Why a Fresh Start in January Benefits Digital Bills Implementation

Starting the year with digital bills is a smart way to use January’s calmer pace to modernise your payment flow without disrupting service, while setting your team and your guests up for a smoother year ahead.

In January, lower footfall creates ideal conditions to train staff properly, test the system in real-life scenarios, and fix small issues before the next rush. Digital bills reduce waiting time at the end of the meal, cut paper usage, and make payments clearer and faster for both guests and staff. They also align with changing customer expectations around contactless and mobile payments, while making tipping more natural through built-in gratuity prompts. Beyond speed, a well-designed digital flow can improve staff morale by removing stressful back-and-forth with card terminals and simplifying bill-splitting for groups. Choosing a user-friendly QR-code solution helps avoid technical friction, supports a more consistent guest experience, and can even boost reviews by making feedback easy to leave right after payment.

1. January’s Calmer Pace Helps You Train Your Team

After the busy festive season, your team will likely appreciate a slight slowdown. Customer traffic often dips in January due to post-holiday budget constraints or lifestyle changes, such as Dry January or new diet resolutions. This gentle lull can actually work in your favour: fewer customers translate into more pastoral conditions in which you can train your staff without the pressures of a fully packed dining room.

Hands-on Learning: Rolling out digital bills requires training on new equipment or platforms. Whether you use a QR-code payment solution or a fully integrated point-of-sale system, your staff need to know how to guide customers through the process. January’s relative calm gives them a chance to practise in real-life scenarios without feeling rushed.

Fewer Mistakes: Technical issues can arise. Maybe a server isn’t sure how to explain the new system to a table, or there’s a glitch in the device. Fewer diners mean fewer potential frustrations and negative experiences. This environment is more forgiving, allowing your staff to troubleshoot calmly and grow comfortable with the technology.

Team Feedback: End-of-shift debriefs are much more productive when everyone’s not exhausted by the continuous churn of customers. It’s a perfect time to gather feedback, listen to concerns, and refine your approach. Investing in a robust start to your digital bills project ultimately benefits you all year.

2. Setting the Tone for a Modern, Customer-Focused Year

Introducing digital bills in January sends a clear message to your guests: you’re ready to innovate and prioritise their convenience. In a rapidly digitising world, adopting new technologies early shows that your restaurant values efficiency, sustainability, and progress—all crucial factors that resonate with modern diners.

First Impressions Count: January is a time for industrious new beginnings. People are still buoyed by their year-end reflections, looking for signs of change and possibility. Rolling out digital bills during this period signals that your restaurant is moving with the times. Customers may be more patient and intrigued to try something new, especially if they have mostly encountered paper bills in the past.

Encouraging Return Visits: Once they experience quick and frictionless digital payments at your tables, they’re likely to return, especially if they’ve faced slow or cumbersome bill processes elsewhere. Imagine diners praising how easy it was to scan a QR code, add a tip, and leave a review—right from their phone—without waiting for the card reader to arrive, or finding the right change.

Positive Environmental Impact: Modern diners care about eco-friendly practices. By reducing paper usage, digital bills show that your restaurant is conscious of its environmental footprint. This can differentiate you from competitors and inspire customers to share their positive experience on social media or Google reviews.

3. Capitalising on a Shift in Consumer Tech Adoption

Smartphones are universally present in today’s society, and diners are increasingly open to scanning and tapping rather than fumbling with coins or cards. This mainstream acceptance of mobile-based transactions means guests expect faster, more secure, and more engaging experiences.

What better time to adopt new payment methods than in January, when shoppers and diners alike are rethinking behaviours, including how they spend money? With budgets top of mind, people appreciate simple ways to split bills, monitor their outgoings, and add tips without fuss. Digital bills are an excellent fit for these needs.

According to The Caterer (source), UK consumers increasingly favour contactless and mobile payments, and with card transaction limits set higher than ever, paying with a phone or watch is now second nature to many. By welcoming this transition early in the new year, you’re ahead of any eventual rush to digital solutions—or the confusion that may come from rushing into systems mid-peak season. You’ll have the advantage of a thoughtful onboarding process for both staff and diners.

