Time to Rethink Your Card Transaction Fees: A Savvy Approach for the New Year

In the UK, restaurant owners often face complex credit card fees that vary by provider, card type and pricing model. Hidden charges, such as authorisation fees or account maintenance costs, can quietly erode your margins. Having a clear overview of interchange fees, card scheme costs and payment terminal agreements is essential to avoid overspending. Negotiating with your card processor, regularly reviewing statements and considering digital payment tools are effective steps to save money. By making informed decisions, you can maintain smooth, customer-friendly payment experiences without paying more than necessary. Taking action now can free up precious resources for better ingredients, staff support or other enhancements to your business.

A Fresh Financial Start for Your Restaurant

It’s that time of year when most restaurateurs are reflecting on their finances and planning for future growth. But there’s one area often overlooked: the cost of card transactions. In the UK, those fees can silently nibble away at your bottom line like a hungry diner snacking on the complimentary bread rolls. And with increasing reliance on contactless payments, credit cards and digital wallets, you’ve got to keep an eye on those silent charges that can add up over time.

Whether you run a small high-street café or a bustling family-owned bistro, trimming unnecessary expenses should be top of mind. Getting to grips with your card transaction fees is as vital as perfecting your signature dish. Understandably, the subject can make anyone’s head spin—”authorisation,” “scheme costs,” “interchange,” and more. Don’t worry, though: once you know the basics, you’ll be better equipped to negotiate fees, choose the right provider and potentially save thousands of pounds per year.

1. Understanding the Basics of Card Fees

Before you can tackle those fees head-on, it helps to learn the main elements involved in typical card transactions. In every payment processed in your restaurant, different players come into the mix: the cardholder, your restaurant (the merchant), the card issuer (like a bank), and the payment processor or acquirer.

What Are Interchange Fees?

Interchange fees are like the backbone of card payments. They’re set by card networks and paid by your payment processor or acquirer to the cardholder’s bank. While they might sound small at a glance—often a tiny percentage plus a flat fee—these sums can accumulate rapidly across hundreds of transactions per month. In the UK, interchange fees vary depending on the type of card (debit vs. credit) and whether the card is from a domestic or international issuer.

Card Scheme Fees

Card scheme fees are distinct from interchange. They’re levied by the card brand—such as Visa or Mastercard—and can differ based on transaction volume or merchant category. Think of these scheme fees like membership dues for accessing the card network’s “club.” It’s not enough to just look at your interchange rate; you must also keep an eye on these scheme costs if you want a complete understanding of your outlay.

Processor Markups and Authorisation Fees

On top of interchange and scheme fees, your acquirer adds its own markup. Some providers also charge separate authorisation fees for every transaction they process on your behalf. Then factor in the possibility of monthly account maintenance fees, payment terminal rental and inactivity fees if you fail to meet a transaction minimum. At times, it feels like finding an unexpected parsley garnish in a dish you never asked for. That’s why you want to examine every slice of the total charge.

2. Common Myths About Credit Card Processing

Navigating the card processing jungle can be confusing, especially with some widely circulated myths. Let’s peel back the layers on a few misconceptions that might be costing you money.

Myth 1: “I Have Zero Leverage to Negotiate”

Many restaurant owners assume that card fees are set in stone. While interchange fees are typically fixed by the card networks, your processor’s rates and certain scheme costs can often be negotiated—especially if you have a healthy transaction volume or if you’re comparing multiple providers. Like haggling over fresh produce at a farmer’s market, you can often strike a better deal with the right approach.

Myth 2: “Cheapest Rate per Transaction Is Always Best”

A super-low percentage rate might look appealing at first, but don’t forget to check other charges, such as monthly fees, authorisation fees and terminal costs. Your total cost of ownership might shoot up if you blindly chase the lowest headline rate. Remember that a strong relationship with a transparent provider who helps you troubleshoot issues quickly can be worth a slightly higher nominal rate.

