Start the New Year with a Fresh Approach to Payment Solutions

January is often a quieter season for restaurants, making it an excellent opportunity to step back and reassess all expenses, including payment processing. By reviewing your fees and comparing different providers, you can spot hidden charges or outdated contracts. Modern payment solutions, such as transparent QR code systems, can help boost customer satisfaction and reduce staff workload. Ensuring your payment system integrates well with your existing processes can also enhance tipping and generate more positive online reviews. Being proactive in January allows you to fine-tune your operations and save money for the year ahead.

1. Why January Matters for Restaurant Owners

The new year is a moment of fresh beginnings—whether that’s kick-starting a healthier routine, planning a summer holiday, or, in the case of restaurant owners, conducting a thorough financial check-up. January ushers in a calmer period following the frantic Christmas and New Year celebrations. During that intense festive season, the priority is serving the abundant flow of guests and ensuring that operations run smoothly. With all the holiday dues out of the way, January is often quieter and gives you the breathing room to reflect on what worked well—and what didn’t—in the past year.

When we talk about cutting costs in a restaurant, we instinctively think about re-evaluating suppliers, portion sizes, or staff hours. But seldom do restaurant owners focus enough attention on the real costs of accepting payments. This is where you can unearth meaningful savings. By rethinking how customers pay—be it by contactless cards, smart devices, or QR codes—you’re likely to find ways to increase efficiency, boost customer satisfaction, and strengthen your profit margin.

And given the current economic climate, every penny saved counts. As energy bills rise and supply chains stay volatile, discovering new areas where expenses can be streamlined is essential. If a payment provider is hitting you with sneaky fees every transaction, that’s money you could otherwise put into kitchen equipment upgrades, staff training, or menu innovations.

2. Uncovering Hidden Fees in Your Payment Processing

Payment processing fees can be surprisingly complex. From interchange rates and additional per-transaction fees to monthly statements and maintenance surcharges, it can feel like deciphering a secret code. It’s hardly surprising that many restaurant owners renew their existing contract year after year, simply accepting all the costs without questioning them.

But this unawareness can drain your finances. Take a closer look at payment statements from your current acquirer or provider. You might notice lines like:

- Interchange fees: These are bank and card network fees that vary based on transaction types and card brands.

- Authorisation fees: A set fee for each transaction that requires authorisation from the card issuer.

- Monthly service charges: Regular fees for servicing and maintaining your payment terminals.

- Chargeback fees: Added costs that arise whenever a customer disputes a transaction.

- Payment terminal lease fees: Ongoing rental costs for hardware devices you use to process cards (for instance, the countertop or portable card readers).

Several providers also build in minimum monthly fees. If your sales are lower in quiet months, you may still end up paying a fixed sum that eats into your profit margin. The key is to understand precisely what you’re being charged and why. January is a perfect time to gather three or four months’ worth of statements and dissect them.

According to UKHospitality, many restaurant operators in Britain are concerned about the growing burden of complex, opaque fees. There’s a genuine interest in transparent, user-friendly options that simplify life both for customers and the back office. Spotting these hidden cost layers can lead to significant savings if you make the switch to a better solution.

3. How Outdated Payment Methods Can Weigh You Down

Picture a slow-braising stew. If left unattended and left simmering beyond the perfect moment, it may lose its punch or even burn the bottom. Similarly, if you hold onto outdated payment methods for too long, thinking they’re working just fine, you risk missing out on technological leaps that could add more flavour to your profit margins.

The old practice of handing customers a traditional card reader can still be adequate, but it might not impress forward-thinking diners who are used to faster checkouts and contactless experiences. Similarly, if your terminals are old or your payment system still relies on a complicated, multi-step process, your staff and customers may be feeling frustrated by small inefficiencies that persist throughout the day.

For example, in the UK, cash usage has declined significantly over the past decade as consumers increasingly prefer cards and smartphones for payment. According to The Guardian, contactless payments have soared in popularity since the pandemic. Still, if you’re paying a fortune for a legacy payment terminal provider that’s slow to adapt, you’re likely missing out on easier solutions that boost turnover and improve customer happiness.

With each beep of a card machine, as the transaction flickers through the old system, there might be hidden pitfalls: longer settlement times, higher risk of errors, and precarious maintenance fees. This overhead can quickly add up, leaving you with less time for what truly matters—perfecting dishes and delighting your guests.