4. Greater Operational Efficiency and Productivity

In many restaurants, the hustle behind the scenes can be as hot as a sizzling grill. Adding digital bills can relieve some of this pressure, making your service flow surer and swifter. Let’s look at how this transformation can improve day-to-day operations:

- Reduced Wait Times: If guests can scan a QR code to view the bill, redeem offers, and pay on the spot, your staff remain free to attend to other tables.

- Higher Table Turnover: Faster settlement of bills can lead to quicker table turnover, increasing your revenue potential—especially vital on weekends or during special events.

- Automated Record Keeping: Management software often integrates with digital bill systems, automatically updating your sales, taxes, and tip distribution data, thus reducing the likelihood of miscalculations.

- Less Paperwork: Digital alternatives bypass the need for printing out bills, receipts, and duplicates. This not only saves paper but also frees staff from endless stapling or rummaging for the right slip on a busy night.

- Accuracy Improvement: Handwritten or manually tallied bills can carry a margin of error, which can impact the bottom line and customer satisfaction. Digital bills greatly reduce this risk, ensuring items and prices are always correct.

By using January as a training ground for these operational improvements, your restaurant can reap the benefits throughout the rest of the year. Think of it like seasoning a new frying pan: it takes time, but once it’s properly prepared, everything that follows becomes easier.

5. Attracting Tech-Savvy Diners Who Love Convenience

Technology has significantly altered diner expectations. Today’s guests want convenient, intuitive interactions, whether they’re booking a table, browsing a menu, or settling their bill. Luckily, implementing digital bills meets this desire head-on, and January is an excellent time to showcase your restaurant as an innovator.

Early adopters within your customer base often become brand ambassadors, recommending your establishment to friends, family, and colleagues. Combine swift digital payments with an excellent meal experience, and watch your online reputation flourish. Some solutions, for example, prompt guests to leave a Google review immediately after they pay. That immediate positive feedback loop can exponentially increase your visibility and attract more diners.

6. Boosting Staff Satisfaction and Tips

Surprisingly, your team may be just as excited by this upgrade as your customers. Digital bill systems can reduce some of the everyday stress front-of-house staff endure, making their jobs more pleasant. Here’s how:

- Fewer Card Readers to Manage: Servers won’t have to juggle multiple payment terminals at peak rush.

- Automatic Tip Suggestions: Many digital solutions suggest a tip at checkout. This can gently nudge customers to leave a gratuity, often resulting in higher total tips.

- Seamless Splitting: When large groups want to split the bill, staff can feel the headache before they even begin. Digital bills handle individual totals at lightning speed.

- Reduced Checkout Process: Because guests pay at their own pace, staff can cycle back to check on them only when needed, allotting more time for upselling or personal touches at the table.

When staff feel more in control and less bogged down by mechanical tasks, they can focus on delivering a memorable dining experience. That’s the real heart of hospitality. Additionally, by introducing digital bills in January, you give your team ample time to familiarise themselves with the software, ensuring they feel comfortable and confident once busier months roll around.

7. Overcoming Common Implementation Concerns

Change can be daunting, but proper planning and communication make a world of difference. Below are a few typical concerns restaurant owners face when introducing digital bills, along with simple solutions to help you breeze through:

7.1 Fear of Technology Glitches

Solution: Choose a reliable provider with solid user reviews and a track record of consistent service. Test the system thoroughly behind the scenes, using dummy transactions and staff role-play scenarios. Keep a backup payment method (like a standard card reader) on hand during the transition.

7.2 Staff or Customer Resistance

Solution: Host a demonstration or ‘tech evening’ where staff can invite their partners or friends to a soft launch. Get them comfortable with the system in a friendly, low-stakes environment. Emphasise benefits like increased tips, time saved, and a greener footprint to win them over.

7.3 Loss of the Personal Touch

Solution: Digital bills don’t have to replace hospitality. They can free staff from mechanical tasks so they can spend more time checking on diners, sharing menu stories, and recommending desserts. Ensure your brand remains visible on the digital platform—adding your restaurant’s logo, colour palette, or signature style can keep your identity strong.

