Going Beyond Contactless: Embracing Instant Pay-at-Table for Modern Diners

Observing a Shift in Expectations

Let’s paint a picture you might know well. It’s Saturday evening, your dining room is buzzing, and that sweet aroma of freshly baked bread has customers smiling. You’ve nailed the ambience, staff are attentive, and everything’s running smoothly—until the moment of payment arrives. If contactless card payments were once hailed as the ultimate time-saver, this is no longer enough. Diners today want something faster, more seamless, and delightfully convenient: instant pay-at-table solutions.

In today’s restaurant scene, technology is no longer just an afterthought; it’s a crucial ingredient in the recipe for success. As reports from UK Finance highlight, contactless payments continue to rise in popularity, but so do customer expectations. The next frontier? The freedom to pay instantly—no waiting, no awkward card terminals, and no queueing around the till. Instead, a simple, self-directed way to settle their bill straight from the table.

What Do We Mean by Instant Pay-at-Table?

When we talk about instant pay-at-table, we’re referring to a simple, frictionless method that allows guests to settle their bill the second they decide they’re ready. Think of it like a culinary magic trick: the moment your guest finishes their meal, they whip out their phone, scan a QR code, pay digitally, and walk out feeling satisfied—without needing to chase down any server or wait for a card reader. It’s quick, it’s easy, and yes, it’s entirely possible with modern payment solutions.

But let’s be clear: this is more than just tapping a contactless card. Contactless has been a boon for speed, but it often still requires staff involvement, whether to bring over the card machine or wait by the till—especially if your guest wants to split the bill. By contrast, instant pay-at-table solutions shift control to the diner. There’s no need to wave down a team member, and absolutely no rummaging for cash. It’s basically the culinary version of “check, please,” but with zero fuss.

The Journey from Contactless to Instant Payment

A Short History

Not too long ago, contactless payments were novelty enough to give restaurants a competitive edge. Diners loved the speed, owners appreciated the security, and servers benefited from quicker table turnover. Since then, consumer behaviour has evolved rapidly. According to a BBC News report, the UK’s contactless spending limit was raised to £100 in 2021, reflecting the growing trust and reliance on this technology. But for many restaurants, the tipping point came when customers started asking for even faster options—ones that practically eliminate waiting entirely.

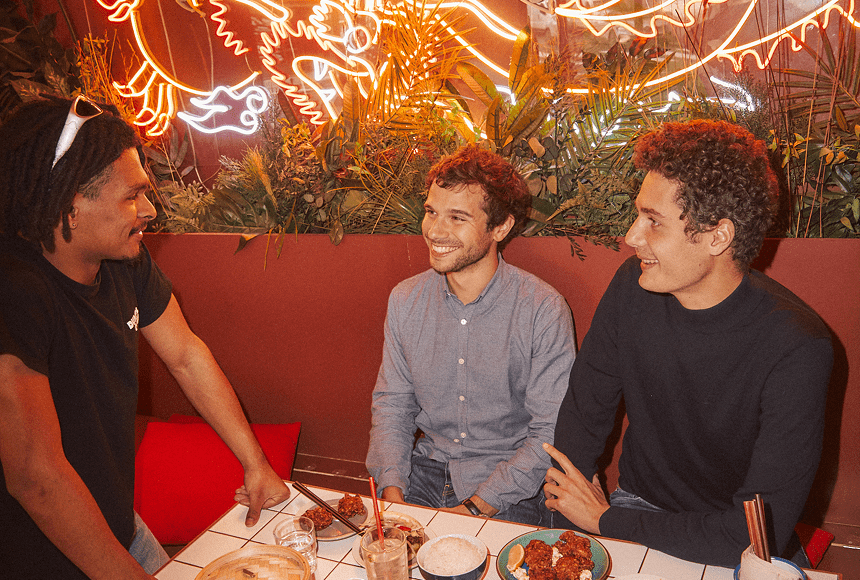

The moment diners became accustomed to contactless taps, they started wondering why they needed any machine at all. Digital-first solutions, triggered by a simple QR scan, can handle every aspect of the payment experience: from splitting the bill among friends to leaving a tip. This means fewer steps for the diner, shorter waiting times, and a more polished impression of your service.

