Is It Time to Modernise Your Restaurant’s Payment Setup?

Why Payment Terminals Matter More Than Ever

Every restaurant owner knows that serving exceptional food and providing top-notch service isn’t enough to thrive in today’s competitive dining scene. In the UK, customers expect more than a cosy ambience and remarkable flavours—they want a seamless, friction-free payment experience. And if your establishment’s payment terminal (sometimes called a card reader or chip-and-PIN device) isn’t meeting those expectations, you could be sending valuable customers straight into your competitor’s arms.

Picture this scenario: You’ve just prepared the perfect Beef Wellington with a side of roasted vegetables, delighting even the pickiest diners. They’re ready to pay—and then the awkward dance with the card machine begins. It’s slow, unresponsive, or simply too outdated to accept contactless payments without fuss. Within seconds, that magical dining moment dissipates.

In an era where so many aspects of the dining experience have modernised—online reservations, digital menus, automated scheduling—the last impression your guests have shouldn’t be a subpar payment process. Restaurants across the country have rapidly adopted new technology to keep pace with customer expectations. According to a report published by HospitalityNet, more than 70% of British diners expect contactless payment options as standard. That means a sluggish, outdated, or clunky payment terminal is more than an inconvenience: it’s a potential deal-breaker.

So, how do you know when it’s time to upgrade? Below are five key signs your restaurant could benefit from a new payment terminal. Let’s explore them in detail, so you can identify the right moment to switch—and keep your customers coming back for more.

Sign #1: Sluggish Transactions That Slow Everything Down

Speed and efficiency are at the heart of any great restaurant operation. When your kitchen staff churn out exquisite dishes at a steady pace, the last thing you want is for customers to queue at the till because of a slow device. If your payment terminal consistently lags after you insert a card, struggles to process contactless payments, or regularly conflicts with your point-of-sale (POS) software, you probably have a time-waster on your hands.

A speedy payment process isn’t just a perk; it’s an essential ingredient in the dining experience. Today’s diners have more options than ever, and a slow terminal can cause them to think twice about returning. If you’re noticing any of the following symptoms on a regular basis, it might be time to upgrade:

- The terminal takes more than 5–10 seconds to process standard chip-and-PIN transactions.

- “Tap” or contactless transactions frequently fail, forcing customers to insert their cards anyway.

- Staff often have to restart the device to resolve payment hangs or software glitches.

- Your service is delayed even when the kitchen runs smoothly.

Remember: The faster your customers can complete payment, the quicker you can reset tables, The result? High customer turnover, a more pleasant experience, and greater overall profitability.

Sign #2: Outdated Security Features and Rising Fraud Concerns

Keeping customer information secure should be a top priority for any restaurant. From high-street bistros to family-run pubs, data protection regulations in the UK remain strict—failing to comply can lead to fines or, worse yet, a tarnished reputation. Today’s advanced payment terminals incorporate top-tier security features, like end-to-end encryption and PCI DSS compliance, to minimise risk.

If your restaurant’s current payment device doesn’t support the latest encryption standards or updates regularly, you may be vulnerable to security breaches. Outdated hardware is often the easiest pathway for cybercriminals hunting for unprotected data. Any time a customer pays for their meal, they trust you with their sensitive information. If you can’t guarantee that security, you undermine trust and degrade long-term customer loyalty.

Look for warning signs such as:

- Frequent software crashes or error messages indicating outdated firmware.

- Lack of compliance badges or missing documentation for PCI DSS approval.

- Inability to handle advanced fraud-detection protocols (e.g., suspicious transaction alerts).

- Minimal digital receipts or no record-keeping function, raising the risk of mismanagement.

Neglecting modern security standards isn’t just risky business. It can also damage your brand’s reputation and turn away potential guests. If trust is paramount—and it should be—choosing a new payment terminal with robust security features is a no-brainer.

Sign #3: Limited Payment Options Leave Customers Wanting More

Changes in consumer tastes aren’t limited to what’s on the menu. Payment preferences evolve just as much, if not more. The days when customers always pulled out cash or a debit card are gone. Today, many diners expect to pay through mobile wallets (like Apple Pay and Google Pay) or online payment platforms integrated with the restaurant’s ordering system.

Ask yourself a straightforward question: Does your current system cater to these demands? If not, you’re inadvertently placing obstacles between your establishment and your customers’ chosen ways to pay. That’s like vigorously recommending your steak and then telling them you’re out of knives—it just doesn’t make sense.