8. Practical Steps for a Smooth January Rollout

Ready to get started? Consider the following practical steps:

- Evaluate Your Current Setup: Decide whether you need a fully integrated point-of-sale overhaul or a standalone digital bill system that complements your existing payment terminal. Factor in your restaurant size, number of covers, and typical transaction speed.

- Select a Reputable Platform: Look for solutions with user-friendly interfaces, robust security features, and good customer support. Check if it allows QR codes so guests can easily scan and pay, and ensure it can generate digital receipts to limit paper use.

- Plan Your Budget: Most digital bill solutions have monthly or transaction-based fees, so weigh that investment against potential cost savings. Factor in training hours, and see if the system will pay for itself through improved table turnover and higher tips.

- Train Your Staff: Develop a thorough training plan using short sessions, role-play, and real test transactions. Provide written guides or tutorial videos, so employees can review in their own time.

- Market to Your Diners: Let your customers know you’re embracing modern payment methods. Put up discreet signs, mention it on your website, or have your servers introduce the concept while taking orders.

- Gather Feedback and Adjust: Launch in a ‘beta’ mindset. Encourage employees and diners to share thoughts, so you can tweak your roll-out strategy if necessary.

By planning the process carefully, you maximise benefits and minimise disruptions. January is a famously quiet time for many restaurants—perfect for testing and polishing your new system without the chaos of high-season crowds.

9. Creating a Memorable Customer Experience

While operational efficiency is hugely important, don’t forget the emotional side of dining out. For many, a restaurant visit is a mini-escape filled with good food, a pleasant atmosphere, and a chance to relax. Digital bills can enhance—not replace—that sense of hospitality if used thoughtfully.

- Visual Appeal: Customise the on-screen look of your digital bills, using attractive fonts or images. A dash of your restaurant’s branding reminds diners of your unique personality.

- Excellent Communication: Even if the payment is facilitated by technology, staff should remain available to guide customers through the process and answer questions. A quick “Did everything go smoothly?” at the end of the transaction can leave a lasting positive impression.

- Moment of Connection: The time saved on manual billing can be refocused on building rapport, offering menu suggestions, or simply chatting with familiar guests. That final personal note can transform an ordinary meal into an unforgettable experience.

The charm of a restaurant rests in its tasteful mix of great food and warm human interaction. Digital bills, when integrated seamlessly, can bring you more of both: the efficiency needed to spend time on real customer engagement instead of chasing down receipts and pens.

10. Tapping into Customer Reviews and Marketing Opportunities

Have you ever walked into a café or restaurant because of an excellent online review or a friend’s personal recommendation? Digital bills play a role here, too. Certain solutions prompt guests to leave a Google review immediately after paying, capitalising on their positive experience while it’s still fresh in mind. Prompts can range from a gentle request for feedback to more direct “Rate us on Google” calls-to-action.

This timely nudge can significantly boost your online ratings, which in turn influences potential new customers who rely heavily on star reviews. By rolling out your digital bills in January, you can kickstart a year of improved marketing. Word of mouth, amplified through digital reviews, remains a powerful tool for driving footfall—especially when combined with the novelty factor of a slick payment system.

