Weighing the Options: How a Modern Payment Terminal Can Transform Your Service

Why the Right Payment Terminal Matters

Restaurants live or die by how smoothly they cater to their diners’ needs. You’ve likely poured hours into perfecting your menu, training your team, and creating the perfect atmosphere. But consider the final stage of the dining experience: settling the bill. If you’re still relying on a traditional payment terminal without real-time connectivity, you might be missing out on improved efficiency, higher tips, and valuable customer insights.

In the UK, card and contactless transactions continue to surge, with UK Finance reporting steady year-on-year growth in digital payments. This shift isn’t just about convenience; it’s about aligning with what guests now expect. The question is, how do you choose between a standard, standalone card machine and a connected, all-in-one terminal that syncs with your wider operations? Let’s compare the two, focusing on what each really brings to the table—especially if you’re aiming to streamline your restaurant’s front-of-house experience.

Defining the Traditional Payment Terminal

A traditional payment terminal is essentially a basic card reader that handles credit or debit transactions. It may support contactless functionality, but it lacks deep integration with your point-of-sale (POS) system. Often, it also can’t automatically handle multiple tasks like calculating split bills or updating inventory counts in real time.

These older machines tend to be functional and robust. Many restaurant owners consider them tried-and-true. They’re not overly complicated: you or your staff just punch in an amount, present the device to the customer, and wait for authorisation. But the gap between these terminals and a restaurant’s other systems often creates inefficiencies, particularly during peak service times.

What “Connected” Really Means

On the other hand, a connected payment terminal is designed to sync seamlessly with your existing setup, whether that’s a standard POS system or a fully cloud-based platform. This integration means when a server inputs an order, the total can be immediately accessed by the payment terminal—no manual re-entry, no guesswork. Payment data flows back into your sales and accounting software automatically, reducing errors and streamlining end-of-day reconciliation.

Some connected terminals also allow for additional features, like real-time tipping prompts, digital receipts, or quick upsells. You might even link them to loyalty programs or marketing tools. Essentially, the device does more than process payments—it becomes an extension of your broader business strategy.

Speed and Efficiency: Why It Matters at Peak Times

Imagine your restaurant at 8 PM on a bustling Saturday night. The dining room is packed. Servers rush from table to table. If you rely on a traditional payment terminal, staff often have to input each amount manually, wait for authorisation, then cross-check the total with what’s listed in the POS. If there’s a mismatch or a diner wants to split the bill in multiple ways, confusion sets in. Multiply that by 20 tables, and you have a recipe for chaos.

A connected payment terminal speeds this up dramatically. With integrated ordering and billing, the exact total automatically appears on the machine. Split payments become a matter of pressing a few buttons, and tip prompts are built into the user interface. The check-out phase shrinks from several minutes to just seconds, freeing up staff to see to other guests—or seat new arrivals at that table. When every minute counts, those saved seconds can be a game-changer for table turnover.

Improving the Customer Experience

Think about the final impression you leave with diners. The last thing you want is for them to wait ages for the bill or watch servers fuss with a payment device that seems stuck in the 1990s. A modern, connected payment terminal complements a smooth dining journey, showing that you’re up-to-date and considerate of their time.

A swift, hassle-free payment process is particularly popular with younger diners, who often use contactless or mobile wallets and expect that “tap-and-go” experience. But even older guests appreciate skipping the queue near the counter. If the payment process is integrated with a table-based QR code, as with sunday, customers can settle up on their phone, leave a tip, and even add a Google review in one go. That’s convenience for them—and less foot traffic jam for you.

Accuracy and Fraud Prevention

Human error creeps in whenever staff must juggle multiple systems. A price might be mistyped, or a server might forget to input an item before the payment. With a traditional terminal, there’s often no immediate cross-check between the total due and the actual order data. Any discrepancy might go unnoticed until you run the day’s reports—by which time it’s too late, and you’re left with a shortfall or an awkward discussion with staff.

A connected payment terminal automatically fetches the correct amount from the POS, drastically cutting the risk of discrepancies. This is beneficial not just for revenue integrity, but also for preventing potential fraud. No extra lines can be covertly added to the bill, and no inflated tips can slip by. If your team knows that every transaction is recorded in real time, the potential for internal mistakes or abuse is greatly reduced.