4. What to Look For When Reviewing Payment Costs

So, if January is the season of scrutiny, which metrics and factors should you examine closely when it comes to payments? Here are key points to consider:

- Transaction Fees: Per-transaction costs can vary widely depending on the provider. Pay attention to variable and fixed components.

- Monthly or Annual Charges: Are you paying a flat monthly fee for using the payment gateway or hardware?

- Hardware Expenses: If you lease payment terminals, factor in their monthly lease, any insurance costs, or long-term maintenance contracts.

- Settlement Times: Delayed settlements can reduce cash flow. Some providers may offer next-day funding, while others take several business days.

- Contract Lock-in Periods: Keep an eye on long lock-in periods that prevent you from switching to a better service.

- Customer Experience: Does your current setup allow fast checkouts, contactless payment, and the integration of optional extras, like tips or Google reviews?

Ideally, you’ll find a payment provider that’s transparent about these elements, offers competitive rates, and integrates seamlessly with your existing EPOS (electronic point-of-sale) system. Perhaps you’re also looking for a flexible, QR-based approach so guests can split bills easily and pay at their own convenience. If so, you’re not alone. Progressive restaurateurs across the UK are looking for ways to streamline front-of-house operations without sacrificing the human touch.

5. Harnessing the Power of QR Codes and Contactless Solutions

The hospitality world is changing, and so too is the way diners want to pay. QR codes aren’t just squares of black-and-white boxes that link to random websites; they’re an efficient, proven way of connecting a customer’s phone to a secure payment page. By placing a table-specific QR code on each table, you empower guests to pay as soon as they’re ready—without waving down a server or waiting for the bill.

But there’s a lot more to it than streamlining the payment process. Modern QR-based systems can autofill the bill details, automate tip suggestions, and even prompt satisfied diners to share a quick Google review. This synergy reduces friction, cuts down on staff time spent running back and forth, and is far more cost-effective than dealing with ageing payment terminals that might charge you a premium for every card type.

When you’re reassessing payment costs, it’s not only about identifying where you spend money—it’s also about exploring ways to enhance revenue. A frictionless payment process often leads to happier guests, better tips for staff, and more spontaneous visits from those who new diners who see glowing online ratings. And because you can truly track your orchestration from order to payment, you get clearer insights into consumer behaviour, frequent issues, and best-selling items.

Technological innovations like QR codes are being embraced by forward-thinking companies such as BigHospitality, which consistently highlights how the pandemic has accelerated digital solutions in the restaurant sector. Embracing these advancements can give you an edge in a competitive market, especially if you’re situated in a bustling city where discerning customers expect convenience at every turn.

6. The Role of Transparent Contracts and Flexible Pricing

One aspect often overlooked when reviewing payment solutions is the contract structure. It’s not uncommon for providers to lure businesses in with promotional rates, only to hike them on renewal or attach lengthy contractual obligations with steep early termination fees. Think of it like a fancy appetiser: you’re told it’s a special offer, but when the main arrives, you find the hidden costs are multiplied.

When talking to potential providers or negotiating with your existing one in January, aim to:

- Confirm if there’s an introductory offer: Ask how long it lasts, and what the standard fees will be once it ends.

- Examine termination clauses: Check if you can exit the agreement without penalty if rates become unmanageable.

- Request a breakdown of charges: Make sure you are aware of every fee, from monthly rentals to transaction percentages.

- Seek flexible pricing models: Some providers offer pay-as-you-go schemes suited to restaurants with fluctuating seasonal volumes.

- Ask about integration: If the system easily links with your EPOS, kitchen display, or customer loyalty programmes, you’ll save on additional software costs.

This level of clarity lets you gauge whether the arrangement truly is profitable. Moreover, transparent contracts foster trust—both between you and your payment provider, and by extension, between your restaurant staff and the tools they rely on daily.

7. Setting Up for Growth and Resilience in the New Year

January can be a slow month, but it’s also your springboard. Thinking ahead is as crucial in hospitality as it is in cooking. Just like you’d plan your menu with seasonality in mind, the time to set up a robust, scalable payment operation is when you’re not overloaded by day-to-day demands.

Here are a few ways to position your restaurant for success in the new year:

- Invest in Staff Training: Even the most modern payment system can falter if your team doesn’t know how to use it properly. Ensure they’re comfortable explaining contactless or QR code payments to guests.

- Integrate Loyalty Programmes: If your POS or payment provider offers a built-in loyalty or CRM scheme, capitalise on it to keep your guests coming back.

