Is Your Card Reader Quietly Eating Away at Your Restaurant Earnings?

Why Card Machine Fees Matter in the UK

Walk into any restaurant in the UK these days and you’ll notice most customers pay by card. It’s convenient, quick, and often contactless. Yet, while card machines have become an essential part of doing business, they come with a price tag many restaurant owners overlook. These seemingly small fees can accumulate like spare change dropped into a jar. Over weeks, months, and years, those “insignificant” costs can add up to a serious hit to your bottom line.

Whether you run a cosy café in Manchester or a fine-dining establishment in London’s West End, card machine fees matter. They can influence everything from your menu pricing to the tips your servers earn. While these fees are generally unavoidable, understanding their structure and negotiating better deals can make an enormous difference to your restaurant’s profit margins. According to UK Finance, card usage continues to climb each year, meaning these fees will keep having a big impact for the foreseeable future.

In the fast-paced hospitality sector, every pound matters. Competition is fierce, and if you’re not vigilant, card fees may quietly drain your revenues. Let’s explore how these charges work, what drives them, and how you can regain control of your costs.

What Are Card Machine Fees? Breaking Down the Components

You might think it’s a simple matter of paying a percentage for each card transaction, but card machine fees typically include a variety of components. Understanding them is the first step to trimming the fat from your monthly bills:

- Transaction Fee: The most obvious cost, usually a set percentage of each payment made by your customers.

- Authorisation Fee: A small fixed amount charged every time the card is authorised—often a few pence but significant for high-volume restaurants.

- Monthly Rental: The fixed rate you pay to lease the card reader itself (sometimes called a card machine), regardless of how often it’s used.

- Payment Gateway Fee (for online ordering): If you also offer online takeaway, you’ll often face an additional fee for the gateway that processes digital payments.

- Chargeback Fees: If a charged transaction is disputed by a customer, you might get hit with a separate chargeback penalty from your provider.

The cumulative effect of these various fees means that even if each individual cost seems minor, you can quickly find yourself paying hundreds—if not thousands—of pounds more than you anticipated each quarter. While transaction fees might be the most visible, those background charges can pack just as big a punch if you don’t monitor them.

How Hidden Fees Affect Your Restaurant’s Profit Margins

Restaurant owners already face a range of expenses: staff wages, rent or mortgage, equipment maintenance, food supplies, and more. Card machine fees often get lost in the shuffle—regarded as part of the cost of doing business. But consider this: if your average profit margin hovers around 5% to 10%, every percentage point lost to fees can eat into the earnings that keep you afloat.

Rather than ignoring these expenses, it pays (quite literally) to treat them like any other strategic cost item. For instance, you might budget for food wastage by adjusting order quantities or negotiating better deals with suppliers. In the same way, you can treat card fees as an area where small changes can deliver meaningful adjustments to your financial health.

The difference between paying 1.8% and 2.2% on card transactions can look minuscule at first. However, if you process £50,000 in card payments monthly—far from unusual in a busy establishment—that 0.4% difference equates to £200 saved monthly or £2,400 per year. That could finance kitchen upgrades, staff bonuses, or even marketing campaigns.

A Culinary Metaphor: Preparing for Profit Requires the Right Ingredients

Think of your restaurant’s finances like a recipe. To create a successful dish, you need the right ingredients in the right proportions. Miss a pinch of salt, and the result might be bland. Overdo the sugar, and your dessert becomes sickly sweet. With card machine fees, every fraction of a percent acts like a delicate seasoning. A bit too much, and your profits suddenly lose their flavour.

You wouldn’t trust an outside party to slip extra garnishes onto your carefully crafted plate without supervision. In the same way, you shouldn’t let hidden fees sneak into your statements. You need to double-check your “ingredients list” each month, ensuring your card machine provider isn’t quietly adding seasoning you never asked for. By staying vigilant, you keep the cost “recipe” balanced so your restaurant’s financials remain just as carefully curated as your menu.

A Brief Look at Different Fee Models

One size seldom fits all in the restaurant world. The same is true for card machine payment structures. You might encounter:

- Flat Rate: A single percentage applied to all transactions, whether they’re debit or credit, contactless or chip-and-PIN.

- Interchange++: You pay the base interchange fee set by card networks plus an additional markup from your provider. This is more transparent but can get complicated.

- Tiered Pricing: Fees may vary depending on the type of card used (e.g. debit vs. corporate credit) and the transaction’s nature (online vs. in-person).