Observing customer reactions offers vital clues. If guests keep asking, “Do you accept Apple Pay?” or “Can I settle the bill via my phone?” and your staff respond with blank stares or apologetic shrugs, it’s time to update your technology. Modern payment terminals offer built-in compatibility with:

- Mobile wallets (Apple Pay, Google Pay, Samsung Pay)

- QR code-based payments

- Contactless card transactions

- Gift cards and restaurant loyalty schemes

This flexibility is more important than ever. A report by UK Finance highlights that contactless payments accounted for nearly a third of all UK payments in 2021, and this figure continues to rise. If you’re not keeping pace, you’re almost certainly losing diners to competitors who offer quick, easy, and varied payment methods—and that’s not an appetising prospect.

Sign #4: Integration Headaches with Your POS and Other Systems

Picture your restaurant’s day-to-day operations: Orders flow from servers to the kitchen, updates bounce back to the front of house, and everything is tracked so you know precisely what’s happening at any given moment. Smoothly synchronising these steps is key, and your payment terminal’s job is to fit neatly into that organisational puzzle.

If your terminal operates like an island—failing to “talk” properly with the rest of your POS—problems are inevitable. Double entry, staff confusion, or data misalignment can not only waste admin hours but also increase the likelihood of human error. For example, if your payment terminal doesn’t directly communicate with your order management system, your staff may need to re-key transaction details, leading to miscalculations or inaccurate sales data.

How do you know if integration is an issue? Signs might include:

- Transaction amounts entered manually on the payment device, leaving room for keying errors.

- Discrepancies in sales reports that don’t match your inventory usage.

- Time-consuming end-of-day reconciliations that tie up staff well past closing.

- Lack of real-time data on sales trends, popular menu items, or tips collected.

Allocating labour hours to reconcile your daily takings is both tedious and costly. Plus, the longer you delay moving to a fully integrated payment setup, the longer you risk missing out on insights that could help you refine the dining experience. Modern, cloud-based payment terminals integrate seamlessly with your POS, online ordering, and even loyalty programmes. Some solutions—like sunday, which uses QR code-based payments—can also let customers pay directly from their phones, leave a review, and tip the team, all in one go.

Sign #5: Lack of Guest-Friendly Features

Restaurants are all about hospitality. While you might focus on mouth-watering dishes or memorable service (and rightly so), today’s diners also appreciate a payment process designed for convenience and peace of mind. Think about the last time you travelled. How do you feel when you can flick out your phone, settle your bill in seconds, and even add feedback on the spot?

Outdated payment terminals often lack user-friendly features like digital receipts, prompts for Google reviews, or ways to simplify tipping. Something as small as seamlessly adding a tip or splitting the tab between friends can elevate your restaurant’s service from good to phenomenal.

If you want to leave a strong, lasting impression on your guests, you need a terminal that complements your operations. Payment terminals with built-in prompts for tips and reviews (without feeling pushy) can contribute to higher tipping rates, better online reputation, and, ultimately, happier patrons.

When evaluating this sign, consider:

- Are your staff confident when teaching diners how to use the payment device?

- Do customers find it easy to split bills?

- Is there a straightforward way for them to add a tip or leave feedback?

- Can they make a quick payment without handing over personal details?

Meeting these modern expectations is crucial. A better payment experience can transform a pleasant meal into a memorable occasion—one that compels your diners to recommend your place to friends and family, both online and in person.

Comparing Traditional and Modern Payment Terminals

How can you tell if your current setup is behind the curve or right where it should be? The differences between older, traditional payment terminals and newer, tech-savvy options are often stark. Below is a quick comparison to help you see where your device stands today.

| Traditional Payment Terminal | Modern Payment Terminal |

|---|---|

| Slower processing times | Immediate transactions and fast contactless support |

| Manual data entry into POS | Seamless POS integration and automatic data sync |

| Limited mobile wallet support | Multiple payment options (QR codes, Apple Pay, Google Pay) |

| Basic security, often older encryption | Advanced encryption and fraud detection |

| Few or no add-on features (e.g., tipping prompts, review links) | Enhanced user-friendly functionality (tips, digital receipts, integrated reviews) |

If you find yourself in the left-hand column more often than not, it’s likely time to think about upgrading. Whether you’re a single independent café or a growing chain, adopting a modern payment system can address many everyday pain points and boost customer satisfaction.

