Ensuring Safe and Smooth Transactions: A Guide for Restaurant Owners

Why Online Pre-Payments Demand Solid Security

Digital transactions are becoming second nature in the hospitality world. Diners routinely order and pay online, often before stepping foot in your restaurant. This shift brings clear benefits—shorter wait times, fewer no-shows, and smoother end-of-meal checkouts. But there’s a flip side: handling online pre-payments also raises the stakes for security. When your guests trust you with their card details, they expect a frictionless and risk-free experience.

According to BigHospitality, the number of people eating out (and pre-paying) continues to surge, making robust payment security a top priority. A single data breach can damage your reputation in an already competitive market. That’s why it’s vital to get things right. This article breaks down the best practices to ensure your pre-payments remain safe—and keep your diners happy.

1. Choose a Trusted Payment Gateway

Any platform that processes credit or debit card details must be watertight. While you might be tempted by a cheap or lesser-known payment gateway, it’s safer to stick with reputable providers that follow stringent industry standards. Most well-established gateways come with built-in compliance features that protect sensitive data, saving you the hassle of rolling out your own encryption methods.

- PCI-DSS compliance: The Payment Card Industry Data Security Standard sets rules on how card information is stored and transferred. Opt for a gateway that’s fully compliant from day one. This ensures you meet basic security protocols without needing to create them from scratch.

- Transparent fees and terms: Hidden charges can erode your profit. A respected gateway typically discloses costs upfront, from transaction fees to currency conversion rates.

- User-friendly interface: Your team shouldn’t need a tech degree to handle refunds or check transactions. The best gateways blend robust security with an intuitive dashboard.

Remember that your diners’ impressions start the moment they hand over card details. Even subtle signals—like a professional checkout page or recognisable payment icons—reassure guests you’re taking their security seriously.

2. Embrace Encryption and Tokenisation

Online pre-payment is all about capturing sensitive data before the diner arrives. But storing full card numbers or CVV codes on your own servers is risky. Instead, encryption and tokenisation provide safer methods.

- Encryption: Ideally, any personal or payment info is encrypted during transmission, usually via SSL or TLS certificates. This ensures data can’t be easily intercepted and read by malicious actors.

- Tokenisation: Once the transaction goes through, a “token” replaces the card details—think of it as a placeholder. Your system never sees or stores the raw data. Even if hackers break in, they only see useless tokens, not the actual card number.

Fortunately, many established payment gateways handle both encryption and tokenisation behind the scenes, letting you focus on delivering great food and warm hospitality. Double-check that your chosen provider offers these core features by default.

3. Keep Your Systems Updated

Hackers rely on restaurants overlooking software patches and updates. When a point-of-sale app or booking system falls behind on updates, it can harbour vulnerabilities that criminals exploit to skim data. Regular maintenance is key.

- Enable automatic updates: If your software or operating system allows auto-updates, switch them on. This saves you from manually patching security holes.

- Audit third-party plugins: Many restaurants use add-ons for loyalty programs or table management. Make sure all plugins are current and from reputable developers. Outdated add-ons can jeopardise the entire setup.

- Monitor your web hosting: If you run your site on a hosting platform, confirm that it keeps server-side software up to date. The server environment must be as secure as your front-end tools.

Staying current with updates isn’t glamorous—like nightly cleaning routines, it’s easy to put off. But skipping patches is akin to leaving your back door wide open for intruders. Taking these precautions builds your security backbone.

4. Verify Diners’ Identities

Online transactions come with a unique challenge: you can’t see the customer face-to-face. Advanced ID verification tools help ensure the person paying is legit. While requiring too many steps can scare away impatient diners, a basic layer of security goes a long way.

- 3D Secure (3DS): This protocol—offered by many card issuers—adds an extra authentication step. Customers might need to confirm via text message or an app. Once verified, they proceed to pay. This significantly reduces fraud attempts.