Streamlined Reporting and Insights

You’re likely aware that data analysis is playing an ever-larger role in successful restaurant management. Knowing how many desserts you sold on a Thursday night or tracking the average tip rate can inform your staffing, menu offerings, and special promotions. A connected terminal logs each transaction in real time, feeding data straight into your POS and analytics platforms.

In contrast, a traditional device might store basic transaction info and tip amounts, but it can’t seamlessly merge that data into your broader sales statistics. Instead, you’re forced to reconcile numbers at the end of the day, which is time-consuming and leaves room for error. Real-time metrics allow you to spot trends on the fly and react accordingly—like calling in an extra server if sales are spiking, or offering an impromptu dessert special if you notice certain items are performing well.

Handling Splits and Custom Requests with Ease

The phrase “Can we split the bill?” can fill staff with dread if they’re working with clunky hardware. Dividing items equally or proportionally using a traditional payment device is often a headache, leading to awkward fumbling at the table. This friction can leave a sour note at the end of the meal. However, with a connected setup, you can typically split bills in a snap.

- Seat-level billing: In some advanced systems, each seat gets its own tab that’s automatically tallied. If table three decides to split six ways, it’s already done in the system.

- Simple gratuities: You can also add an extra tip for a single diner without messing up the entire group’s payment. This fosters a positive environment for both diners and servers.

Less confusion at the table often means happier guests, and guess what that means? Better reviews and higher tips, especially if the technology gracefully supports custom requests. It’s a classic example of user-friendly design translating into real-world customer satisfaction.

Long-Term Savings vs Initial Investment

Cost is a legitimate concern. Traditional card machines usually come with lower upfront fees, while connected terminals often require a bigger initial investment or a monthly subscription model. But it’s worth crunching the numbers beyond immediate costs. Faster transactions mean you can serve more covers per shift, and fewer mistakes on the bill reduces losses. Automated reporting and integrated insights free your management team from tedious admin tasks, allowing them to focus on strategy or guest engagement.

Additionally, your staff will likely find working with a connected device less stressful. Reduced friction translates into lower staff turnover, saving you money on training and recruitment. Meanwhile, higher customer satisfaction often drives word-of-mouth marketing—arguably the most effective form of promotion in the restaurant world.

Enhancing Guest Loyalty with Extra Features

Another factor that sets connected terminals apart is the potential for added value. Some devices include built-in loyalty programs, letting customers earn points or receive discounts with each visit. Others can automatically add a link to an online feedback form or encourage diners to follow you on social media.

If you leverage sunday’s solution, for example, you can let diners scan a QR code at the table, pay in seconds, and then leave a public review. This immediate feedback loop helps you spot service successes or slip-ups before they become bigger issues. Plus, every new positive review can help drive footfall—vital in a highly competitive industry.

Keeping Pace with Evolving Payment Preferences

In the last few years, we’ve seen contactless card payments become the norm, with many diners also embracing Apple Pay and Google Pay for convenience. Some restaurant-goers even prefer paying directly from their mobile device without ever touching a card machine. A connected terminal system is more likely to stay up-to-date, offering upgrades or firmware updates that accommodate these evolving trends.

A traditional device might also support contactless, but it isn’t built to adapt as quickly if new payment methods—like digital currencies or emerging mobile wallet platforms—gain mainstream traction. Adopting connected hardware signals to your clientele that you’re forward-looking, ready to meet their evolving payment habits head-on.

Keeping Staff Motivated and Guests Content

A stressed or frustrated server rarely provides top-tier service. By reducing the time they spend wrestling with technology, you allow them more face time with your guests. Small talk, checking on satisfaction, suggesting add-ons—these little touches boost the dining experience and can lead to higher average spends. When staff morale is high, guests pick up on that energy, often resulting in better reviews and a more loyal customer base.

Let’s not forget how tipping factors into motivation. With a traditional terminal, tips can be missed or awkwardly handled if the system doesn’t prompt for them. In a connected environment, the prompt can appear seamlessly, potentially boosting the average tip amount. When your staff see consistent, fair tip distribution, they’re more likely to stay and put their best foot forward every shift.

