QR Code Payments: A Key Ingredient for Modern Restaurant Success

QR code payments remain a powerful asset for restaurants even during quieter periods, offering convenience, efficiency and a consistently modern guest experience regardless of footfall. By eliminating waiting times at payment, reducing physical contact and minimising human error, they support smoother operations and free staff to focus on hospitality rather than transactions. These digital tools also encourage tipping, simplify bill splitting and make it easier to collect reviews and customer feedback at the right moment. With lower hardware costs, enhanced security and valuable data insights, QR code payments help restaurants strengthen loyalty, optimise performance and build long-term resilience well beyond peak service hours.

The Calm After the Rush: Why Contactless Payments Still Shine

Picture the lively clinking of silverware and the hum of content diners filtering out after your busiest season. As a restaurant owner, you might think that when tables are not fully booked and there’s a lull in the air, certain features—like QR code payment options—become less significant. After all, with fewer guests around, what’s the harm in going back to traditional card terminals or handling a bit more cash?

Yet, there is a strong argument that QR payments remain a vital part of your operational toolkit regardless of restaurant footfall. Even if you can theoretically place a card reader on every table without causing congestion, the digital convenience behind QR solutions can keep you ahead in terms of efficiency, customer satisfaction, and even your bottom line. In an era when every second saved can be crucial for both your staff and your profit margins, maintaining contactless payment options can be like having a secret sauce in your culinary repertoire.

The New Normal in Payment Preferences

According to UKHospitality (visit website), consumer behaviour around dining out has changed significantly in recent years. Customers not only crave good food and pleasant service, but they also expect convenient payment methods that are quick and seamless. That goes for the busier weekends as much as it does for a quiet Wednesday afternoon. Why line up at a till if you can simply tap a QR code, settle the bill, and leave feedback all on your phone?

Contactless card and mobile transactions have surged, becoming the new standard, with many diners now presuming that a restaurant will have some form of contactless payment method ready to go. While a quiet dining floor might reduce the urgency, it doesn’t eliminate the desire for modern convenience. If anything, a quieter setting could highlight how smoothly your establishment operates, and having a QR payment solution signals professionalism, forward thinking, and respect for your guests’ time.

Why QR Codes Are Ideal Regardless of Footfall

Just as a skilled chef can whip up the perfect dish whether they’ve got one ticket or a hundred, a solid QR code payment solution remains useful no matter how many customers are walking through your doors. Here are a few reasons why:

- Zero Wait Times: Even in slow periods, people still appreciate speed. Removing the need for diners to wait for the bill or for staff to bring a card reader can upgrade their entire experience.

- No Physical Exchange: Germ-consciousness is here to stay. QR codes reduce physical touchpoints—no passing a card reader back and forth—and make some diners feel more at ease.

- Reduction in Human Error: Mistakes in handling orders, splitting bills, or processing tips can be minimised when the payment process is done via a user-friendly interface on the customer’s own smartphone.

- Data Capture in Real Time: Digital systems allow you to import and analyse payment information straight away, smoothing accounting procedures and improving marketing opportunities.

Simply put, a reliable QR code system takes the pressure off both staff and customers, a benefit you can relish all year round.

The Speed and Convenience Factor

Imagine you have two tables seated at once: a business party on a tight schedule and a couple out for a relaxed meal. The business diners might appreciate how quickly they can scan a code, settle their share of the bill, and dash off to their next meeting. Meanwhile, the couple might prefer a leisurely environment but still find comfort in knowing they can leave at their own pace, without flagging down a server.

QR payment solutions also support multiple payment methods: diners can apply discount codes, pay by credit or debit card, or even pay using digital wallets like Apple Pay or Google Pay. This breadth of choice can quietly remove hurdles at the moment of payment, creating a warm sense of autonomy for your customers. It’s about letting them finalise their meal in the way that suits them best.