Myth 3: “Cashing Out Is Always Cheaper”

Yes, cash payments bypass card fees. However, they bring challenges like bank deposit charges, theft risk and more complicated accounting. Plus, many diners now find contactless or card payments more convenient, which can lead to higher sales and smoother tips. Balancing your acceptance of cash alongside card and digital payments is key. Attempting to avoid fees entirely by insisting on cash payments might cost you more in lost business opportunities.

3. Spotting Hidden Card Costs in Your Statements

Have you looked at your merchant account statement recently? If the thought of deciphering a labyrinthine breakdown of fees sends chills down your spine, you’re not alone. For example, you might see terms like:

- Cross-border fees: Typically apply if your customer’s card is issued outside the UK.

- Assessment fees: Add-ons from the card scheme (Visa, Mastercard, etc.) that appear in your statements.

- Transaction minimums: If you don’t meet a certain volume, you might be charged extra.

- Refund fees: Some providers even charge you for processing refunds, so watch out.

For maximum clarity, you might want to check sources like UK Finance where industry insights and guidance are often published. It’s not the most thrilling read, but it can help you ensure you’re paying only what you owe and not a penny more.

4. Strategies to Reduce Your Card Transaction Fees

Now that you know the basics, it’s time to roll up your sleeves and take action. Here are some strategies that may help reduce your overall card-processing burden.

4.1 Compare and Negotiate

Just like you’d compare different suppliers for fresh produce with the right balance of quality and cost, it pays to shop around for a card processor. If you’re already locked into a contract, consider renegotiating when you’re up for renewal.

- Gather quotes from multiple processors and see if they can match or beat your current rates.

- Look at both per-transaction cost and any flat monthly fees.

- Request full transparency. Don’t settle for line items that aren’t clearly explained.

Keep your transaction statements handy so you can speak knowledgeably about your volumes and highlight where you think fees seem out of line. If you do high-volume sales, it’s worth emphasising that to get a better deal.

4.2 Optimise Payment Methods

In the UK, certain types of debit transactions often have slightly lower interchange fees than credit cards, as debit interchange is capped for domestic consumer cards. Encouraging more debit card usage could help bring costs down, but do it subtly. You never want to deter card-based convenience for your diners.

Additionally, you could explore alternative digital payment options or e-wallets where the fees might be more straightforward. Offering a convenient, frictionless checkout can boost table turnover and customer satisfaction, potentially offsetting any costs.

4.3 Reduce Chargebacks with Better Procedures

Chargebacks can be the bane of a restaurant’s existence—like an overcooked steak returned to the kitchen. While you can’t always avoid them, establishing robust procedures can reduce the frequency. This includes training your staff thoroughly on verifying signatures or ensuring that contactless transactions go through smoothly. Fewer chargebacks mean fewer fees.

4.4 Provide QR Code Payment Options

QR code payments, popularised by tools like sunday, add convenience for both customers and your staff. Diners simply scan the code on their table, settle their bill instantly, and even add a tip with just a few taps. This approach can reduce your reliance on multiple card machines, saving on terminal rental costs. It also encourages a higher table turnover because guests can pay at their own pace. When integrated into your point-of-sale system, it may help you negotiate better overall terms by streamlining your volumes through a single payment channel.

5. How Payment Solutions Can Support You

A solid payment solution isn’t just about taking money—it’s about giving you the freedom to do what you do best: delight patrons with memorable dining experiences. By investing in a payment solution that provides transparency and added-value features, you can transform a basic card payment into an engine for growth.

5.1 Enhanced Guest Experience

Remember that customers want convenience, speed and clarity. A modern payment setup, such as one that allows QR code payments and digital receipts, can leave guests feeling impressed. They can quickly split bills, choose their tip amount and even post a Google review. All these small touches can create loyal, happy diners.

5.2 Secure and Compliant Payments

Compliance is crucial. For instance, the Payment Card Industry Data Security Standard (PCI DSS) sets the requirements for keeping transactions secure. Reputable payment providers handle the heavy lifting so you don’t have to worry about safeguarding card details on your own. This is particularly vital when you’re offering varied forms of payment to keep up with modern diner expectations.