Why an Instant Pay-at-Table Option Is Vital

Is it just speed we’re after? Not quite. Offering an instantaneous way to settle bills is about more than shaving off a few seconds. It’s about meeting current standards of convenience, boosting table turnover, and allowing servers to focus on more rewarding tasks—like upselling desserts or ensuring diners feel at home. Below are a few key reasons why instant pay-at-table is worth considering.

- Speed and Efficiency: Quick bill payments free up your staff, reduce queueing, and enhance overall diner satisfaction.

- Higher Table Turnover: When guests can pay the moment they’re ready, you can seat the next party sooner, maximising use of your space.

- Better Staff Utilisation: Rather than scurrying with bulky payment terminals, your team can spend time making personal connections with diners.

- Seamless Splitting: Collecting separate payments is easier when diners split the bill directly on their own devices.

- Enhanced Upselling Opportunities: Servers have more energy to focus on recommending signature dishes or special cocktails.

Culinary Metaphor: The “Instant Recipe”

Imagine your favourite soufflé recipe. You know each stage intimately—preheat the oven, separate the eggs, whip the whites, fold them in. Timing is everything. Contactless payments might be like whisking egg whites until they peak: it’s quick work, but by itself, it doesn’t complete the recipe. Pressing “bake” to achieve a perfect soufflé is akin to implementing instant pay-at-table. It’s a seamless last step, ensuring the final dish rises to its full potential.

If you skip that crucial stage, or if you leave the soufflé in limbo, your masterpiece collapses. The same is true for your diners’ experience: a subpar payment process can overshadow the best meal. Conversely, an instant self-pay solution completes the dish with flair. It’s the final flourish on a memorable experience, giving your guests a confident finale that matches the quality of their meal.

The Anatomy of an Ideal Instant Payment Tool

Not all QR code or digital payment systems are created equal. To harness the full potential of instant pay-at-table, you need a solution that integrates seamlessly with your restaurant’s workflow. Here’s what to look for in a robust platform:

- User-Friendly Interface: Your customers are here to dine, not to wrestle with technology. A clear, intuitive layout ensures smooth usage.

- Split-Bill Functionality: Large groups often want to divvy up the cost. Any system worth its salt should allow instant splits without staff intervention.

- Tip Integration: Ensure it’s easy for diners to leave a tip in just a tap—this can significantly boost overall tips.

- Google Review Prompting: A built-in option to invite guests to post a quick Google review helps you capture feedback while the experience is fresh.

- Speedy Payout and Transparent Fees: The best solutions get you your money quickly without hidden charges. Keep an eye on the details when comparing providers.

- Robust Security: Protecting customer data is paramount. Choose platforms that comply with strict security standards like PCI DSS.

Case Study: The Story of The Rose & Thyme Bistro

Let’s follow a fictional example that might sound familiar. The Rose & Thyme Bistro, a family-owned establishment in Manchester, noticed their busy weekends often led to queues of eager diners waiting for available tables. Yet guests were lingering after their meals, waiting to settle the bill. Servers had to juggle main-course refills and run for the card machine in the same breath.

The bistro introduced an instant pay-at-table solution, letting diners scan a QR code and handle their payment from their own devices. Within weeks:

- Table turnover increased by 15%, allowing an additional four to five tables to be seated on Saturday nights.

- Tip earnings for servers grew by 20%, as the interface gently suggested a tip at checkout.

- Online reviews jumped by 30%, thanks to prompts that nudged guests to share feedback instantly.

Beyond the numbers, staff morale improved. Servers now spend less time hovering over card terminals, focusing more on meaningful interactions and ensuring each table gets a warm, personalised experience. The result? Happy guests, happy staff, and a restaurant that consistently delivers convenience.

Stepping Into the Diners’ Shoes

Why do diners love instant pay-at-table so much? Let’s turn the tables and imagine you’re the customer. You enjoyed a mouth-watering steak and a decadent dessert. You’re relaxed, conversation is flowing—and then you remember you have to request the bill. It might take a few minutes to catch a server’s eye, a few more minutes to process the card payment, and by the time you stand up to leave, that warm after-dinner glow has cooled down.

Instant pay-at-table solutions prevent that energy dip. The moment you decide to leave, you can quickly finalise your bill without leaving the table. It’s perfect, too, for those on quick lunch breaks, couples who prefer their privacy, or large friend groups splitting costs. From a guest perspective, it’s the comfort of controlling your time and environment—there’s no waiting, and certainly no awkward chase for the next available server. It’s freedom to enjoy your meal, your way.