And from your staff’s point of view, it also frees them up to focus on delivering excellent service—refilling water glasses, checking on diners’ comfort, and even chatting about a new dessert on the menu—rather than running back and forth with a card machine.

Freed-Up Staff for Better Service

On the topic of staff, it’s no secret that scheduling can be one of a restaurant owner’s trickiest puzzles. In quieter times, you might be tempted to reduce staff hours to save on labour costs, but you still want to maintain a top-notch level of service. How do you manage that with fewer hands on deck?

If your waiting team isn’t bogged down by endless trips to tables with a handheld card terminal, they can be more proactive in other areas: upselling a special starter, chatting about wine pairings, and ensuring the overall atmosphere is inviting. QR code payment systems act like an extra pair of capable hands in the dining room. Suddenly, the waitstaff can focus on the “experience” rather than the “transaction.” Even in a slow spell, attention to detail can earn rave reviews and encourage return visits.

The Psychological Boost: Encouraging Tips

Let’s turn the conversation to gratuities. Tipping might be a delicate subject in some circles, but the reality is that many restaurant staff in the UK rely significantly on tips to boost their income. When you incorporate QR payment technology, you often give customers the polite nudge they need to add a little extra for good service. Why?

First, the digital interface can include an automatic prompt for tipping. Rather than an awkward face-to-face moment with a server hovering over the handheld card terminal, guests have the privacy to select a percent or choose a custom amount via their phone. It’s simple psychology: if diners feel well looked after, and they have an easy prompt to leave a tip, they’re more likely to go for it. It’s a small tweak that can make a substantial difference to your staff’s earnings, especially in quieter times.

Building Loyalty and Gathering Reviews

Reviews—particularly Google reviews—can be the lifeblood of small businesses. Yet gathering real-time feedback can be challenging. By placing a gentle button within the payment interface that invites diners to share their thoughts, you make the journey from satisfied feedback to public review much more direct. They are still at the table, possibly savouring their final bite, and can log a five-star comment on the spot.

Moreover, the seamless data capture from a digital platform allows you to follow up with guests—if they’ve opted in for marketing updates, of course—with promotions or loyalty programmes. In quieter periods, these personal touches can drive return visits and cement your place in a guest’s personal list of go-to restaurants. It’s a bit like adding a special garnish to your dish: thoughtful, subtle, and pleasantly surprising.

Security to Keep You Calm

Security is never off the menu. Traditional card terminals and cash handling have their vulnerabilities, but QR payments can enhance data protection and reduce potential for misuse. With fewer steps involved and fewer physical devices floating around, the scope for error or fraud diminishes significantly.

Customers, meanwhile, appreciate the reassurance that contactless or digital payments provide. Instead of handing over a card or rummaging for exact change, they can pay via a smartphone, which typically requires biometric or passcode authentication. That extra layer of security can be a powerful peace-of-mind factor, encouraging repeat business and protecting your reputation.

Cost Efficiency in Slower Seasons

It doesn’t hurt to think about cost savings. When your restaurant is operating below its usual capacity, controlling overheads becomes even more critical. Printing paper bills uses resources, and investing in multiple conventional card machines will drive up leasing or purchase costs. Each additional “touchpoint” in the payment process can accumulate fees and logistical headaches.

By contrast, QR code payment services rarely demand the same level of hardware investment or ongoing maintenance. In many cases, you simply need a well-printed QR code placed on each table and a suitable software platform to facilitate the transactions. The overhead stays low, especially when compared to the number of typical card payment terminals a restaurant might deploy.

This means not only do you save on equipment costs, but your staff can handle more tables without rushing back and forth—a boon when you can’t justify having extra people on shift. Essentially, it’s like using an efficient oven that bakes multiple dishes at once without increasing energy consumption.

