospitality. Eager to upsell a dessert or highlight a daily special? That’s much easier to do when you’re not juggling paper bills and searching for pens.

Creating a Cohesive Brand Experience To Stand Out

In an industry where competition is fierce, restaurants need innovative ways to stand out. Adopting a digital, cashless checkout can elevate your brand image. Picture your establishment as modern, forward-thinking, and conscious of guest preferences. When you integrate a QR code system or an easy digital payment flow, you’re telling your audience: “We value your time, your safety, and your comfort.”

Brand consistency matters, too. If you have a specific aesthetic, your digital billing interface can mirror those brand elements. That might mean using the same colours, fonts, or design that runs throughout your restaurant’s social media and printed materials. Suddenly, paying the bill becomes an extension of your restaurant’s vibe, instead of a disjointed, paper-based afterthought.

Moreover, a digital system can prompt diners to leave feedback or reviews on the spot. Since everything is integrated, it’s far easier for a guest who had a wonderful meal to share a glowing review online. If you work with a tool like sunday’s payment solution, you can customise the feedback process, so the moment they pay, your diners are gently nudged to leave a star rating or a written impression. These positive reviews can do wonders for your search presence and overall reputation.

Practicality for Groups: Making Splitting Bills Effortless

Everyone’s been there: a large table of friends or colleagues, finishing a meal, and then struggling to figure out who owes what. “I only had a starter and a soft drink,” someone points out. Another says, “I’m covering the wine, but not the steak.” Sorting out dozens of line items across multiple paper receipts is tedious. And for the restaurant, that’s time your staff could be spending on better tasks.

With a digital solution, splitting the bill suddenly becomes easy. Some apps allow guests to select the items they ordered, tally up their total, and pay individually. No wait times, no confusion. This level of convenience is especially appealing for business lunches or group celebrations, where people prefer to pay their share independently. By catering to this scenario, you earn major goodwill—and potentially spark more group reservations because the “bill drama” is eliminated.

Incorporating Tipping Features That Benefit Staff

Tips are crucial for your front-of-house team. Yet, traditional tipping methods often require small notes or coins. Even card machines sometimes place the tip option in an awkward place, making it easy for diners to skip. A streamlined digital platform can encourage guests to tip generously—especially if they had a notably good experience. When you give them an easy “Add Tip” button with a choice of percentages or a custom entry, you reduce any friction.

Digital bills can also provide transparency. If your staff relies on pooled tips, the system can record each transaction and distribute gratuities automatically. Everyone sees how much was tipped, and funds can be allocated fairly. This fosters trust, bolsters staff morale, and ensures that the employees who deliver outstanding service feel rewarded.

Leveraging Participant Data (Ethically) for Personalised Service

The digital age excels at collecting data—but the best restaurant owners use it responsibly. When customers pay with a digital bill, you gain insights that can help shape your offerings. You might discover that a high percentage of guests always skip dessert or that a particular cocktail sells better on weekends. By tracking these trends, you can tailor your menu or even your staffing.

Certain digital billing systems allow you to store guest preferences, like dietary restrictions or favourite drinks. So, if a customer who loves your vegan dishes returns, a server can proactively offer recommendations without making them sift through the entire menu. This kind of personalised attention can turn one-time visitors into loyal regulars. Just ensure you comply with data protection regulations in the UK and remain transparent about any information collected.

Keeping Up with a Tech-Savvy Customer Base

In today’s world, most people carry smartphones everywhere. They expect to do practically everything with a few taps—from booking a table online to posting photos of their meals on social media. By extending this digital-savvy experience to payment, you’re aligning with the lifestyle of the modern diner. The convenience factor is huge: they don’t need to sign receipts or rummage for the right card. Instead, the process is streamlined from start to finish.

Additionally, offering a digital checkout can speak volumes to the younger demographic (Gen Z and millennials). These groups tend to gravitate towards businesses that embrace technology. And while you certainly don’t want to alienate older customers who may prefer cash, providing a flexible range of payment options ensures you capture everyone.

Spotlight on Efficiency: A Real-World Example

Let’s say you run a small but busy bistro in Manchester. During lunchtime, you typically get a rush from office workers on a tight schedule. Before switching to digital bills, you noticed that many guests would ask for the bill, wait several minutes, then pay, and leave. On average, the entire payment process took at least eight to ten minutes from the request for the bill to collecting the payment terminal, finalising the transaction, and returning change or receipts.