Addressing Concerns Around Service Quality

Perhaps you’re worried that transferring payment responsibility to your guests might lessen personal interaction. In reality, it can elevate the experience. Consider these points:

- Staff Freed for Hospitality: Servers can devote attention to food recommendations, wine pairings, and enthralling conversation rather than running for the card reader.

- Better Pace for Everyone: Guests who want a leisurely dining experience can linger without feeling rushed, while those in a hurry can settle up quickly.

- Reduced Misunderstandings: Automatic itemisation and digital receipts clarify what’s being paid for. Mistakes and disputes dwindle when the process is transparent.

At the end of the day, service is about making diners feel welcomed, valued, and at ease. An instant pay-at-table option doesn’t replace the human factor—it streamlines the admin side of hospitality, letting your team do more of what they do best: offering amazing service.

Comparing Contactless vs. Instant Pay-at-Table

The following table outlines the key differences between standard contactless payments and an instant pay-at-table approach:

| Contactless Payment | Instant Pay-at-Table | |

|---|---|---|

| Speed of Service | Quick, but requires staff to bring a payment terminal and process the card | Immediate, initiated by the customer from their phone |

| Bill Splitting | Staff often need to split manually or individually process multiple cards | Guests can split seamlessly themselves, no staff intervention needed |

| Tip Collection | Typically an optional prompt on the card reader | Tip suggestions integrated through the digital interface, often increasing tips |

| Guest Review Prompt | Usually none or requires separate manual steps | Built-in prompts for Google or other review platforms |

| Staff Involvement | Staff must operate the reader and finalise payment | Limited staff role, freeing them for other tasks |

A Note on Security

It’s natural to question whether removing the physical payment terminal introduces risk. The truth is, any reputable instant pay-at-table solution places security at its core. End-to-end encryption, PCI DSS compliance, and tokenised transactions are standard, ensuring that sensitive card information is never directly exposed. In the eyes of both diner and owner, that confidence is priceless.

Moreover, removing the need to handle a physical card can, in some cases, reduce the risk of fraud. With digital receipts stored securely, guests also have a record of their payment that they can quickly reference, all without a scrap of paper in sight.

The Positive Impact on Your Restaurant’s Brand

Modern diners notice details. They’ll remember if you have a signature dessert, unique décor, or a staff that radiates friendliness. They’ll also remember if it took 15 minutes to pay. When you offer instant pay-at-table, you make a statement about your brand:

- Innovation: You’re demonstrating that you prioritise a tech-forward, frictionless experience.

- Respect for Diners’ Time: By minimising waiting, you show that you understand your guests’ busy lives and want to simplify their dining experience.

- Professionalism: Flawless operations elevate the perceived quality of your entire establishment.

Ultimately, it shows that you’re meeting 21st-century dining expectations, bridging impeccable customer service with advanced technology. That’s a recipe for repeat visits, word-of-mouth recommendations, and a host of glowing online reviews.

Implementation Strategies: Making the Transition Smooth

Switching from a traditional card reader approach to instant pay-at-table can feel daunting. However, with the right strategy, the migration can be a breeze. Below are some practical tips to get you started:

- Identify Pain Points: Gather feedback from staff and customers on current payment bottlenecks. Use these insights to choose the best digital solution.

- Train Staff Thoroughly: Ensure everyone is confident in explaining and troubleshooting the new system. Emphasise the benefits so your team feels ready to support the transition.

- Simplify Onboarding: Choose a tool that’s intuitive for staff and guests alike. Provide brief instructions at the table or on your menu to guide first-time users.

- Test and Evaluate: Introduce the solution to a small section or specific times before rolling it out fully. Gather feedback, iron out kinks, and refine the process.

- Promote the Feature: Let your diners know you offer instant pay-at-table! Post discreet signage, add a line to your menu, or mention it when seating guests.

The Tipping Advantage and Beyond

If you’ve ever struggled to encourage tipping at your restaurant, you’re not alone. Instant pay-at-table solutions can help by embedding a tip suggestion directly into the payment flow. This gentle nudge often results in more frequent and more generous tipping. Why? Because everything is happening in the moment, and finishing on a high note with the press of a button feels smoother than rummaging around for spare change.