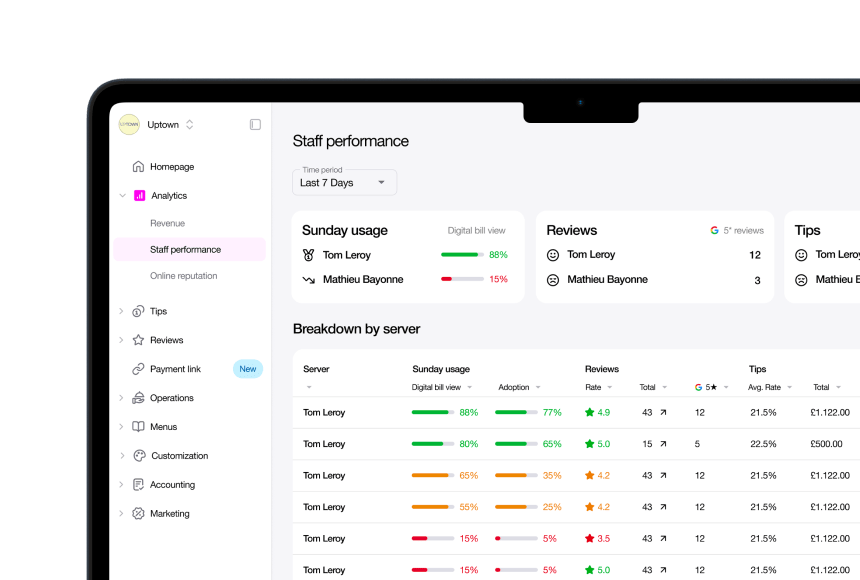

5.3 Integrated Insights for Better Decision-Making

Restaurants that integrate their payment solutions into inventory management, staffing software and marketing platforms can gain fresh insights into their operations. Imagine having seamless data on your busiest times of day, the average tip percentages or even which promo codes are used most. Taking advantage of this information makes it easier to set strategic priorities—like adjusting staff schedules to busy peaks or refining a popular meal deal.

6. Looking Ahead: The True Cost of Doing Nothing

Let’s face it: the new year is a great time for personal resolutions—why not for your restaurant’s finances too? Sitting back and letting your current fee structure continue isn’t necessarily an option. Over the long term, ignoring these costs is like leaving the kitchen burners on all day. You’ll waste energy, money and peace of mind.

Restaurants that stay on top of their card fees stand to be more profitable and better positioned to invest in what truly matters—top-notch ingredients, staff training, or that renovation you’ve been dreaming about. On the flip side, not monitoring or taking steps to reduce fees could mean missing your chance to invest in the future of your business.

7. Real Customers, Real Savings

Let’s illustrate with a hypothetical example. Becky, who runs “The Crisp & Savour” bistro in Manchester, was spending an average of 2.3% on credit card transactions plus an additional monthly maintenance fee. After doing a quick audit, she found hidden charges and negotiated 2.0% instead, combined with a transparent monthly fee. She also switched to a flexible payment solution that offered:

- Lower contactless fees on domestic debit transactions

- Smart revenue analytics

- Streamlined table turnover with QR code checkouts

The results were immediate and noticeable. Becky saved over £2,000 in the first quarter, enabling her to upgrade her outdoor seating and install new heaters for year-round alfresco dining. While every restaurant’s journey will be different, the potential for savings can be substantial.

8. Actionable Tips to Get Started

Wondering where to begin? Here are some action points to guide your next steps:

- Review Your Current Statement: Locate your latest merchant statement. Identify all fees, note their definitions and compare them month-to-month.

- Analyse Your Business Profile: Note the proportion of debit vs. credit transactions, average ticket size and any chargeback incidents.

- Research Payment Providers: Gather at least two or three quotes, ensuring you understand each line item. Don’t forget to check if they charge monthly account fees.

- Negotiate: Ask for specific reductions based on your volume. Emphasise the longevity of your business and your potential to grow.

- Consider Digital Payment Solutions: Evaluate whether switching to a system like sunday can simplify your tableside checkout, reduce overheads on card machines and boost the customer experience.