- Offer Seamless Bill Splitting: Larger groups often appreciate quick ways to split the tab. Solutions that support fast split-pay options can expedite turnover and reduce headaches.

- Review Transaction Speed: A swift transaction improves table turnaround, and it also enhances the diner’s overall experience.

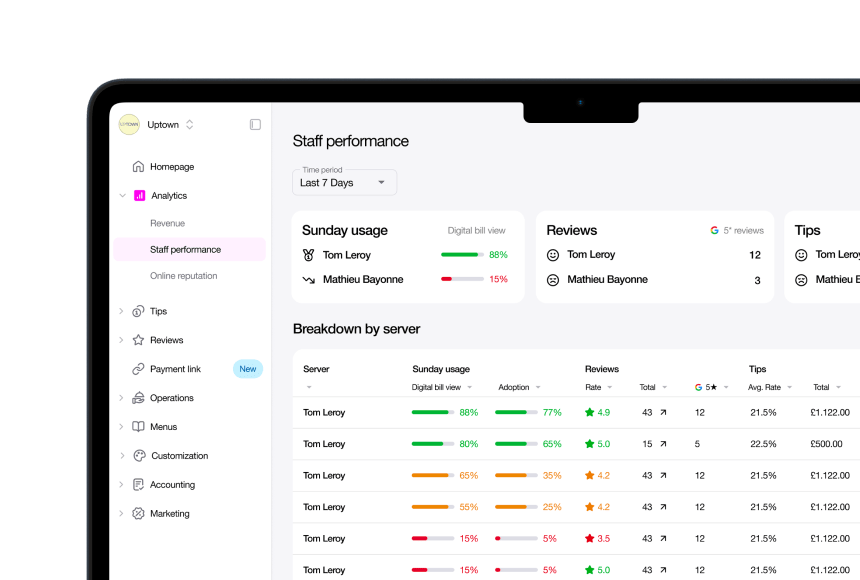

- Look into Data Analytics: Many digital payment solutions feed real-time data back to your analytics dashboard. Tracking metrics like average spend per table, peak dining times, and tip rates can guide strategic decisions.

Implementing these strategies in January can work wonders, as your staff will have the time to learn the ropes and your guests will quickly latch onto the convenience. By spring, you’ll be fully tuned up and ready to wow those warmer-season diners who’ve come out of hibernation.

8. Weighing the Costs Versus the Benefits

It’s one thing to note a list of fees; it’s another to match them with tangible benefits. In many cases, the reason restaurants pay higher fees to certain providers is the promise of reliability and brand recognition. However, reliability is no longer a premium extra—it’s a standard requirement, and many alternative providers maintain top-tier security and uptime.

At the same time, cost-savings shouldn’t come at the expense of diminished service quality. For instance, if a cut-price deal leaves you with non-existent customer support or outdated hardware, you might lose more money (and time) in the long run. Balance is key. Ask yourself:

- How quickly can I get help if something goes wrong with a payment?

- Do my guests have a seamless experience from the moment they request the bill to the final receipt?

- Are there additional features—like integrated tipping or reviews—that might boost my restaurant’s brand image?

- Will my staff find it easy to navigate the system, especially during peak hours?

The ideal solution feels effortless, both for you and your customers. It’s reminiscent of those plates that come out of a fine-dining kitchen: no one sees the hustle behind the pass, just the perfectly assembled dish. Your payment system should be equally invisible in operation, allowing staff to focus on service and guests to settle up without fuss.

9. A Glance at QR Code-Based Payment with sunday

sunday is one such provider that takes advantage of QR code technology to simplify the paying stage of dining. It transforms the clunky ‘wait for the card machine’ routine into a smooth user-driven process. When guests are ready, they simply scan the code, view their bill, tip with a tap, and complete payment. This approach can be beneficial for large groups, as splitting is straightforward, and it also invites happy customers to leave a quick Google review before they leave—which can be a boon to your online reputation.

For the restaurant owner, this reduces the overhead of renting payment terminals and cuts the time staff spend physically delivering bills. It’s instant, integrated, and can provide real-time data on each transaction and tip. Although it’s important to weigh up your specific needs, especially if you cater to a clientele that still wants more traditional payment options, solutions like sunday typically layer in easily alongside your existing systems.

Ultimately, exploring whether a QR-based approach aligns with your brand and diner habits is a logical step when rethinking payment processes. If you’ve always done things a certain way, January might be the push you need to try something new.