Making the Transition

Shifting from a classic card machine to a connected payment terminal can seem daunting, especially if your staff are used to the old ways. But the transition doesn’t have to be bumpy.

- Phase it in: Try using the connected terminal in one section of the restaurant first, gather feedback, and iron out any wrinkles before a full rollout.

- Offer staff training: Spend time showing servers how to use the new interface, split bills, and offer tips. If they understand the “why” behind the shift, they’ll be more open to adopting it.

- Promote it to guests: Let your diners know about your new, faster system. Sometimes a small prompt—“Feel free to tap or scan if you’d like to pay at your convenience!”—is all it takes to delight them.

Once everyone is up to speed, you’ll likely wonder how you ever managed without a connected approach.

Bottom Line: Maximising Gains

Between a classic card reader and a connected, modern payment terminal, the difference lies in how deeply the device can integrate into the fabric of your restaurant. The latter doesn’t just accept payments; it communicates with your POS, helps staff handle complex requests, and delivers data that can sharpen your business strategy.

That added speed and flexibility can raise the bar for your entire operation—whether it’s reducing queues, improving table turnover, preventing billing errors, or boosting guest satisfaction. Coupled with a user-friendly solution like sunday, which allows diners to pay via a simple QR code and leave a review on the spot, you’re well on your way to building a streamlined and memorable dining experience.

In an industry where every second and every penny counts, investing in the right payment setup isn’t just about staying in line with modern standards. It’s about positioning your restaurant to thrive—both in the eyes of your guests and your team. Traditional payment terminals might have served you well in the past, but connected options offer a future-proof edge, ensuring you stay ahead in a rapidly changing market.

More Insights on UK Payment Trends

If you want to dig deeper into how consumer preferences are shaping card usage and contactless adoption, you may find the British Retail Consortium website helpful. They regularly publish updates and insights on UK payment trends. Keeping abreast of these shifts will ensure your payment technology continues to resonate with your diners’ evolving expectations.

Ultimately, the decision between a traditional card machine and a connected payment terminal comes down to what you value most—simplicity or scalability, familiarity or innovation. By opting for a connected approach, you stand to gain speed, data, and an enhanced customer journey that sets you apart in a competitive restaurant scene. And that, at the end of the day, is worth raising a glass to.

Find out more today

Drop us your details below and we’ll reach out within the next 24

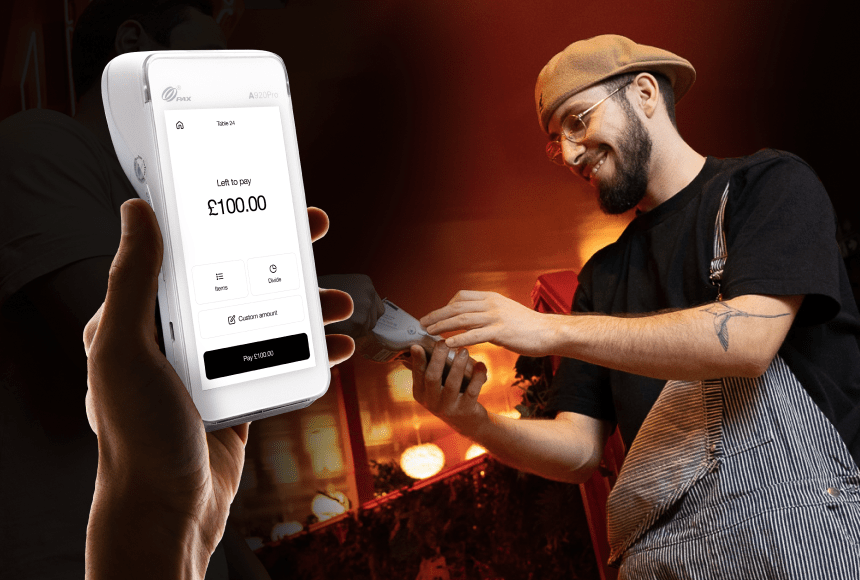

The payment terminal to make your operation simpler.

Connected to your POS, we offer the only payment terminal specifically designed for restaurants.