And tipping is just one highlight. These platforms can also host promotions or surveys without feeling intrusive. You might offer a digital loyalty stamp, a discount on the next visit, or even an invitation for immediate feedback. Guests who might have been reluctant to fill out paper forms are often more inclined to click a quick rating on their phone.

Adapting to Different Audience Segments

Restaurants cater to countless demographics, from tech-savvy Gen Z diners to older clientele who might be less confident with technology. Fortunately, instant pay-at-table solutions are increasingly intuitive, bridging generational gaps. Meanwhile, staff can always assist if a guest feels uncertain. Over time, you’ll likely discover that once hesitant diners quickly find the experience simpler than they expected.

Consider posting a small how-to card on each table: “Scan the QR code, review your order, press pay—done!” With a friendly, minimal approach, you empower everyone to engage with this new payment option at their own pace.

Saving Costs in the Long Run

Speeding up payments and boosting table turnover can translate into higher revenues. But there’s also the potential for cost savings. When fewer servers are needed to shuttle card readers around, your labour expenses can reduce. Additionally, less paper is wasted on printing receipts. Over time, a streamlined digital system can more than pay for itself.

Of course, you will likely pay a transaction fee to the payment solution provider. This fee may resemble typical card processing charges, so do your research. However, the increase in turnover, tips, and overall satisfaction can offset those fees. When done right, instant pay-at-table is a win-win scenario—your staff is less stressed, your customers are happier, and your bottom line benefits.

Encouraging Online Reviews in Real-Time

Think about when a diner is most inspired to leave a positive review—often right after a stellar meal. An instant pay-at-table system can prompt guests to share their experience while they’re still basking in the afterglow of a fabulous dinner. Clicking a star rating or writing a quick comment takes mere seconds, yet the impact on your reputation is enormous.

For instance, solutions like sunday encourage guests to leave a review as soon as they pay. By making it effortless, you increase the likelihood of real-time feedback. This can significantly improve your visibility on Google, especially for local searches. And in a competitive market, those glowing endorsements can be the difference between a full house and empty tables on a Saturday night.

Looking Ahead: Staying on the Cutting Edge

The hospitality industry evolves swiftly, influenced by consumer trends, technological breakthroughs, and shifting economic climates. Contactless payment served us well, but the new standard is instant. Restaurants that stay alert to these shifts stand the best chance of thriving. And as new features emerge—like pay-by-face or voice-activated ordering—instant pay-at-table solutions are likely to form the foundation for whatever comes next.

Ultimately, the key is remaining open to innovation. Staying current isn’t about chasing every new gadget, but about intelligently adopting changes that genuinely enhance the guest experience. As a restaurant owner, you have the power to blend tradition with cutting-edge tools, preserving what’s unique about your establishment while providing the seamless service modern diners crave.

Frequently Asked Questions (FAQ)

Below are answers to some of the most common questions restaurant owners ask when considering an instant pay-at-table solution.

Do I need to change my entire point-of-sale system?

Not necessarily. Most pay-at-table solutions can integrate with popular POS systems or function independently via a dashboard. Check compatibility with your current setup and weigh the benefits of deeper integration (auto-exporting sales data, inventory tracking, etc.) over a standalone approach.

How do I handle customers who prefer a physical card reader?

Keep a card reader on hand for diners who feel more comfortable with that method. However, you’ll likely find that once customers see how easy the instant solution is, they’re open to giving it a try.

Will staff lose out on tips if customers pay digitally?

In most cases, digital tipping features lead to equal or higher tips. The built-in suggestion and the ease of tapping a tip percentage often encourage guests to leave a gratuity.

Does implementing an instant pay-at-table solution disrupt the dine-in experience?

One of the main goals of pay-at-table is to enhance, not disrupt, the dining experience. Guests can settle up at their leisure and rely on staff for genuine hospitality, rather than mechanical tasks like bringing card machines. It simplifies the final stage of service.

How soon do I receive the funds from these digital payments?

It depends on your provider’s policies. Some solutions disburse funds the next business day, while others take two to three days. Always review the details before signing up.

Find out more today

Drop us your details below and we’ll reach out within the next 24

“Bill please” is a thing of the past.

With our integrated QR codes your customers pay in seconds, straight from their table.