Each has pros and cons. The best choice depends on your restaurant’s transaction volume, the types of cards your clients prefer, and any extra services you might want. For example, if you see a high volume of smaller transactions in a café setting, a per-transaction fee might hurt you more than a flat percentage fee.

Negotiation Tactics: Securing Lower Fees (and Peace of Mind)

Providers often build in wiggle room. Remember, your card machine service is competitive—if you threaten to leave for a rival company, you might be surprised how quickly your provider is willing to offer a lower rate. Here are a few negotiation points worth keeping on your menu:

- Your Monthly Processing Volume: The more business you do, the more valuable you are as a client.

- Equipment Options: Leasing the latest, sleekest card reader might be tempting, but you could trim costs by opting for a simpler model.

- Contract Lengths and Hidden Clauses: Sometimes, providers reduce monthly fees if you agree to a longer contract. Be sure to assess any early termination fees or other hidden surprises first.

- Competitive Quotes: Firmly request quotes from multiple providers. Having them in writing can strengthen your bargaining power.

These tips work best if you know your average transaction volume, busiest periods, and the proportion of contactless or online orders. The more data you have, the more compelling your argument.

Case Study: Olivia’s Bistro Learns the Hard Way

Imagine Olivia, who runs a bistro in Bristol. With a rotating menu of seasonal produce and a loyal group of regulars, her restaurant always bustles. She assumed her card machine fees were just an unavoidable cost of business—until she noticed her profit margins were noticeably slimmer than expected.

When she investigated, she found multiple charges that had crept in. The transaction fees were higher than what she initially signed up for, small monthly surcharges had been added for “support services,” and she was also being charged for paper receipts she didn’t remember requesting. She renegotiated with her provider and removed unnecessary extras, saving around £300 a month. For this local bistro, that was enough to hire a part-time sous-chef to handle the growing weekend crowd.

Her lesson? Never think of card fees as set in stone. They may be as flexible as a freshly prepared dough, easily kneaded into shape if you’re persistent.

Technology and Card Payment Trends Shaping the Future

The payment landscape is constantly shifting. The growing popularity of contactless, mobile wallets (like Apple Pay or Google Pay), and even online ordering for takeaway means you need a system that adapts. As new technologies enter the market, you might find additional fees for these services or better bundling options if you consolidate them under a single provider.

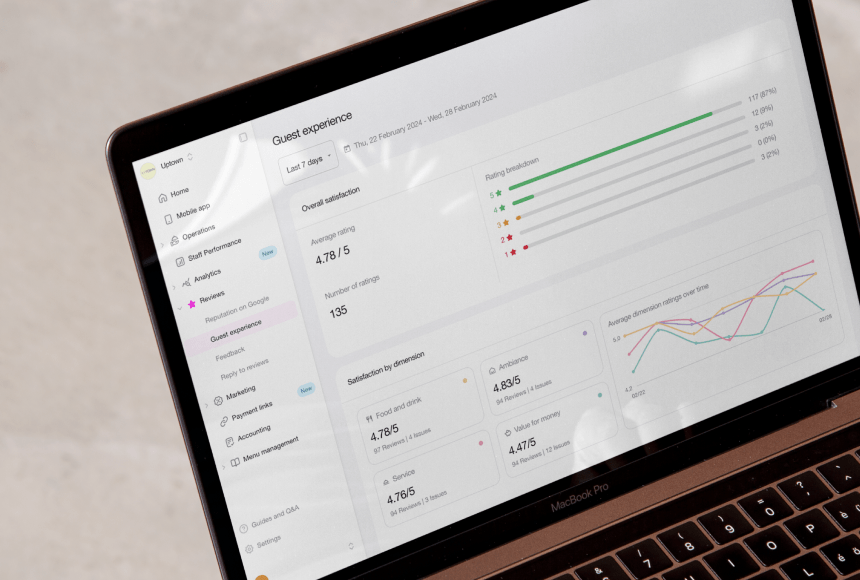

But the ultimate question is: do you want to spend your time continually investigating the intricacies of these changes, or would you rather focus on your main passion—delivering fantastic meals to your customers? This is where modern payment solutions like sunday can help, by offering a polished, user-friendly interface that gives both you and your customers a seamless payment experience. Many restaurant owners appreciate that a well-designed solution can simplify tipping, ensure faster table turns, and gather feedback from guests without adding unwanted complexities to your fee structure.