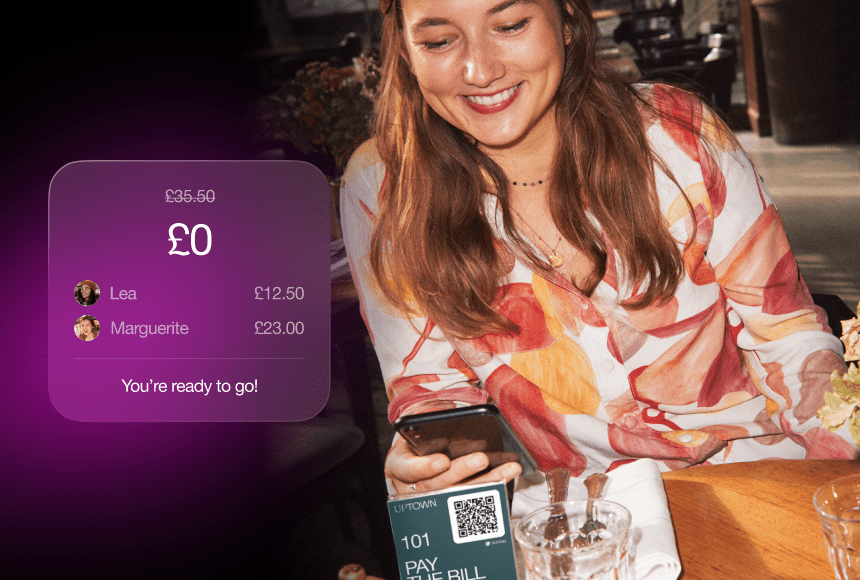

The Role of Solutions Like sunday

If you’ve ever considered upgrading to a designed-for-restaurants solution, sunday could be an option worth exploring. It’s a flexible payment tool that integrates with many existing POS systems and allows diners to pay via QR code. That includes splitting the bill, leaving a tip, or writing a review on Google—right on the spot. It’s built with the quirks and hustle of the restaurant environment in mind, saving both time and energy for you and your staff.

A key advantage is that you can intuitively customise your payment screens with your own branding, keeping the user experience cohesive from the moment they see your signage to the moment they depart. As a result, diners recognise your brand instantly, fostering trust and continuity. When quieter spells hit, you’ll have an infrastructure in place that ensures customers still enjoy the same level of hospitality and convenience they would at peak times.

1. Enhancing Table Turnover—Even If You Don’t Need It

The phrase “table turnover rate” is usually associated with rush-hour scenes. But quicker table-turning can be an asset even in calmer spells. When you speed up or streamline the payment process, you ensure that any potential bunch-up doesn’t happen at the cashier. So if you get a sudden influx—a tour group, a spontaneous social gathering, or simply a clustering of bookings—you’re better prepared.

It’s a bit like having an efficient kitchen kit: you might not need to use all the burners at once, but it’s handy to know they’re there. Computers, tablets, and smartphones that quickly display the bill, accept payments, and log receipts keep the flow smooth. And that efficiency extends to staff time: fewer lost minutes here and there accumulate into hours saved overall.

2. Creating a Memorable Guest Experience

Whether you run a cosy bistro in a small market town or a trendy café in Central London, customer experience remains paramount. In a world brimming with digital tools, integrating frictionless payment methods contributes to an overall impression of modernity, comfort, and care.

It’s not just about paying the bill. A good QR payment system can offer options to explore your menu for future visits, request a takeaway, or even donate to a local community initiative if you choose to partner with one. The more you can seamlessly integrate into the dining experience, the more your guests see you as a forward-thinking, community-minded restaurant owner. It’s these small, integrated touches that leave diners remembering—and talking about—the experience.

3. Data Insights: Turning Quiet Periods into Opportunities

Quiet times aren’t necessarily unprofitable if you know how to utilise them. By leveraging the data from your QR payment system—reports on average spend, popular items, or correlations between certain dishes and certain tip amounts—you can make strategic decisions to help refine your menu or your pricing.