After integrating a QR code payment system, you track an immediate shift. Bills are settled in as little as two to three minutes, often even faster if guests are keen to get back to work. Your table turnover improves, and you can seat more diners during peak hours. Some customers express how refreshing it is to avoid the hassle of waiting around. This approach leads to more efficient midday service, translating into greater revenue and happier guests.

Addressing Potential Concerns About Going Cashless

Despite the many advantages, a few diners still prefer paying in cash—or they might worry about security. As a restaurant owner, you can reassure them by offering multiple methods (some digital, some traditional). While you might intend to phase out cash entirely, a transitional period can help you assess how ready your customer base is for an all-digital approach.

Security is another question. Card fraud and data hacks can happen in any industry. The key is to make sure your payment provider or platform invests heavily in encryption, secure servers, and compliance with Payment Card Industry Data Security Standards (PCI DSS). By mentioning the security measures in a subtle but clear way, you show that you take data protection seriously. This transparency will help build customer trust.

The Role of Technology in Shaping Future Dining Experiences

As the UK hospitality industry continues to evolve, technology stands at the forefront of change. Cash was once considered the “universal” form of payment, but contactless cards and smartphones have redefined what customers view as normal. Within a few years, guests might expect even more from digital billing. Perhaps they’ll want personalisation features, unique loyalty rewards, or one-click ordering that automatically calculates the correct table and preferred tip percentage.

All these advancements point to a broader shift: the restaurant of the future is likely to integrate multiple touchpoints—online booking, digital menu browsing, real-time order tracking, and, of course, a swift digital checkout. Embracing these solutions sends a clear message: you respect your customers’ time.

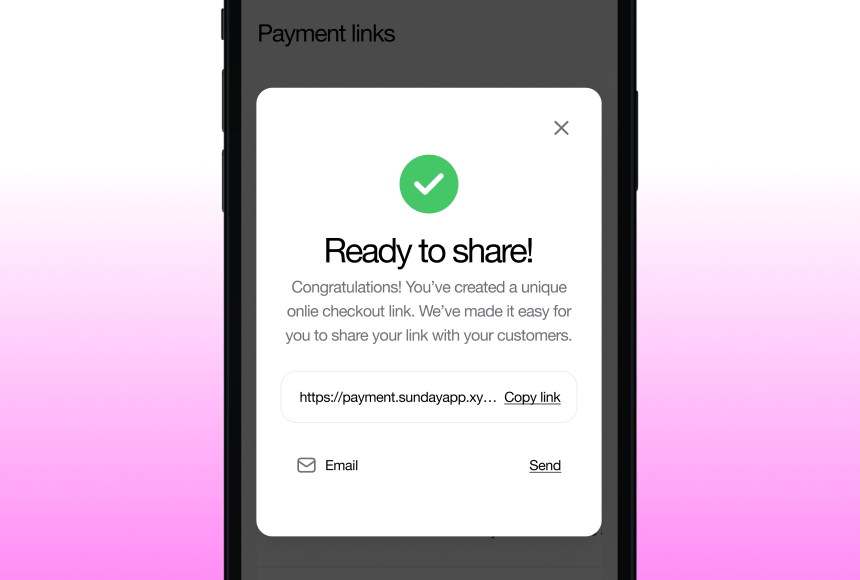

A Peek Into sunday’s Payment Solution

Let’s talk specifically about how an approach like sunday fits in. sunday’s solution allows restaurant owners to place QR codes directly on tables, letting customers open their bill instantly, split costs, tip, pay, and even post Google reviews in the space of seconds. When you go with a modern, streamlined platform, you remove friction throughout the entire dining journey. There’s no need for complicated set-up or staff training—just a straightforward interface that benefits both diners and management.

On the operational side, you can observe real-time analytics. If six tables have run up totals, you can see exactly who has paid, who has asked for the bill, and who still needs to settle. It keeps everything transparent and traceable, giving you a clear overview at a glance. For your guests, it’s like having a personal payment station that doesn’t require them to wait for anything. They can walk away the moment they tap “Pay.”