What It Means to Upgrade

Upgrading your restaurant’s payment terminal doesn’t need to feel like a dramatic leap. More often than not, you’ll experience minimal downtime if you choose a solution that pairs easily with your existing workflow—like a cloud-based application that installs quickly and can be managed online. Many modern providers will also help with training staff to ensure they’re comfortable with the new device.

Here are a few practical tips for a smooth transition:

- Assess Your Needs: Identify key functionalities—like fast transactions, strong security, and advanced tipping options. Pinpoint what matters most for your unique business.

- Check Integration: Confirm the new terminal plays well with your POS, online ordering platform, and any other critical systems you already use.

- Train Your Team: Make sure staff know how to operate the new device, explain its benefits, and troubleshoot common issues.

- Update Your Customers: Let your guests know you’ve upgraded to a new system that offers quicker, safer, and more convenient methods to pay.

Real-Life Example: The Revamped Bistro

Imagine you run a rustic yet modern bistro in Manchester that proudly serves elevated local cuisine. You notice that towards the end of each shift, your staff often struggle with your old payment terminal—some guests can’t pay contactless, card transactions fail, and tips are awkwardly handled in cash. You decide to switch to a new terminal that enables QR code payments, card transactions, and digital tipping in one place.

Within a few weeks of rolling out the new device, the dinner rush no longer stalls at the card machine. Your staff appreciate how the new system automatically sends transaction data to your POS, reducing confusion and end-of-day reconciliations. Meanwhile, guests feel more in control, swiftly checking out in seconds or scanning a table-specific QR code to pay securely from their phone. Some even leave a quick Google review on the spot—no need for your team to chase feedback.

The bistro’s turnover improves, tips see a slight upswing, and you find that diners talk about the convenience factor in their online reviews. Word of mouth spreads, drawing new visitors who heard about your efficient service and pleasing ambience. All because you made a small upgrade that perfectly complements your larger mission to delight customers.

Where sunday Fits In

Technology providers like sunday have recently taken these advancements to a new level. People often remark how easy it is when diners can just scan a QR code, split the bill themselves, add a tip with a single tap, and even share immediate feedback via Google reviews—skipping the old, cumbersome routine of waiting for a staff member to collect cards and print receipts.

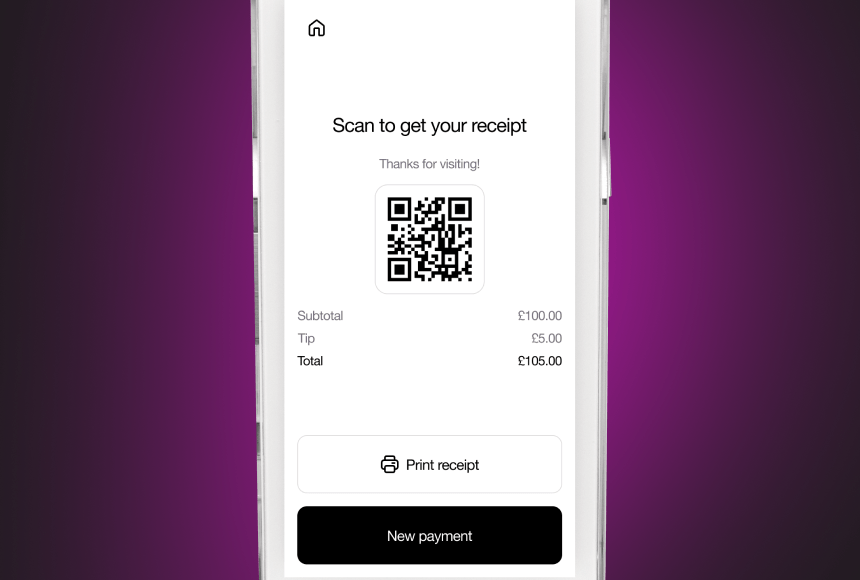

Because sunday was built with restaurant operations in mind, it can complement your existing workflow instead of disrupting it. The technology is all about simplicity and speed without compromising on security. Here’s what a typical workflow might look like with such a system:

- You place small QR codes on each table, as discreet or visible as you choose.

- When customers are ready to pay, they simply scan the code with their smartphone.

- The itemised bill appears, and the customer selects their payment method—card, Apple Pay, or Google Pay.