- Revisit Contracts Regularly: Set a reminder to review your fees annually, if not quarterly. Payment landscapes and your restaurant’s needs both evolve.

Much like testing new recipes, these steps might take time. But each iteration yields insights to help refine your strategy and ultimately save you money.

9. The Wider Context: Digital Payment Trends in the UK

The UK leads Europe in many digital banking and payment trends. As reported by the Bank of England, contactless payments now form a significant portion of everyday transactions, especially as transaction limits have been raised over recent years. Diners expect speed and convenience; that’s unlikely to fade. Rather than seeing card fees as a burden, view them as the cost of providing a modern, convenient service that meets the expectations of today’s diners.

That said, with the rise of fintech solutions offering more transparent fee structures, competition is stirring among payment service providers. This is good news for businesses: you have more choices at your disposal. Take advantage by seeking providers that align with your restaurant’s goals.

10. Elevating the Diner Experience While Cutting Fees

Finding ways to reduce card transaction costs doesn’t have to mean compromising on diner experience. In fact, a more streamlined, tech-savvy checkout can enchant your customers, leading to higher satisfaction and loyalty.

- Mobile and QR payments: Speed up table turnover and let customers pay when they’re ready.

- Integrated tipping: Encourage subtle tip prompts that generate better rewards for your staff.

- Automated receipts: Digitise this aspect to reduce clutter and speed up end-of-day reconciliations.

Such enhancements can also differentiate you from the restaurant down the road. People love forward-thinking establishments, especially if it means less waiting time to settle the bill.

11. Building Trust Through Transparency

Restaurants thrive on trust. Your patrons trust you to serve safe, high-quality food. You trust your suppliers to deliver fresh produce. Why treat your payment processor any differently? Make sure you choose one that’s transparent about costs—and communicate any changes or advantages to your team.

Training your staff on how to handle transactions effectively, including refunds or split bills, can help avoid accidental fees or confusion. Ensuring your staff are well-versed in the restaurant’s payment policies fosters a sense of unity and consistency that benefits both team members and customers.

12. The Value of Ongoing Education

Staying updated isn’t just for your culinary skills. Regulations around interchange caps, card brand policies and technology capabilities can all shift. Maintain a habit of reading relevant restaurant or hospitality trade publications—like The Caterer—so you don’t miss any changes that might affect your fees or compliance requirements.

Whenever possible, connect with fellow restaurateurs. Local associations, online forums or even casual chats with colleagues could reveal new insights. Someone else might have discovered a cost-saving tactic you hadn’t considered yet or uncovered a new provider that aligns better with your business model.

FAQ

Below are some frequent questions restaurant owners ask when dealing with card transaction fees.

- How can I negotiate better rates with my card processor?First, gather data on your average ticket size, monthly sales volume and existing costs. Contact various processors and request transparent quotes with all fees itemised. Use the information from your current contract as a benchmark and emphasise your transaction volume to see if they can offer a lower or more flexible rate.

- What is the difference between an interchange fee and a scheme fee?An interchange fee is paid to the cardholder’s issuing bank, set by card networks like Visa or Mastercard. A scheme fee is charged by the card brand itself. Both add to your overall card-processing costs but come from different sources within the payment process.

- Are there hidden costs in my statement I should look for?Yes, watch out for line items like cross-border fees, authorisation fees, assessment fees and monthly account charges. If anything is unclear, ask your provider for an explanation. Transparency is essential.

- Do digital payment solutions cost more?Often, digital payment platforms can help lower overall costs by reducing reliance on multiple card machines and improving table turnover. Some solutions might charge a subscription fee, but the streamlined workflow and potentially higher tips can produce an overall net gain.

- How can sunday improve my payment workflow?sunday offers a user-friendly way to pay via QR code, eliminating the waiting game for the card machine. It can integrate with your EPOS, encourage quick bill settlement, and even prompt customers to leave Google reviews, all in a few simple steps. This can enhance the guest experience while helping you manage your transaction costs in a transparent manner.

Find out more today

Drop us your details below and we’ll reach out within the next 24

Get the full, detailed picture.

sunday elevates your business with insightful data, instant feedback and precise analytics.