- Address Verification Service (AVS): The system checks if the billing address matches the one on file with the card issuer. Mismatches might flag possible fraud.

- CVV checks: Ensuring the card verification code is present and correct eliminates some stolen data attempts—especially if criminals only have partial card info.

While these measures add an extra second or two to the payment flow, they’re often accepted by customers who value security. A short note on your checkout page—“We use advanced verification to keep your details safe”—can ease any concerns about extra steps.

5. Provide a Clear Refund and Cancellation Policy

Pre-payment implies diners pay long before the meal. What happens if something changes—like a dietary restriction or a schedule conflict? A straightforward cancellation policy fosters trust and minimises disputes.

- Honest disclaimers: Place your refund policy front and centre on your booking page. Whether you offer full refunds if they cancel 48 hours ahead or partial refunds after a certain cutoff, be explicit.

- Flexible approach: If feasible, allow changes to reservations. A family with an unexpected emergency might prefer rescheduling to losing their money outright. This flexibility can lessen negative reactions.

- Automated refunds: If you do grant a refund, do it swiftly. Modern consumers expect real-time updates, so a quick note—“We’ve processed your refund; it may take 3–5 days to appear”—instils confidence.

When diners know they’re not locked into a no-refund scenario, they’ll feel more comfortable paying in advance. A well-handled refund or date switch can even boost loyalty, showing you genuinely care about customers’ situations.

6. Train Your Team on Payment Security Essentials

Technology can only do so much if your front-of-house or back office staff aren’t on board. Everyone from servers to managers should grasp the basics of secure payment handling—especially if your system blends in-house and online processes.

- Spot red flags: If a reservation seems suspicious or if payment details don’t match the diner’s name, employees should know how to handle it. Maybe it’s verifying ID or politely clarifying the discrepancy.

- Protect physical devices: If you have a card machine on-site, keep it where staff can monitor it. Unattended or tampered-with terminals are a hacker’s dream. Lock them away at closing time.

- Maintain confidentiality: Remind everyone never to write down card numbers or share login credentials. Even quick scribbles on a sticky note can leak sensitive info if misplaced.

Think of it like a safety briefing in a busy kitchen. Just as your chefs follow hygiene rules to avoid contamination, your team should follow simple guidelines to prevent data spills. By fostering a security-first culture, you avoid many avoidable risks.

7. Select a Reliable Payment Partner

As you embrace online pre-payments, the right partner can lighten your load. Some restaurants attempt to build their own payment page—only to find themselves bogged down in compliance red tape. That’s where third-party solutions come in.

- Proven track record: Check references and testimonials. If a payment gateway or provider has a strong presence in the restaurant world, they’ve likely ironed out the usual kinks and comply with standard regulations.

- Integration ease: You want a solution that plugs neatly into your ordering or reservation systems. If it’s a struggle, your staff ends up doing double data entry or managing multiple interfaces, which spells confusion.

- Responsive support: Issues can pop up at the worst times—like a busy weekend. A top-tier provider offers 24/7 or extended hours support to tackle urgent queries swiftly.

A frictionless tool like sunday is a good example, enabling diners to pay with minimal fuss while ensuring advanced data protection. With a partner you trust, you can focus on your specialty—great food and atmosphere—rather than wrestling with glitchy payment tech.

8. Prioritise Strong Customer Authentication

Fraud prevention isn’t just about stopping theft. It’s also about making sure legitimate diners don’t get flagged. Striking a balance between safety and ease matters.

- Multi-factor authentication (MFA): Encourage or require customers to enable it if your system offers the option. This extra layer (like a code sent to their phone) can block many fraudulent attempts.

- Geo-monitoring: Some platforms track suspicious geolocations. For instance, if your restaurant is UK-based and an order arrives from across the globe, it might request an added step to verify identity.

- Adaptive triggers: High-value transactions or large group reservations might need more robust checks than small casual bookings. Adaptive systems scale up or down their security demands accordingly.