- They can add, adjust, or remove any tip, choose to leave a quick review (prompting them at just the right moment), and then confirm payment.

- Seconds later, a digital receipt is sent via text or email.

It’s seamless, straightforward, and reduces the need for multiple pieces of hardware. While sunday is just one example, it underscores how far payment technology has come—and why your restaurant shouldn’t be left behind.

How to Move Forward Once You See the Signs

If several of the symptoms above ring a bell, don’t panic. An upgrade could be simpler and more cost-effective than you imagine. Modern payment terminals often come with flexible pricing models—some might charge a flat monthly fee, others might bill a small percentage of each transaction. You’ll want to examine all your options, factoring in:

- Cost of Hardware and Software: Does the new solution require you to purchase devices outright, or can you lease them?

- Transaction Fees: Are they transparent, or do they skyrocket for premium features like digital tipping?

- Support and Maintenance: Will the provider train your staff and offer 24/7 help in case of emergencies?

- Upgrade Path: Look for a platform that updates features regularly, ensuring your terminal remains up to date.

Last, but certainly not least, focus on user-friendliness. At the end of the day, your new payment terminal must feel easy and intuitive for both staff and guests to use. If your front-of-house team are fumbling with the interface or if diners find the tipping menu confusing, even feature-rich hardware won’t help.

A Tasty Future for Your Restaurant

Your payment terminal isn’t just a functional device—it’s an extension of your customer service and brand identity. Think of it as the final flourish in a carefully composed dish. You don’t want to present a superb meal only to leave a bitter aftertaste when it comes time to pay.

By identifying the five signs—slowness, outdated security, lack of payment options, poor integration, and missing guest-friendly features—you can address issues before they spiral out of control. Replacing your old system with a modern payment terminal can also streamline operations, keep your staff happy, and drive repeat business.

Whether you opt for a stand-alone device with robust security capabilities or a more forward-thinking solution like sunday that leverages QR codes and advanced tipping prompts, remember that technology has evolved precisely to meet the challenges you face. Embracing new options doesn’t just keep you competitive—it helps you stand out in a saturated market.

FAQs for Restaurant Owners

Below are a few frequently asked questions to guide you further as you consider a new payment setup for your establishment.

How do I decide between buying or renting a payment terminal?

That often depends on your cash flow, projected transaction volume, and whether you plan to expand. Renting is appealing if you want to avoid a large upfront outlay and appreciate having maintenance or replacements covered by your provider. Buying a terminal can help in the long run if you prefer to own your equipment outright and possibly pay lower monthly service fees, but the responsibility for upkeep is often on you.

Will switching payment terminals disrupt my current operations?

A little bit of short-term adjustment is normal, but most providers aim for minimal downtime. Today’s cloud-integrated solutions install quickly and rely on digital platforms to manage the transition. While staff training is essential, the end result usually makes your operation more efficient, saving you time and money.

How important is PCI DSS compliance for my restaurant?

It’s essential. PCI DSS (Payment Card Industry Data Security Standard) compliance isn’t just another regulatory box to tick—failing to comply can mean fines and reputational damage if you’re found at fault for a data breach. Ensuring your payment terminal and provider meet these requirements helps secure your customers’ data and fosters trust in your establishment.

When is the best time to upgrade to a new payment terminal?

For many restaurants, a quieter trading period (like midweek afternoons) offers the least disruption. However, if fraud or major technical issues strike unexpectedly, it might be better to act fast, even if it’s a busy season. Weigh the risks of continuing with a faulty terminal against the brief interruption of switching mid-peak.

Can I customise tipping prompts and other features?

Yes, most modern systems allow you to tailor how diners see tipping or review options. If you choose a terminal that’s flexible, you can match it to your brand’s tone and keep the experience friendly without feeling intrusive.

Your choice of payment solution will have a lasting effect on your restaurant’s success. Whether you’re aiming to speed up table turnover, enhance security, or simply generate more positive word of mouth, a modern, integrated terminal is a powerful tool to have on your side. Keep an eye out for those five tell-tale signs—once you spot them, you’ll know it’s time to move forward. And hey, the upgrade could be just the secret ingredient your restaurant’s been missing.

Find out more today

Drop us your details below and we’ll reach out within the next 24

The payment terminal to make your operation simpler.

Connected to your POS, we offer the only payment terminal specifically designed for restaurants.