11. Why sunday Is One Example of a Comprehensive Solution

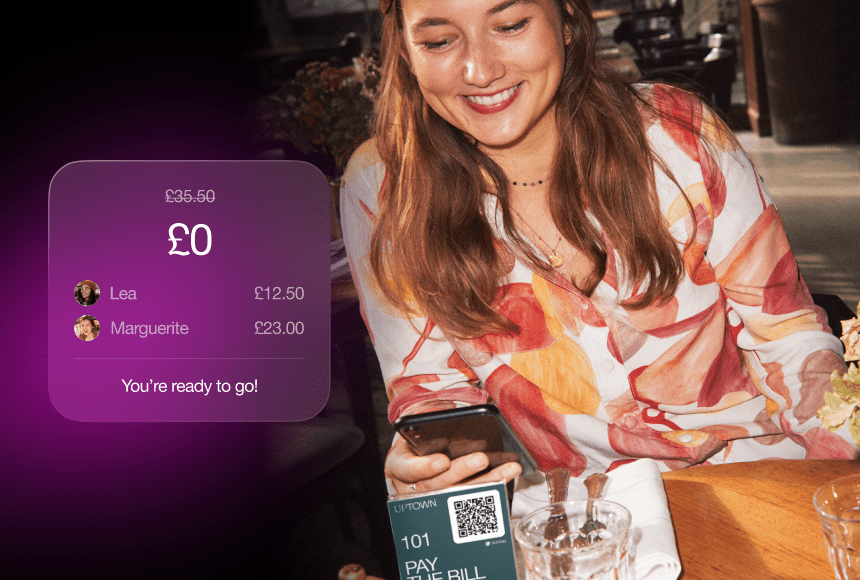

If you’re considering a provider, a user-friendly service is essential. For instance, sunday offers a QR-code-based system allowing guests to view their bill instantly, split payments, or add tips. The entire process is streamlined so servers can spend more time being attentive and less time handling card readers. However, whether you choose sunday or another reputable platform, the goal is to make both the owner’s and the customer’s lives easier.

Remember that the perfect solution for you should simplify staff responsibilities, delight diners, and seamlessly merge with the way you already run your business. Spending time on thorough research—especially in January, when you have more breathing space—ensures that you land on the best option for your establishment.

12. Visual Forecast: Where Digital Bills Can Take You

Imagine your restaurant three months from now, when the bleary winter days begin to lighten, and more customers are stepping out for dinner. By then, your team has had a full practice run with the new digital bill system. Technical hiccups have been ironed out, staff know how to answer typical queries, and diners recognise that swifter service is your hallmark. You’re free to take advantage of the spring bump in business—unfettered by slow manual payment processes.

That’s the crux of rolling out digital bills in January: a modest initial effort leading to a smoother, more confident operation down the line. You’re preparing your restaurant to handle the next set of busy occasions—Valentine’s Day, Mother’s Day, bank holiday weekends—without falling prey to clumsy last-minute changes. The seeds of success are planted early, giving them time to blossom into tangible results.

13. FAQ: Common Questions from Restaurant Owners

Below are some frequently asked questions to help clarify typical concerns and guide you in making the best decisions for your restaurant:

- Q: Will older customers struggle with digital bills? A: Not necessarily. Many older diners already use smartphones for social media or messaging. If staff provide a quick explanation or even offer a brief demonstration, most people adapt quickly. Still, keeping a traditional payment option on standby is recommended.

- Q: How secure are digital bill payments? A: Most reputable solutions operate with advanced encryption protocols. They typically comply with industry standards in data security (e.g., PCI DSS). Always check your provider’s security measures and be transparent with customers if they ask how the system works.

- Q: Can I still offer printed receipts if requested? A: Absolutely. Digital bills are an optional, convenient alternative. Some diners may prefer a paper copy for personal or business records, and you can still provide that upon request. However, offering a digital option first can impress customers who are more sustainability-conscious.

- Q: Are digital bills expensive to implement? A: Costs vary depending on the complexity of the platform. You might pay a monthly subscription or a per-transaction fee. However, consider the potential offset: faster table turnover, higher tips, reduced labour time on billing tasks, and fewer printing costs. Many restaurant owners find these savings quickly compensate for any monthly fees.

- Q: How will I measure the impact of digital bills? A: You can track customer satisfaction through online reviews and direct feedback. Financial indicators like tip percentages, table turnover rate, or even monthly sales can show a clear before-and-after picture. Make sure you gather data in the first month of implementation and compare it to later months to document improvements.

- Q: What if my internet connection fails? A: Choose a system that stores data locally or switches to offline mode. It’s also prudent to keep at least one backup payment terminal on-site. Communication with your provider about potential network fail-safes is key to avoiding downtime.

By addressing these concerns, you’re well on your way to a smooth and fruitful transition into the realm of digital bills. January, with all its quiet potential, might just be the best time to make it happen. Happy rolling out—and here’s to a fantastic year ahead for you, your team, and your diners!

Find out more today

Drop us your details below and we’ll reach out within the next 24

“Bill please” is a thing of the past.

With our integrated QR codes your customers pay in seconds, straight from their table.