Yes, each layer adds a morsel of friction. But used wisely, that friction can be the difference between a secure lunch booking and a compromised customer account. Meanwhile, smaller everyday purchases can remain delightfully quick.

9. Encourage Transparency in Your Marketing

Security can be a selling point, not just an internal headache. Many diners worry about online scams, so highlighting your robust processes can boost confidence and trust.

- Website banners: A brief “We use encrypted transactions for all pre-payments” banner or a small security badge at checkout can go a long way.

- Social media snippets: Share glimpses of your digital approach: “Our new secure platform means you can pre-book your table and pay in advance—no queue for the bill!” This emphasises convenience, while hinting at the underlying protection.

- Customer reviews: If a guest compliments your smooth booking and payment process, amplify their voice. Post a snippet or highlight it in newsletters. Peer reassurance often outweighs your own claims.

Think of it like a hygiene rating in the kitchen. Publicly emphasising a strong security posture can tip uncertain customers into becoming loyal fans—and it differentiates your restaurant from less tech-savvy competitors.

A Secure Future for Online Pre-Payments

As online pre-payment becomes the new norm, especially in a world shifting towards digital reservations and remote ordering, safeguarding card details is non-negotiable. For restaurants, the stakes are huge: data breaches can repel diners, tarnish your brand, and even incur legal penalties. But done right, secure pre-payment can streamline your booking flow, reduce no-shows, and uplift the overall guest experience.

The solution involves a mix of technology and training—layering encryption, verification protocols, and updated software with staff awareness and robust policies. And the payoff is clear: more confident customers, smoother day-to-day operations, and a well-earned reputation as a forward-thinking venue.

Embracing tools like sunday makes it simpler to offer no-fuss digital transactions that prioritise both efficiency and security. By proving you take payment protection seriously, you’ll win over anxious diners who might otherwise hesitate to pay up front. In a market where convenience increasingly rules, offering safe, user-friendly pre-payments is not just an advantage—it’s fast becoming table stakes for restaurants of all stripes. So shore up your protocols, let your patrons know they’re in good hands, and watch as secure online pre-payments pave the way for a more trusted, successful business.

Find out more today

Drop us your details below and we’ll reach out within the next 24

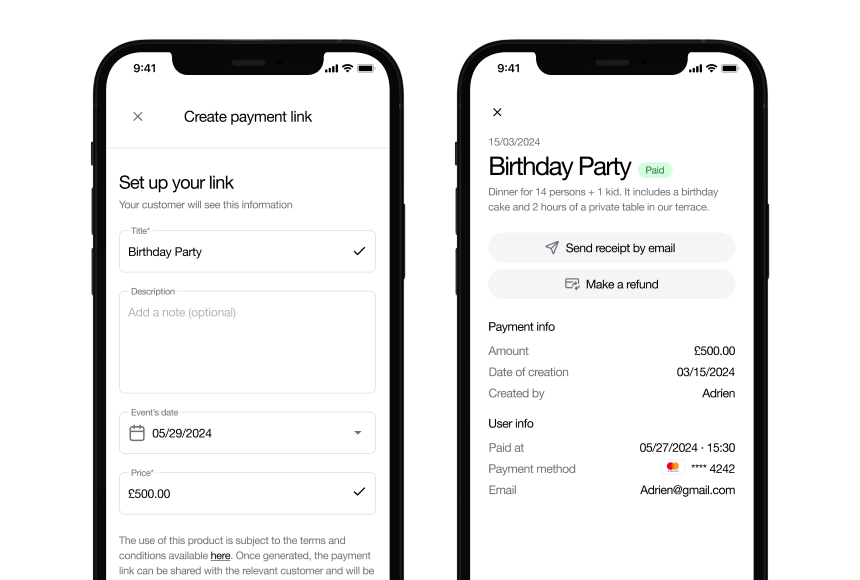

Get paid in advance in a couple of clicks.

Make groups prepay with a simple payment link and cut down on admin work.