10. Five Practical Steps to Reassess Your Payment Costs This Month

You may be wondering exactly how to start reviewing your payment setup. The process can be broken down into five straightforward steps:

- Collect Your Statements: Gather three to six months of payment processing statements. The more data you have, the clearer you’ll see patterns and hidden fees.

- Chart Out Each Charge: Create a simple table or spreadsheet with columns for transaction fees, monthly fees, chargebacks, and equipment leasing costs. Sum up and see your total cost per month and per transaction.

- Compare Providers: Obtain at least two quotes from other payment providers or explore new digital solutions. Ask them to break down every charge, from interchange rates to subscription fees.

- Analyse Features and Benefits: Evaluate the intangible benefits like ease of integration, quick settlement, staff friendliness, tips functionality, and the potential for upgraded features like loyalty or review prompts.

- Negotiate or Switch: Armed with data, approach your current provider and see if they’ll match a better deal. If not, it may be time to switch. Always confirm the terms, notice periods, and potential exit fees.

It might feel daunting at first, but this sort of thorough reevaluation often leads to clear savings or enhancements. Just as you’d trial a new dish before rolling it out across the menu, the more research and testing you do, the more confident you’ll be in your final choice.

11. Plan Your Next Steps to Stay Ahead

After you’ve completed your cost review, remember that payment technology evolves constantly. Keeping one eye on industry developments and consumer preferences can safeguard your restaurant from unexpected cost hikes and the risk of falling behind. Here are a few pointers to stay on the ball:

- Schedule a Mid-Year Review: Don’t wait until next January to look at your statements. Plan a quick check in June or July to verify your pricing remains competitive.

- Build a Relationship with Your Provider: Having a friendly, proactive account manager can be invaluable if issues arise.

- Look at Wider Market Trends: Are contactless and mobile payments continuing to grow? Are there new digital wallets or apps that your guests might want to use?

- Gather Customer Feedback: Ask diners—casually or via a short survey—what payment experience they’d prefer. Their input can guide your next innovations.

Maintaining an evolving mindset will help you refine your approach, whether that means adjusting your tipping policy to reflect industry best practice or incorporating new contactless methods. By next year, you’ll be able to compare your new data with your old baseline and see just how much you’ve gained in both financial terms and customer satisfaction.

Your Top Questions About Payment Costs: FAQ

Below, you’ll find common queries restaurant owners often raise when considering a review of their payment costs.

1. How do I recognise if I’m paying too much in fees?

If your monthly statements are unclear, or if your fees and surcharges amount to more than a few percent of your total credit card sales, it’s worth investigating. Compare multiple statements to look for unexplained increases or extras. Gather competing quotes to see if you can save with another provider.

2. Do I need to keep a traditional card reader if I switch to QR code payments?

It depends on your clientele and comfort levels. Older diners or individuals with limited access to smartphones may prefer a card reader. However, many restaurants make the transition to predominantly QR-based payment while keeping a single card reader as a backup. This approach minimises equipment costs while still accommodating all guests.

3. Will reviewing my payment provider disrupt my operations?

A well-planned switch can usually happen with minimal disruption. Prepare your staff in advance, provide thorough training, and schedule any system changes during quieter times. Good providers offer guidance every step of the way. If you adopt a QR-based solution, staff can quickly adapt and show guests how to scan and pay.

4. How can transparent payment solutions help increase tips?

When tipping options appear on the customer’s phone or screen, it’s a gentle nudge that often translates into higher gratuities. Contactless and QR-based platforms can highlight pre-set tip amounts or percentages, improving staff takings. Customers also appreciate the convenience and clarity.

5. Can a new payment system really boost my online reviews?

Yes. Certain QR code payment solutions include an instant post-payment prompt encouraging happy diners to rate and review you on Google. It’s a seamless way to convert a positive in-person experience into a visible online endorsement, helping you attract more customers in the long run.

January is, indeed, a fabulous time to renegotiate, recalculate, and refresh the way you handle payments. By taking advantage of the lull in service, you can dig deep into your statements, compare quotes, and introduce upgrades that enhance both your bottom line and customer satisfaction. Over time, these small savings and improvements add up, providing you with more resources to devote to your food, your staff, and the distinctive dining experiences only you can offer.

Find out more today

Drop us your details below and we’ll reach out within the next 24

Get the full, detailed picture.

sunday elevates your business with insightful data, instant feedback and precise analytics.