According to a study reported in BBC News Business, contactless payments increased significantly in the last few years, reinforcing how vital it is to keep pace with new opportunities. If your card machine is outdated or your provider isn’t flexible, you might be paying more than necessary—and missing out on convenient ways to delight your guests.

Reducing Card Fees Without Compromising Service

You want to shrink your expenses, but you don’t want to cramp your guests’ style by removing card payment options. Here are some practical strategies to reduce fees while keeping things effortless for diners:

- Consolidate Your Transactions: Minimise the frequency of small, separate charges (like staff meals paid on the business account) by consolidating purchases, so you don’t rack up extra per-transaction fees.

- Educate Your Team: Properly train your servers to handle payments swiftly and correctly. Accidental voids or repeated swipes can lead to extra charges.

- Monitor Statements Religiously: Keep an eye out for new charges that mysteriously appear. A quick phone call may resolve them—or lead you to switch providers.

- Avoid Extra Features You Don’t Need: Some providers bundle analytics or loyalty programmes at an added cost. If those features aren’t used, negotiate them off your plan.

None of these tactics should inconvenience your customers. If anything, a well-optimised system can feel smoother and more professional—improving their overall dining experience.

Why Card Fees Are a Team Effort

It’s not just you who’s feeling the heat from card machine fees. Your entire staff is impacted. Higher fees can mean tighter budgets, leading to wage freezes or less money for staff events. Meanwhile, you must ensure your customers still feel welcome, so you can’t simply tack on a noticeable surcharge for card users—that’s a quick way to frustrate your loyal patrons.

Instead, think of educating your team about the importance of careful cost management. For instance, you might share monthly or quarterly overviews of how much the restaurant pays in card fees. Transparency can help staff appreciate the need to keep an eye on any charges that don’t look right, ensuring that bills match actual orders, and preventing any missteps at the point of sale.

Besides, when staff understand the ripple effect of these fees, they might be more motivated to maintain good relationships with your provider, take care with the equipment, and offer gentle upsells that raise average transaction values—thereby offsetting the percentage-based fees.

Your Next Steps in Taking Control

Restaurateurs often have more on their plate than they can handle—sourcing fresh ingredients, ensuring staff reliability, keeping customers engaged, and refining menus. Amid all that, card fees can slip under the radar. Yet addressing them can be surprisingly straightforward, provided you make it a regular part of your business strategy.

Here’s a structured approach:

- Review Your Current Contract: Scrutinise every line item. Jot down anything that looks vague or new.

- Compare Market Options: Approach at least two or three competitor providers for quotes. Ask how they handle hidden charges and contract lengths.

- Negotiate: Armed with this information, talk to your current provider first. Suggest specific rates that you’d like to see matched or beaten.

- Monitor Ongoing Statements: Keep an eye on your bills monthly, not just once a year. Treat it like checking your oven timer to avoid overcooking a dish.

- Review at Set Intervals: Mark your calendar to reassess fees every six months. Providers regularly update their pricing structures, and you want to stay one step ahead.

Seeing card machine fees as a fluid expense—one that you can actively manage—will help you stay profitable. You don’t have to sacrifice service quality or convenience to keep these costs in check.

FAQ: Common Questions from Restaurant Owners

Why don’t I just pass on the costs to customers directly?

Legally, in the UK, surcharging customers specifically for card usage is restricted. Even if it were possible, it could lead to negative customer experiences. Your best bet is to find a fee structure that minimises costs without penalising your guests.

What if I switch providers and still end up with high fees?

Keep in mind that no two agreements are identical. If you switch and don’t see improvements, it could be due to transaction volumes, the card types you accept, or hidden terms in your new contract. Review the details carefully, and don’t hesitate to renegotiate if you spot issues.

How can technology simplify fee management?

Modern solutions like sunday streamline the payment process and offer transparent transaction summaries. When you can see each charge laid out clearly, you’re less likely to be surprised by hidden costs and better equipped to address them early. Plus, you’ll often benefit from faster service and happier guests.

Is there a recommended threshold for acceptable card fees?

Rates vary widely based on your establishment’s size, the type of cards used, and transaction volumes. Typical fees range between 1% and 3% for most UK restaurants, but anything higher should raise red flags. The main goal is continuous monitoring and negotiation—ensure you’re getting real value for money.

Find out more today

Drop us your details below and we’ll reach out within the next 24

Get to know your team.

Gather insightful data about your staff in real-time.