All that data can also feed into how you schedule staff, plan marketing campaigns, or design special promotions. Perhaps you discover your vegetarian dish sells surprisingly well on Monday evenings, or your dessert orders spike right after payday. Armed with that knowledge, you can fine-tune your offerings and train staff to gently upsell or mention relevant dishes at the right moments. It’s like fine-tuning your recipe for maximum appeal.

If you’re curious about how data can transform a restaurant’s operations, reputable hospitality organisations, including The Institute of Hospitality (visit website), provide insights and case studies showing exactly how strategic data usage can boost profitability.

4. Building a Digital Feedback Loop

Traditionally, gathering feedback was as simple as leaving a comment card on the table. In a slower period, you might think you can just speak to people in person. While face-to-face interaction is wonderful, a digital feedback loop allows you to capture and store that information in real time, without data entry or guesswork.

Additionally, digital surveys or links to Google reviews provide a quick route to public endorsements. Diners who are already comfortable paying through their phone find it natural to click one more button and share a quick note about their meal. The result? A valuable collection of online ratings that can attract future guests. Reviews aren’t just a benefit to you; they also help prospective diners who want to peek into a restaurant’s vibe before deciding where to eat.

5. Subtle Marketing Opportunities

Have you ever considered upselling a dessert after the main meal is paid for? It might sound counterintuitive, but suppose your digital payment menu includes mouth-watering images of your best desserts or your seasonal specials. Diners could be enticed to order an extra treat—especially if they only have to tap their phone to proceed.

Even if the diner has no intention of additional purchases, they might be more likely to consider your next event, special night, or even gift cards if these appear within your payment platform. The discreet yet effective exposure can plant seeds for future visits. Just like an amuse-bouche surprising the palate, a well-timed suggestion can do wonders for your revenue.

6. Real People, Real Results

Admittedly, automation and digital solutions sometimes cause apprehension among owners worried about losing their personal touch. However, digital payments do not have to diminish the human element. They can actually enhance it by freeing your team to engage in meaningful interactions.

When you implement a QR system, you don’t remove your waiters from the equation; you simply relieve them of the mechanical burden of payment. They still greet guests, recommend pairings, and check in to ensure satisfaction. With more mental bandwidth, they can offer the sense of warmth and friendliness that leaves a lasting impression.

It’s a bit like having a kitchen assistant: they handle time-consuming prep tasks so that the chef can devote full energy to perfecting the final dish. In the same way, technology can be your staff’s ally in delivering remarkable service.

FAQ: Your Questions Answered

How do QR code payments work if the customer wants to split the bill?

Most QR payment platforms provide straightforward ways to split bills. Each customer scans the same code and selects which items they’d like to pay for, or they can divide the cost by a specific amount. The system calculates each total automatically, eliminating guesswork and simplifying the process for everyone.

Do I need to invest in expensive hardware to run QR payments in my restaurant?

Generally, no. You need table markers or menus with QR codes printed on them and a compatible software solution. Many such services integrate with your existing POS setup. This helps reduce overhead while still providing a modern, frictionless payment experience for your guests.

Is it safe for customers to pay via their smartphones?

Yes. QR code platforms often use encrypted connections, and most smartphone payment methods require biometric or passcode authentication. This combination, along with the reduced exchange of physical devices or cards, can be more secure than traditional payment methods.

How can QR codes encourage tipping?

By digitally prompting customers with tipping options at checkout. Instead of a presumed or awkward request, diners see a tipping screen that lets them choose a percentage or enter a custom amount. This private, friendly nudge often increases the likelihood of leaving gratuity.

Are traditional card terminals still necessary if I deploy a QR solution?

It’s wise to offer multiple payment methods for the broadest customer appeal. While QR codes can handle the majority of transactions, some diners—particularly older patrons or those less tech-savvy—may still prefer chip-and-PIN or contactless card payments. Offering both means you can keep everyone happy.

Find out more today

Drop us your details below and we’ll reach out within the next 24

“Bill please” is a thing of the past.

With our integrated QR codes your customers pay in seconds, straight from their table.