Cost Savings and Return on Investment

One of the biggest weights on a restaurant’s balance sheet is time-consuming processes. Paper printing, manual bill amendments, or re-conciling multiple tills can all chip away at profits. By incorporating a digital approach, you remove many of these pain points. The fewer bottlenecks, the more sales you can make in a given timeframe.

Another factor is staff allocation. If your team saves ten minutes for each table that’s ready to pay, that extra time can be invested in interacting with the guests, encouraging add-ons like coffee or dessert, or preparing for the next seating. Over a month or a year, that efficiency adds up.

Of course, digital platforms do carry some setup and transaction fees. But many find that the improved turnover, happier customers, and lower operational overhead more than pay for those costs. The key is choosing a payment provider (like sunday) that’s transparent about fees, offers good support, and keeps the user interface smooth and intuitive.

Eco-Friendly Credentials: Less Paper, More Trees

If your restaurant prints hundreds of paper bills daily, that’s a lot of wasted resources—paper, ink, energy. A shift to digital receipts aligns with current environmental priorities. Especially in the UK, consumers increasingly appreciate sustainable practices. By taking a planet-friendly approach, you stand out as a business that tries to reduce waste whenever possible. You might even incorporate a small note in your digital checkout, mentioning how many paper slips you save per month by using QR code payments. Little gestures like these foster goodwill among eco-conscious diners.

Training Your Staff for a Cashless Future

Even with the best technology, adopting a cashless system won’t magically work without proper training. Your servers, hosts, and kitchen staff need to be comfortable with the new process. Feel free to arrange a short session to show them how to troubleshoot common issues—like what happens if a guest’s phone battery dies or how to handle partial payments.

It’s also essential to empower them with talking points. Some guests might hesitate when they see the QR code. Train your team to say, “It’s really simple! Just point your smartphone’s camera at the code, and a link will pop up with your entire bill. You can pay securely right there!” They should emphasise the convenience, safety, and speed of the cashless method. When your staff exudes confidence, customers are more likely to adopt the new system smoothly.

Looking Ahead: Are You Ready to Embrace the New Age of Dining?

The dining world is evolving. From multi-course gourmet feasts to quick-service breakfast spots, guests expect a cohesive, frictionless experience—especially during checkout. If you remain attached to outdated processes, you risk frustrating your diners or appearing behind the times. Shifting to digital bills can energise your restaurant, streamline your operations, and elevate your brand image. At the same time, you serve your core mission: delighting customers and making their experience as pleasant as possible.

So, is it the right time to integrate a cashless checkout solution into your establishment? If you’re eager to speed up table turnover, reduce mistakes, collect meaningful data, and stay on top of evolving guest expectations, the answer may be a resounding yes. Technology has already changed the game—it’s up to you to decide whether you want your restaurant to be a player or just remain on the sidelines.

Frequently Asked Questions (FAQ)

Do I have to eliminate cash payments altogether?

Not necessarily. Many restaurants offer both cash and digital payment methods. Gradually, you might notice that more guests gravitate toward the faster digital option. You can partially phase out cash or keep it as a backup—it’s entirely up to you.

Is it complicated to train staff on a QR code payment system?

In most cases, no. If the system is well designed, staff training should be straightforward. Providers like sunday offer intuitive solutions that require minimal onboarding. Short practice sessions help staff feel confident in guiding diners through the process.

What if my customers are hesitant about security?

Explain the encryption methods and compliance standards to reassure them. Highlight that many digital payment solutions incorporate advanced security features, often more robust than the practices for handling cash. Emphasising transparency about data protection can go a long way.

Can customers still leave a tip using a digital bill?

Absolutely. Modern digital solutions typically include a “tip” section, letting diners pick a preset percentage or enter their own amount. This seamless integration helps maintain or even increase tipping levels, benefiting your staff.

Does a digital solution work for large groups?

Yes. Digital systems can easily split bills among multiple diners, even if they’ve ordered a mix of shared dishes. Each person can view the items they’re responsible for, pay their share, and leave the rest of the group uninterrupted. It’s much simpler than passing physical receipts around the table.

Find out more today

Drop us your details below and we’ll reach out within the next 24

Get paid in advance in a couple of clicks.

Make groups prepay with a simple payment link and cut down on admin work.